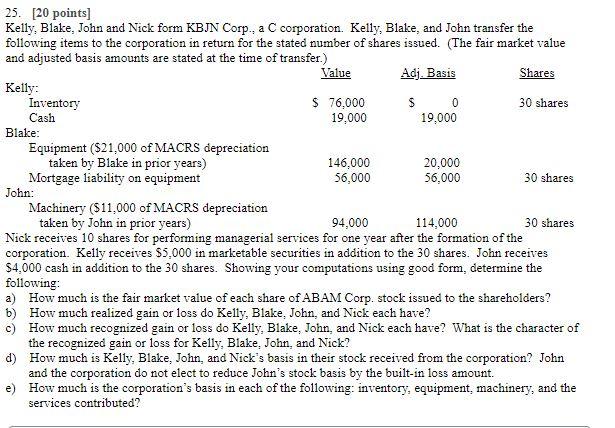

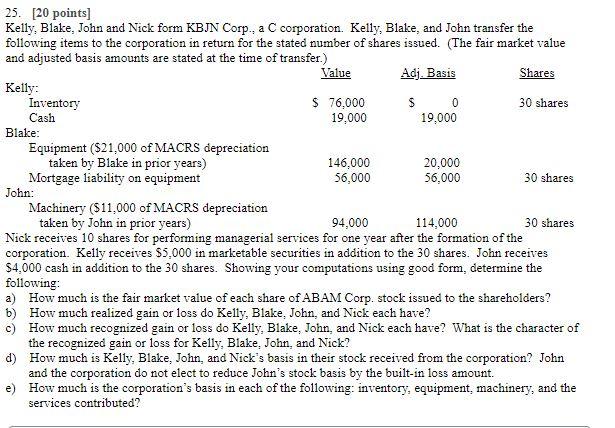

25. [20 points] Kelly, Blake, John and Nick form KBJN Corp., a C corporation. Kelly, Blake, and John transfer the following items to the corporation in return for the stated number of shares issued. (The fair market value and adjusted basis amounts are stated at the time of transfer.) Value Adj. Basis Shares Kelly: Inventory $ 76,000 $ 0 30 shares Cash 19.000 19.000 Blake: Equipment ($21,000 of MACRS depreciation taken by Blake in prior years) 146,000 20,000 Mortgage liability on equipment 56,000 56,000 30 shares John: Machinery (511,000 of MACRS depreciation taken by John in prior years) 94,000 114,000 30 shares Nick receives 10 shares for performing managerial services for one year after the formation of the corporation. Kelly receives 55,000 in marketable securities in addition to the 30 shares. John receives $4.000 cash in addition to the 30 shares. Showing your computations using good form, determine the following: a) How much is the fair market value of each share of ABAM Corp. stock issued to the shareholders? b) How much realized gain or loss do Kelly, Blake, John, and Nick each have? c) How much recognized gain or loss do Kelly, Blake, John, and Nick each have? What is the character of the recognized gain or loss for Kelly, Blake, John, and Nick? d) How much is Kelly, Blake, John, and Nick's basis in their stock received from the corporation? John and the corporation do not elect to reduce John's stock basis by the built-in loss amount. e) How much is the corporation's basis in each of the following: inventory, equipment, machinery, and the services contributed? 25. [20 points] Kelly, Blake, John and Nick form KBJN Corp., a C corporation. Kelly, Blake, and John transfer the following items to the corporation in return for the stated number of shares issued. (The fair market value and adjusted basis amounts are stated at the time of transfer.) Value Adj. Basis Shares Kelly: Inventory $ 76,000 $ 0 30 shares Cash 19.000 19.000 Blake: Equipment ($21,000 of MACRS depreciation taken by Blake in prior years) 146,000 20,000 Mortgage liability on equipment 56,000 56,000 30 shares John: Machinery (511,000 of MACRS depreciation taken by John in prior years) 94,000 114,000 30 shares Nick receives 10 shares for performing managerial services for one year after the formation of the corporation. Kelly receives 55,000 in marketable securities in addition to the 30 shares. John receives $4.000 cash in addition to the 30 shares. Showing your computations using good form, determine the following: a) How much is the fair market value of each share of ABAM Corp. stock issued to the shareholders? b) How much realized gain or loss do Kelly, Blake, John, and Nick each have? c) How much recognized gain or loss do Kelly, Blake, John, and Nick each have? What is the character of the recognized gain or loss for Kelly, Blake, John, and Nick? d) How much is Kelly, Blake, John, and Nick's basis in their stock received from the corporation? John and the corporation do not elect to reduce John's stock basis by the built-in loss amount. e) How much is the corporation's basis in each of the following: inventory, equipment, machinery, and the services contributed