Answered step by step

Verified Expert Solution

Question

1 Approved Answer

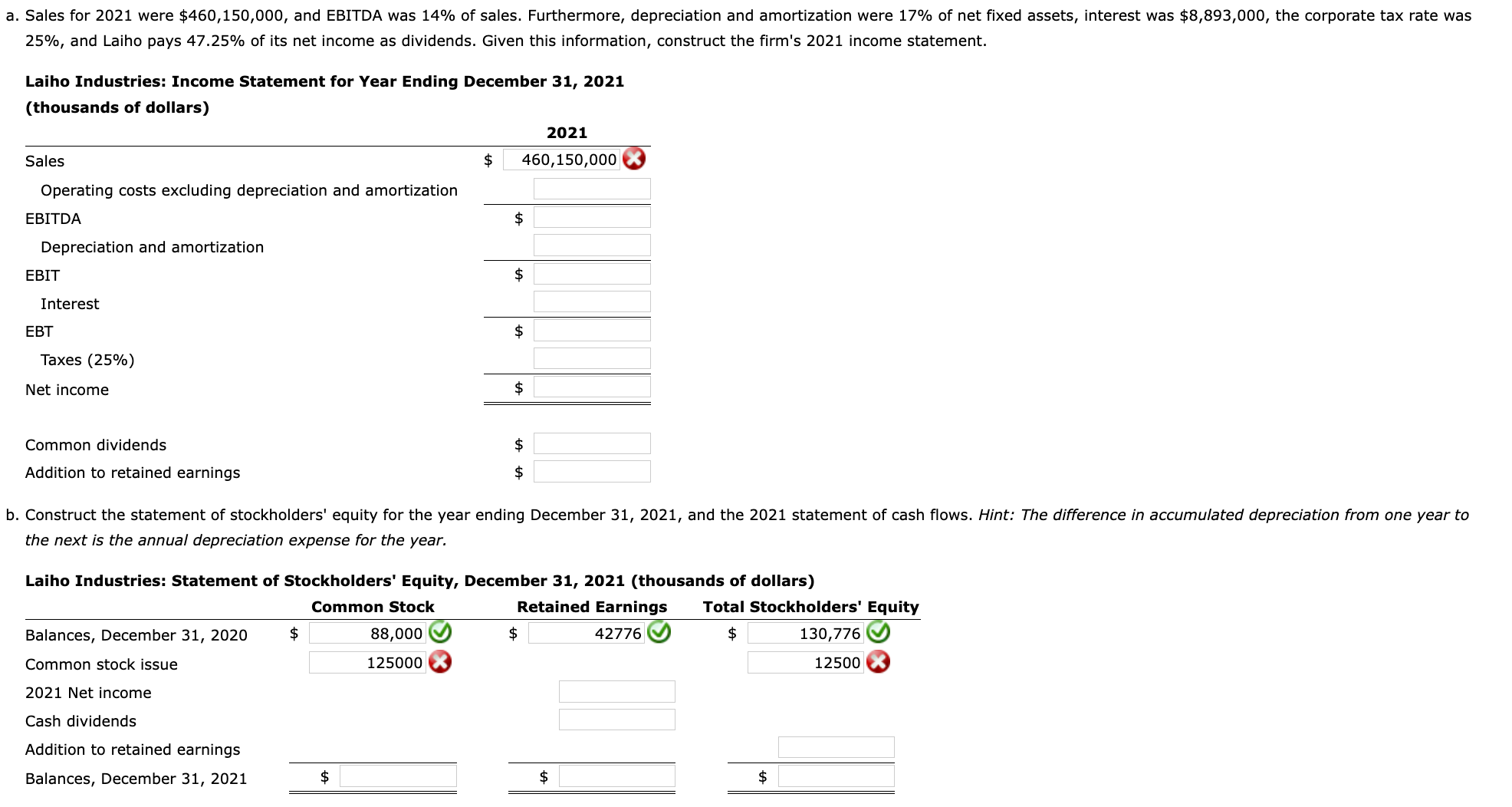

25%, and Laiho pays 47.25% of its net income as dividends. Given this information, construct the firm's 2021 income statement. Laiho Industries: Income Statement for

