Answered step by step

Verified Expert Solution

Question

1 Approved Answer

25 points The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: $ 28,080 (13,000) Collections from

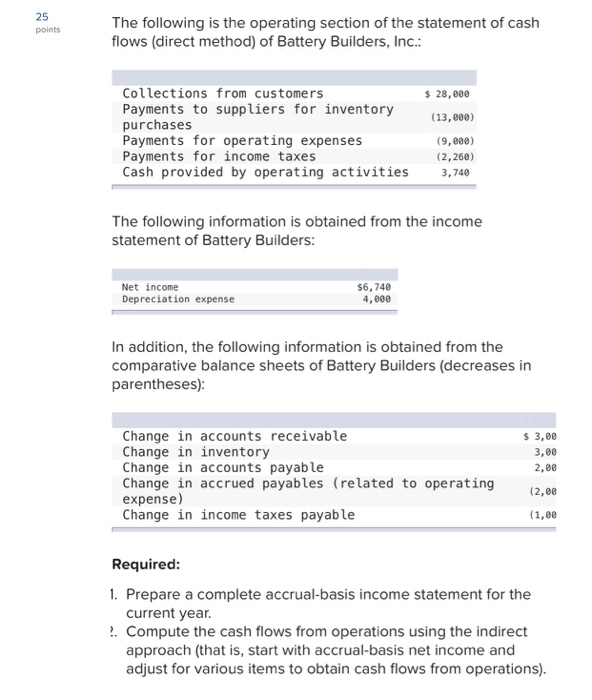

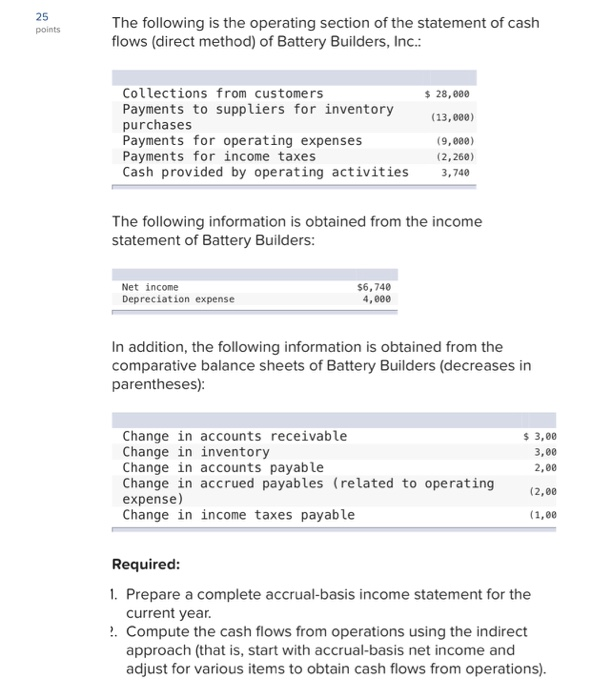

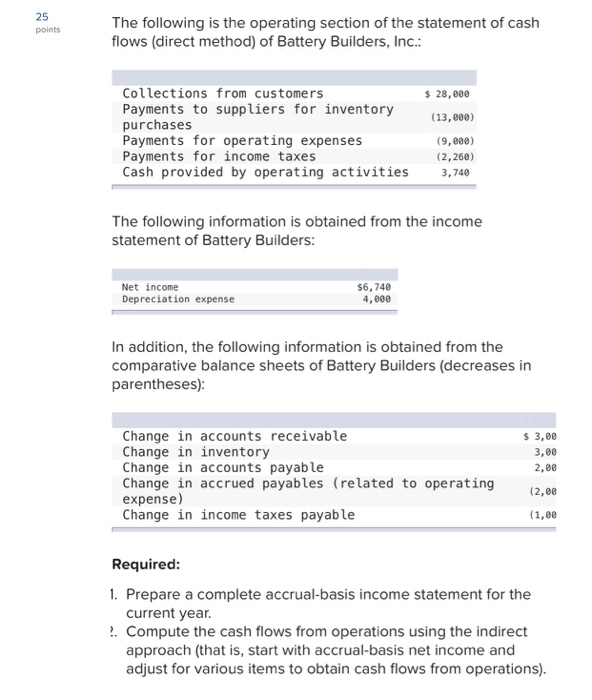

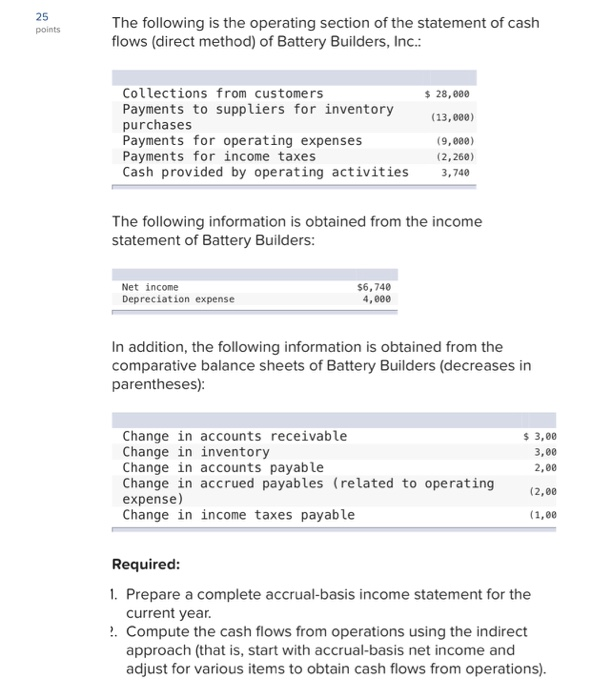

25 points The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: $ 28,080 (13,000) Collections from customers Payments to suppliers for inventory purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities (9,000) (2,260) 3,740 The following information is obtained from the income statement of Battery Builders: Net income Depreciation expense $6,740 4,608 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): $ 3,00 3,00 2,00 Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payables (related to operating expense) Change in income taxes payable (2,00 (1,00 Required: 1. Prepare a complete accrual-basis income statement for the current year. ?. Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations). 25 points The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: $ 28,080 (13,000) Collections from customers Payments to suppliers for inventory purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities (9,000) (2,260) 3,740 The following information is obtained from the income statement of Battery Builders: Net income Depreciation expense $6,740 4,608 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): $ 3,00 3,00 2,00 Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payables (related to operating expense) Change in income taxes payable (2,00 (1,00 Required: 1. Prepare a complete accrual-basis income statement for the current year. ?. Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations)

25 points The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: $ 28,080 (13,000) Collections from customers Payments to suppliers for inventory purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities (9,000) (2,260) 3,740 The following information is obtained from the income statement of Battery Builders: Net income Depreciation expense $6,740 4,608 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): $ 3,00 3,00 2,00 Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payables (related to operating expense) Change in income taxes payable (2,00 (1,00 Required: 1. Prepare a complete accrual-basis income statement for the current year. ?. Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations). 25 points The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: $ 28,080 (13,000) Collections from customers Payments to suppliers for inventory purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities (9,000) (2,260) 3,740 The following information is obtained from the income statement of Battery Builders: Net income Depreciation expense $6,740 4,608 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): $ 3,00 3,00 2,00 Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payables (related to operating expense) Change in income taxes payable (2,00 (1,00 Required: 1. Prepare a complete accrual-basis income statement for the current year. ?. Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started