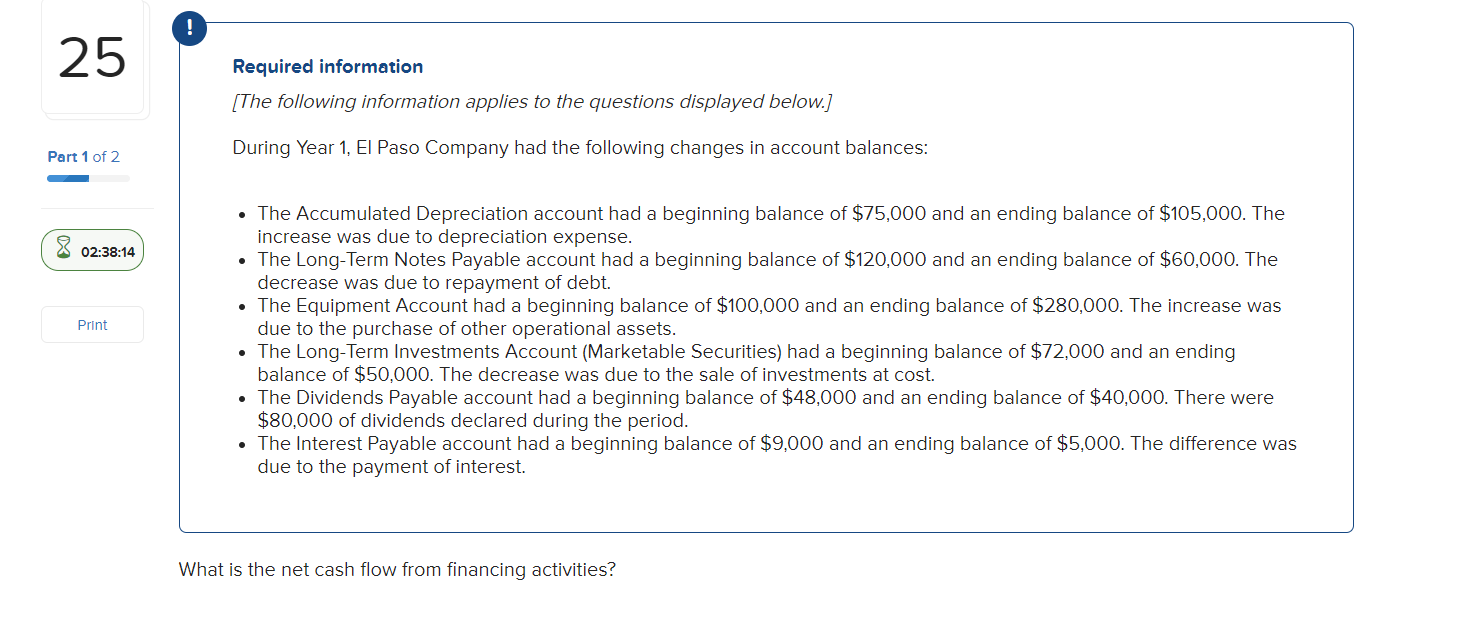

