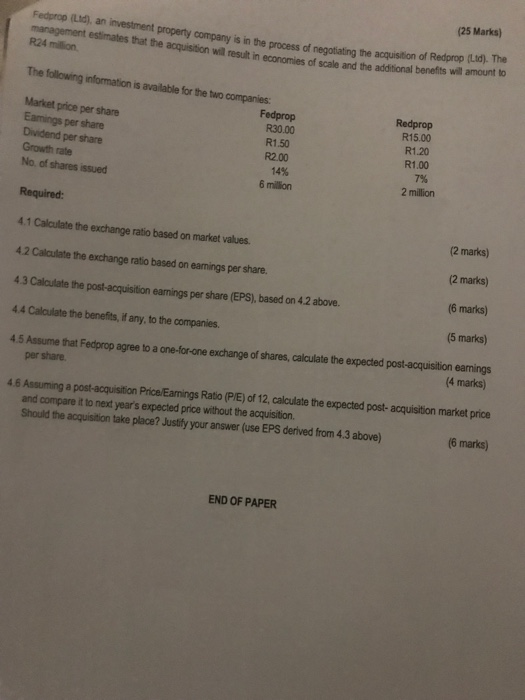

(25 Marks) Fedprop (Ltd), an investment property company is in the process of negotiating the acquisition of Redprop (Ltd). The management estimates that the acquisition will result in economies of scale and the additional benefits will amount to R24 million The following information is available for the two companies: Redprop R15.00 R1.20 R1.00 7% Fedprop R30.00 R1.50 R2.00 14% Market price per share Eamings per share Dividend per share Growth rate No. of shares issued 2 million 6 million Required: (2 marks) 4.1 Calculate the exchange ratio based on market values. (2 marks) 42 Calculate the exchange ratio based on eamings per share. (6 marks) 4.3 Calculate the post-acquisition eamings per share (EPS), based on 4.2 above. (5 marks) 44 Calculate the benefits, if any, to the companies. 4.5 Assume that Fedprop agree to a one-for-one exchange of shares, calculate the expected post-acquisition eamings per share (4 marks) 46 Assuming a post-acquisition Price/Eamings Ratio (PIE) of 12, calculate the expected post- acquisition market price and compare it to next year's expected price without the acquisition. Should the acquisition take place? Justify your answer (use EPS derived from 4.3 above) (6 marks) END OF PAPER (25 Marks) Fedprop (Ltd), an investment property company is in the process of negotiating the acquisition of Redprop (Ltd). The management estimates that the acquisition will result in economies of scale and the additional benefits will amount to R24 million The following information is available for the two companies: Redprop R15.00 R1.20 R1.00 7% Fedprop R30.00 R1.50 R2.00 14% Market price per share Eamings per share Dividend per share Growth rate No. of shares issued 2 million 6 million Required: (2 marks) 4.1 Calculate the exchange ratio based on market values. (2 marks) 42 Calculate the exchange ratio based on eamings per share. (6 marks) 4.3 Calculate the post-acquisition eamings per share (EPS), based on 4.2 above. (5 marks) 44 Calculate the benefits, if any, to the companies. 4.5 Assume that Fedprop agree to a one-for-one exchange of shares, calculate the expected post-acquisition eamings per share (4 marks) 46 Assuming a post-acquisition Price/Eamings Ratio (PIE) of 12, calculate the expected post- acquisition market price and compare it to next year's expected price without the acquisition. Should the acquisition take place? Justify your answer (use EPS derived from 4.3 above) (6 marks) END OF PAPER