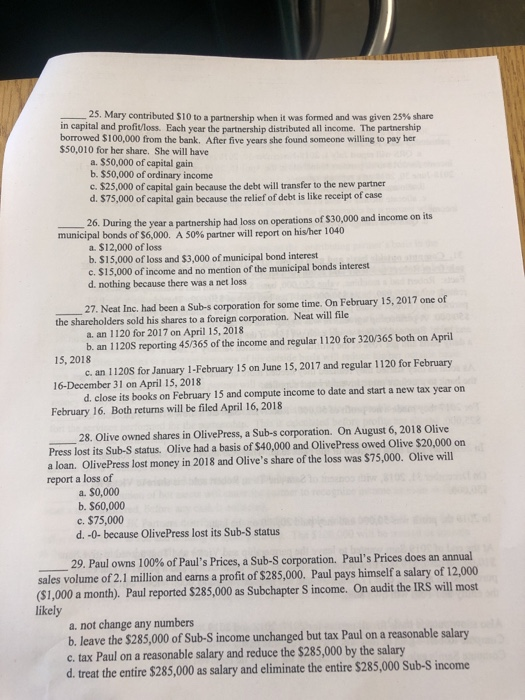

25. Mary contributed $10 to a partnership when it was formed and was given 25% share in capital and profit/loss. Each year the partnership distributed all income. The partnership borrowed $100,000 from the bank. After five years she found someone willing to pay her $50,010 for her share. She will have a. $50,00 of capital gain b. $50,000 of ordinary income c. $25,000 of capital gain because the debt will transfer to the new partner d. $75,000 of capital gain because the relief of debt is like receipt of case 26. During the year a partnership had loss on operations of $30,000 and income on its municipal bonds of$6,000. A 50% partner will report on his/her 1040 a. $12,000 of loss b. $15,000 of loss and $3,000 of municipal bond interest e. $15,000 of income and no mention of the municipal bonds interest d. nothing because there was a net loss 27. Neat Inc. had been a Sub-s corporation for some time. On February 15, 2017 one of the shareholders sold his shares to a foreign corporation. Neat will file a. an 1120 for 2017 on April 15, 2018 b. an 1120S reporting 45/365 of the income and regular 1120 for 320/365 both on April c. an 1120S for January 1-February 15 on June 15, 2017 and regular 1120 for February 15, 2018 16-December 31 on April 15, 2018 February 16. Both returns will be filed April 16, 2018 d. close its books on February 15 and compute income to date and start a new tax year on 28. Olive owned shares in OlivePress, a Sub-s corporation. On August 6, 2018 Olive Press lost its Sub-S status. Olive had a basis of $40,000 and OlivePress owed Olive $20,000 on a loan. OlivePress lost money in 2018 and Olive's share of the loss was $75,000. Olive will report a loss of a. $0,000 b. $60,000 c. $75,000 d. -0- because OlivePress lost its Sub-S status 29. Paul owns 100% of Paul's Prices, a Sub-S corporation. Paul's Prices does an annual sales volume of 2.1 million and earns a profit of $285,000. Paul pays himself a salary of 12,000 (S1,000 a month). Paul reported $285,000 as Subchapter S income. On audit the IRS will most likely a. not change any numbers b. leave the $285,000 of Sub-S income unchanged but tax Paul on a reasonable salary c. tax Paul on a reasonable salary and reduce the $285,000 by the salary d. treat the entire $285,000 as salary and eliminate the entire $285,000 Sub-S income 25. Mary contributed $10 to a partnership when it was formed and was given 25% share in capital and profit/loss. Each year the partnership distributed all income. The partnership borrowed $100,000 from the bank. After five years she found someone willing to pay her $50,010 for her share. She will have a. $50,00 of capital gain b. $50,000 of ordinary income c. $25,000 of capital gain because the debt will transfer to the new partner d. $75,000 of capital gain because the relief of debt is like receipt of case 26. During the year a partnership had loss on operations of $30,000 and income on its municipal bonds of$6,000. A 50% partner will report on his/her 1040 a. $12,000 of loss b. $15,000 of loss and $3,000 of municipal bond interest e. $15,000 of income and no mention of the municipal bonds interest d. nothing because there was a net loss 27. Neat Inc. had been a Sub-s corporation for some time. On February 15, 2017 one of the shareholders sold his shares to a foreign corporation. Neat will file a. an 1120 for 2017 on April 15, 2018 b. an 1120S reporting 45/365 of the income and regular 1120 for 320/365 both on April c. an 1120S for January 1-February 15 on June 15, 2017 and regular 1120 for February 15, 2018 16-December 31 on April 15, 2018 February 16. Both returns will be filed April 16, 2018 d. close its books on February 15 and compute income to date and start a new tax year on 28. Olive owned shares in OlivePress, a Sub-s corporation. On August 6, 2018 Olive Press lost its Sub-S status. Olive had a basis of $40,000 and OlivePress owed Olive $20,000 on a loan. OlivePress lost money in 2018 and Olive's share of the loss was $75,000. Olive will report a loss of a. $0,000 b. $60,000 c. $75,000 d. -0- because OlivePress lost its Sub-S status 29. Paul owns 100% of Paul's Prices, a Sub-S corporation. Paul's Prices does an annual sales volume of 2.1 million and earns a profit of $285,000. Paul pays himself a salary of 12,000 (S1,000 a month). Paul reported $285,000 as Subchapter S income. On audit the IRS will most likely a. not change any numbers b. leave the $285,000 of Sub-S income unchanged but tax Paul on a reasonable salary c. tax Paul on a reasonable salary and reduce the $285,000 by the salary d. treat the entire $285,000 as salary and eliminate the entire $285,000 Sub-S income