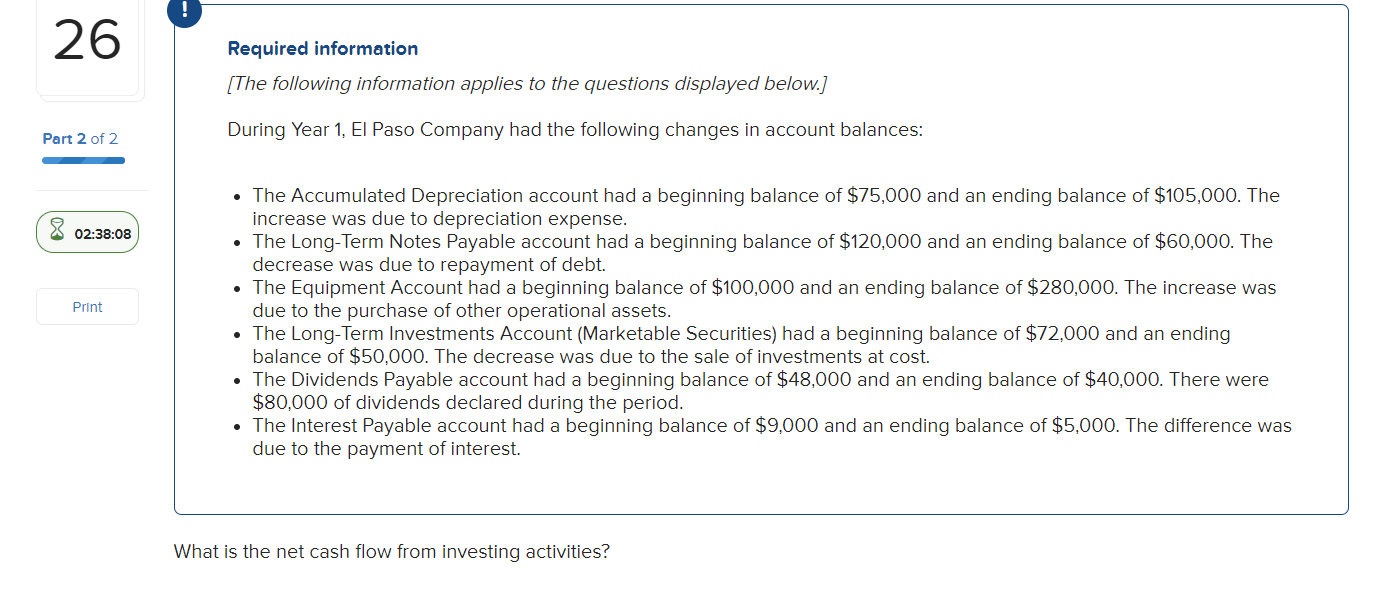

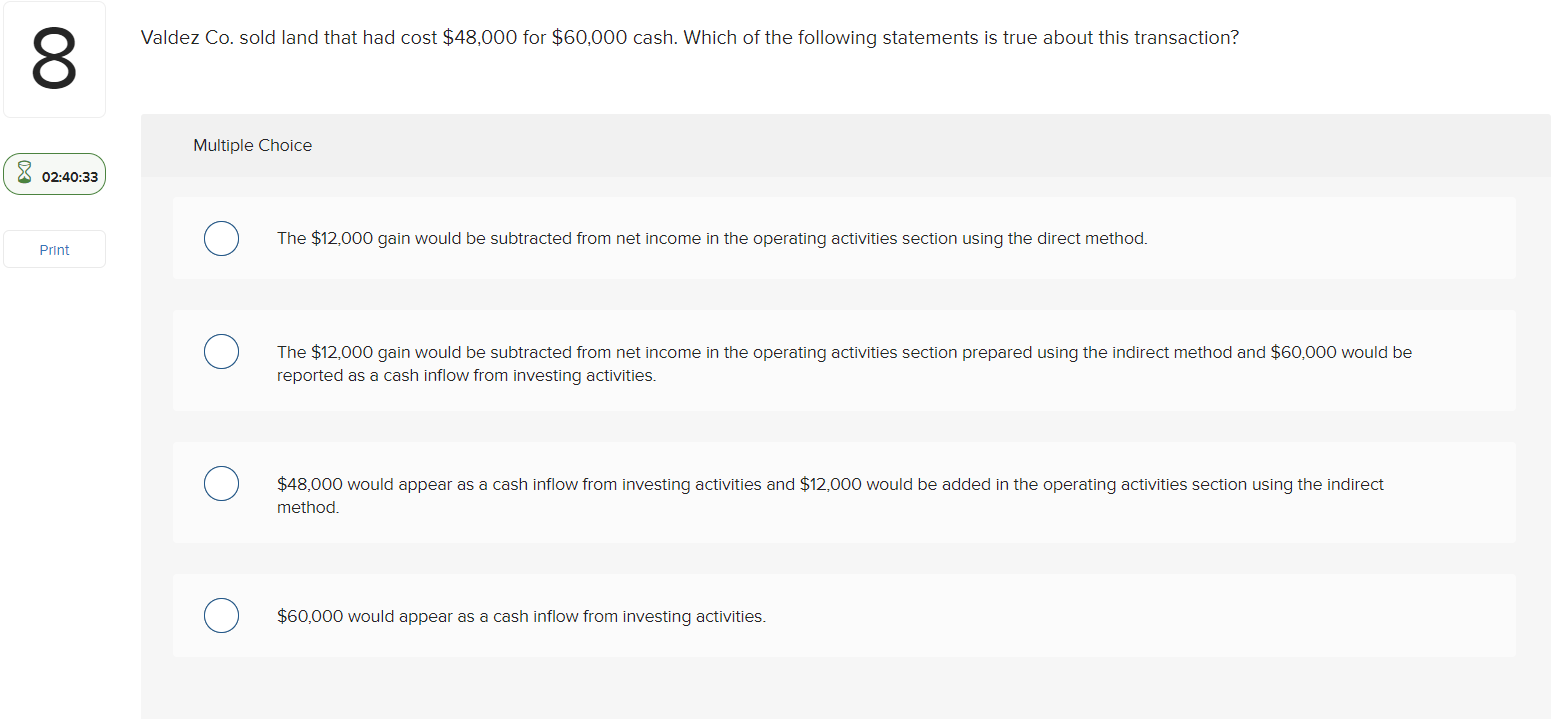

