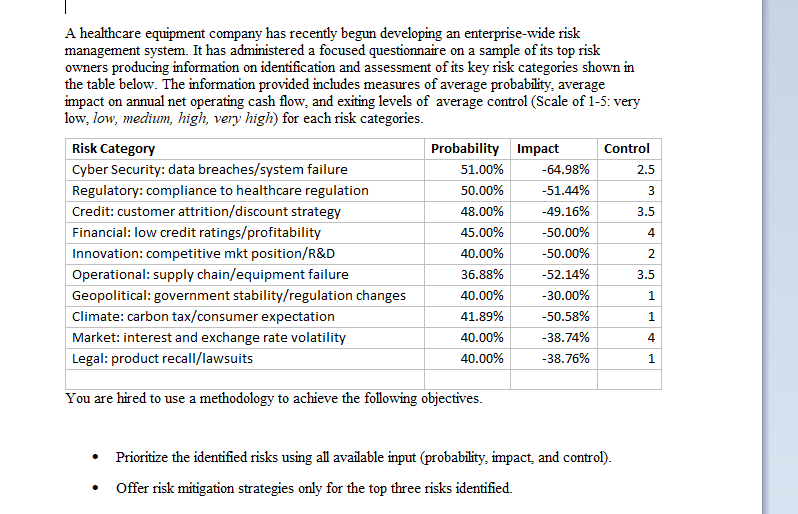

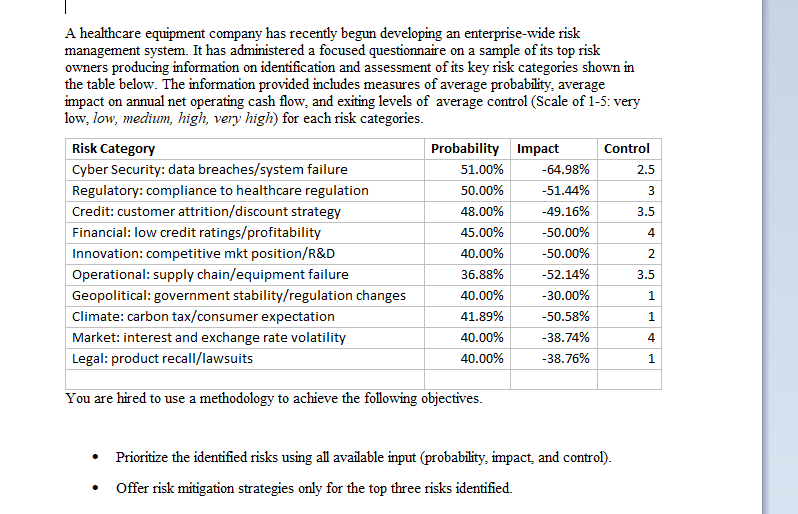

2.5 3 A healthcare equipment company has recently begun developing an enterprise-wide risk management system. It has administered a focused questionnaire on a sample of its top risk owners producing information on identification and assessment of its key risk categories shown in the table below. The information provided includes measures of average probability, average impact on annual net operating cash flow, and exiting levels of average control (Scale of 1-5: very low, low, medium, high, very high) for each risk categories. Risk Category Probability Impact Control Cyber Security: data breaches/system failure 51.00% -64.98% Regulatory: compliance to healthcare regulation 50.00% -51.44% Credit: customer attrition/discount strategy 48.00% -49.16% Financial: low credit ratings/profitability 45.00% -50.00% Innovation: competitive mkt position/R&D 40.00% -50.00% Operational: supply chain/equipment failure 36.88% -52.14% 3.5 Geopolitical: government stability/regulation changes 40.00% -30.00% Climate: carbon tax/consumer expectation 41.89% -50.58% Market: interest and exchange rate volatility 40.00% -38.74% Legal: product recall/lawsuits 40.00% -38.76% 3.5 4 2 1 1 4 1 You are hired to use a methodology to achieve the following objectives. Prioritize the identified risks using all available input (probability, impact and control). Offer risk mitigation strategies only for the top three risks identified. 2.5 3 A healthcare equipment company has recently begun developing an enterprise-wide risk management system. It has administered a focused questionnaire on a sample of its top risk owners producing information on identification and assessment of its key risk categories shown in the table below. The information provided includes measures of average probability, average impact on annual net operating cash flow, and exiting levels of average control (Scale of 1-5: very low, low, medium, high, very high) for each risk categories. Risk Category Probability Impact Control Cyber Security: data breaches/system failure 51.00% -64.98% Regulatory: compliance to healthcare regulation 50.00% -51.44% Credit: customer attrition/discount strategy 48.00% -49.16% Financial: low credit ratings/profitability 45.00% -50.00% Innovation: competitive mkt position/R&D 40.00% -50.00% Operational: supply chain/equipment failure 36.88% -52.14% 3.5 Geopolitical: government stability/regulation changes 40.00% -30.00% Climate: carbon tax/consumer expectation 41.89% -50.58% Market: interest and exchange rate volatility 40.00% -38.74% Legal: product recall/lawsuits 40.00% -38.76% 3.5 4 2 1 1 4 1 You are hired to use a methodology to achieve the following objectives. Prioritize the identified risks using all available input (probability, impact and control). Offer risk mitigation strategies only for the top three risks identified