Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[25] Debby Dale purchased her home in December Year 1 for $135,000. In December Year 7, when her existing mortgage was $110,000, she borrowed $30,000

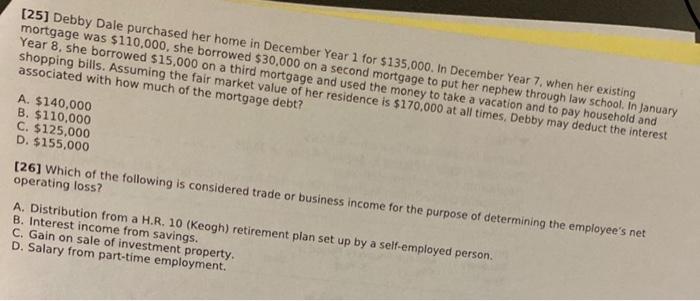

[25] Debby Dale purchased her home in December Year 1 for $135,000. In December Year 7, when her existing mortgage was $110,000, she borrowed $30,000 on a second mortgage to put her nephew through law school. In January Year 8, she borrowed $15,000 on a third mortgage and used the money to take a vacation and to pay household and shopping bills. Assuming the fair market value of her residence is $170,000 at all times, Debby may deduct the interest associated with how much of the mortgage debt? A. $140,000 B. $110,000 C. $125,000 D. $155,000 [26] Which of the following is considered trade or business income for the purpose of determining the employee's net operating loss? A. Distribution from a H.R. 10 (Keogh) retirement plan set up by a self-employed person. B. Interest income from savings. C. Gain on sale of investment property. D. Salary from part-time employment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started