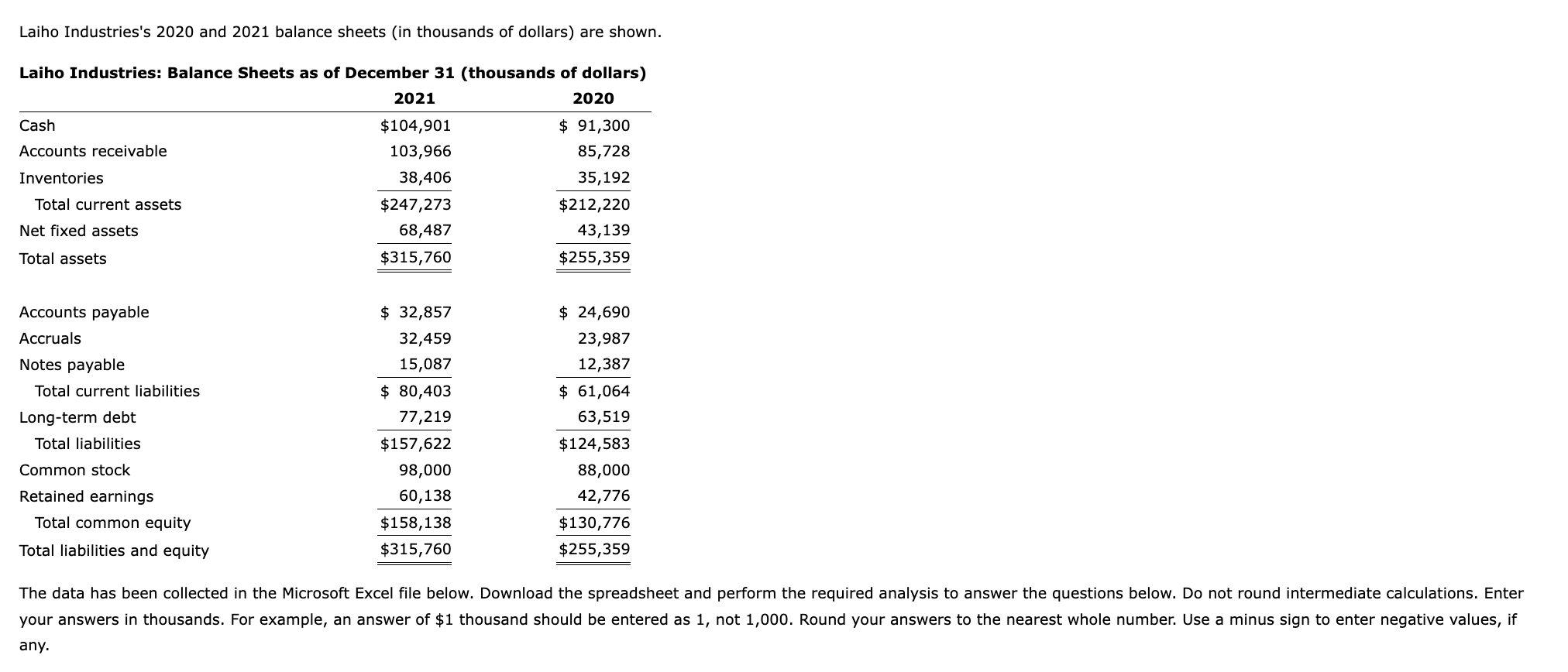

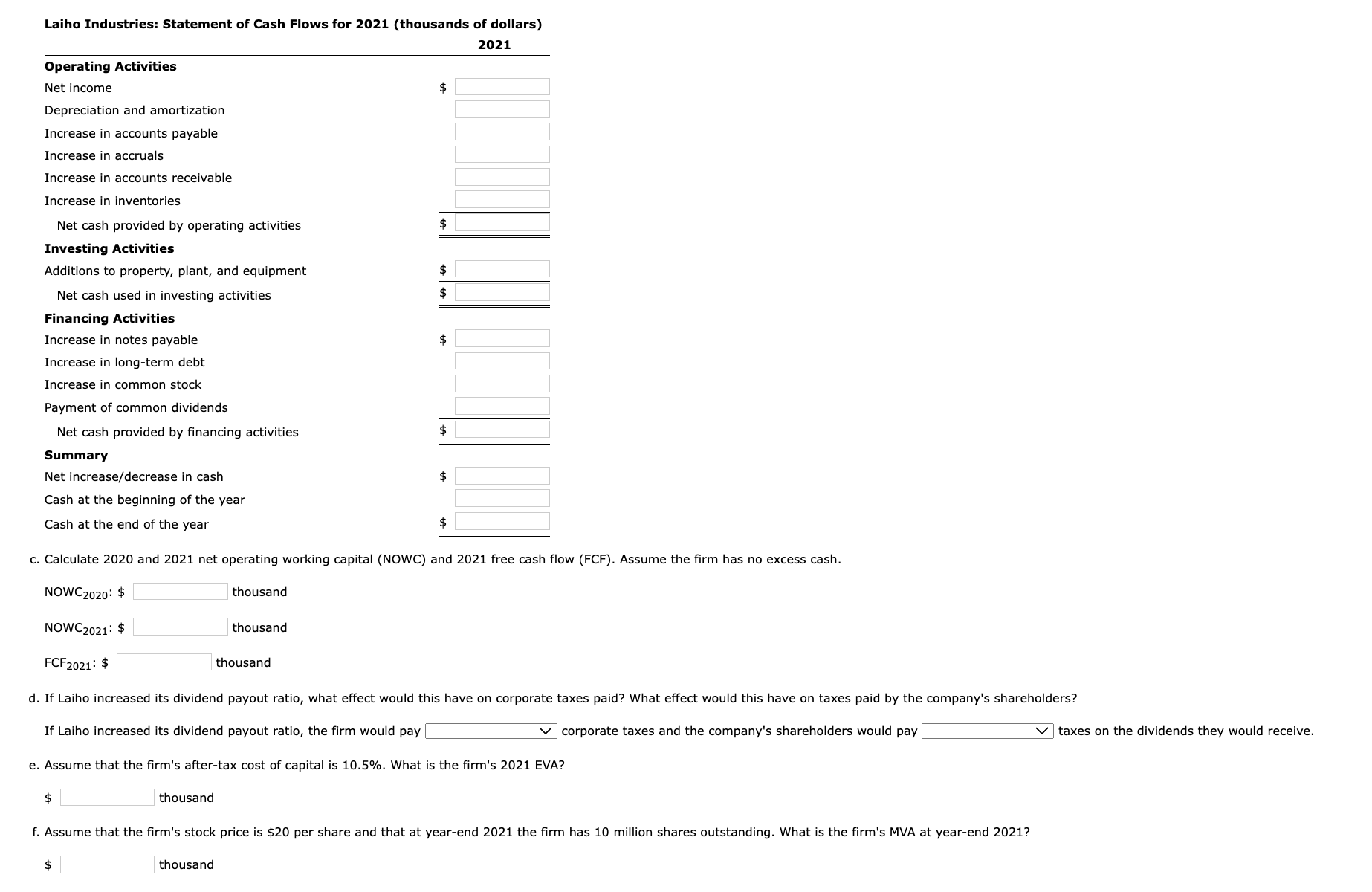

25%, and Laiho pays 47.25% of its net income as dividends. Given this information, construct the firm's 2021 income statement. Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars) the next is the annual depreciation expense for the year. Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. any. c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC2020:$NOWCFCF2021:$thousandthousandthousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10.5%. What is the firm's 2021 EVA? \$ thousand f. Assume that the firm's stock price is $20 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? \$ thousand

25%, and Laiho pays 47.25% of its net income as dividends. Given this information, construct the firm's 2021 income statement. Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars) the next is the annual depreciation expense for the year. Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. any. c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC2020:$NOWCFCF2021:$thousandthousandthousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 10.5%. What is the firm's 2021 EVA? \$ thousand f. Assume that the firm's stock price is $20 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? \$ thousand Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started