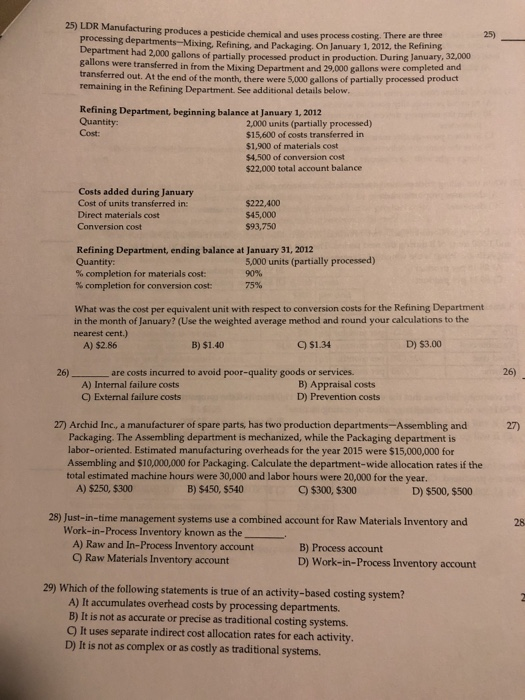

25) LDR Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments-Mixing, Refining, and Packaging. Department had 2,000 On January 1, 2012, the Refining gallons of partially processed product in production. During January, 32,000 ons were transferred in from the Mixing Department and 29,000 gallons were completed and transferred out. At the end of the month, there were 5,000 gallons of partially remaining in the Refining Department. See additional details below Refining Department, beginning balance at January 1, 2012 Quantity Cost 2,000 units (partially processed) $15,600 of costs transferred irn $1,900 of materials cost $4,500 of conversion cost $22,000 total account balance Costs added during January Cost of units transferred in: Direct materials cost Conversion cost $222,400 $45,000 593,750 Refining Department, ending balance at January 31, 2012 Quantity: % completion for materials cost % completion for conversion cost 5,000 units (partially processed) 75% What was the cost per equivalent unit with respect to conversion costs for the Refining Department in the month of January? (Use the weighted average method and round your calculations to the nearest cent.) D) $3.00 B) $1.40 C) $1.34 A) $2.86 are costs incurred to avoid poor-quality goods or services 26) B) Appraisal costs D) Prevention costs A) Internal failure costs C) External failure costs 27) Archid Inc, a manufacturer of spare parts, has two production departments-Assembling and 27) Packaging. The Assembling department is mechanized, while the Packaging department is labor-oriented. Estimated manufacturing overheads for the year 2015 were $15,000,000 for Assembling and $10,000,000 for Packaging. Calculate the department-wide allocation rates if the total estimated machine hours were 30,000 and labor hours were 20,000 for the year. A) $250, $300 B) $450, $540 C) $300, $300 D) $500, $500 28) Just-in-time management systems use a combined account for Raw Materials Inventory and 28 Work-in-Process Inventory known as the A) Raw and In-Process Inventory account Q Raw Materials Inventory account B) Process account D) Work-in-Process Inventory account 29) Which of the following statements is true of an activity-based costing system? A) It accumulates overhead costs by processing departments. B) It is not as accurate or precise as traditional costing systems. Q It uses separate indirect cost allocation rates for each activity. D) It is not as complex or as costly as traditional systems