Answered step by step

Verified Expert Solution

Question

1 Approved Answer

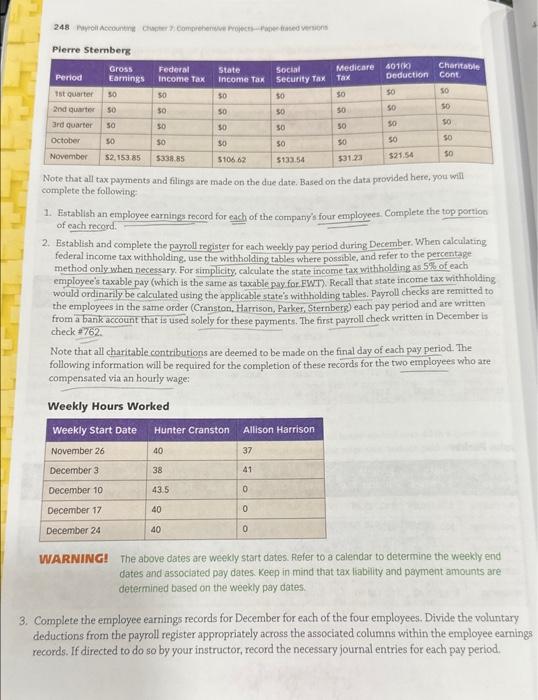

248 Payroll Accounting Chapter 7: Comprehensive Projects-Paper-Based Versions Pierre Sternberg Period 1st quarter $0 2nd quarter $0 3rd quarter $0 $0 October November Gross Earnings

248 Payroll Accounting Chapter 7: Comprehensive Projects-Paper-Based Versions Pierre Sternberg Period 1st quarter $0 2nd quarter $0 3rd quarter $0 $0 October November Gross Earnings $2,153.85 Federal Income Tax $0 December 3 $0 $0 $0 December 10 December 17 December 24 $338.85 Weekly Hours Worked Weekly Start Date November 26 State Income Tax 40 $0 $0 38 $0 43.5 $0 40 $106.62 Hunter Cranston 40 Social Security Tax $133.54 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 37 $0 $0 $0 $0 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. Allison Harrison 41 2. Establish and complete the payroll register for each weekly pay period during December. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. For simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Cranston, Harrison, Parker, Sternberg) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in December is check #762. 0 Medicare Tax Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: 0 $0 0 $0 $0 $0 $31.23 401(k) Deduction $0 $0 $0 $0 $21.54 Charitable Cont. $0 $0 $0 $0 $0 WARNING! The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates. Keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 4. 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started