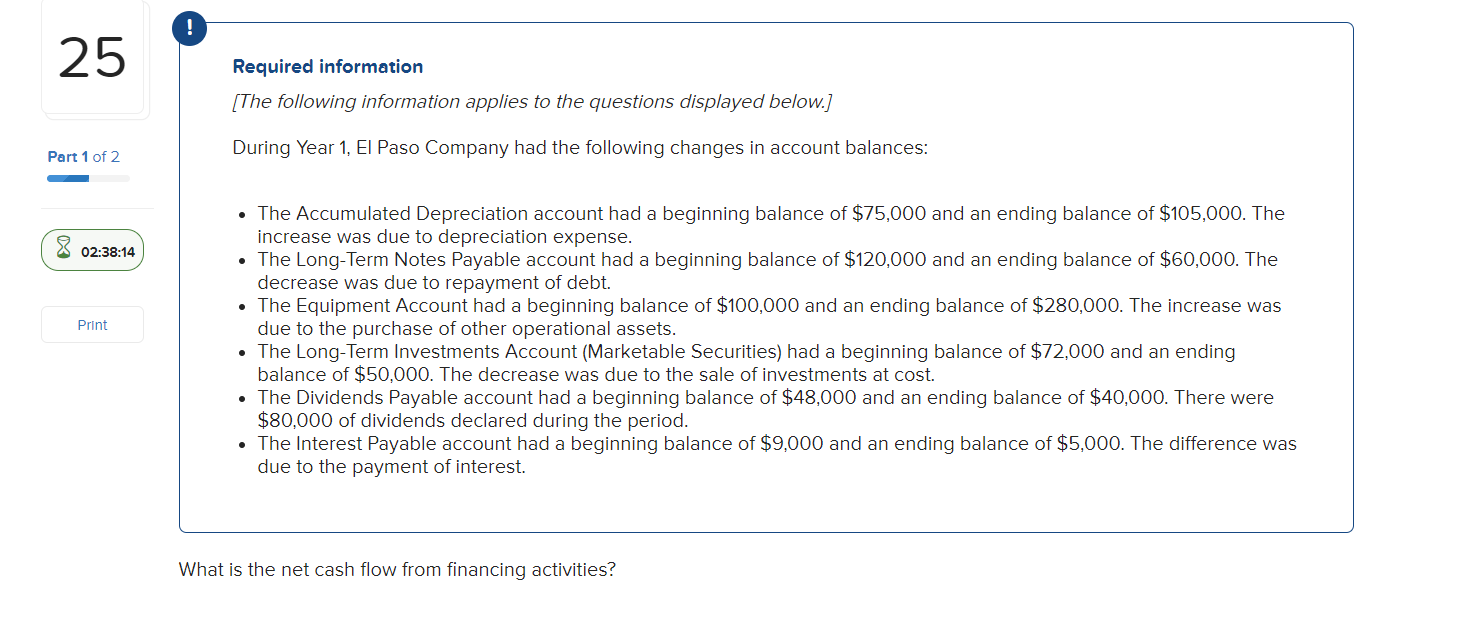

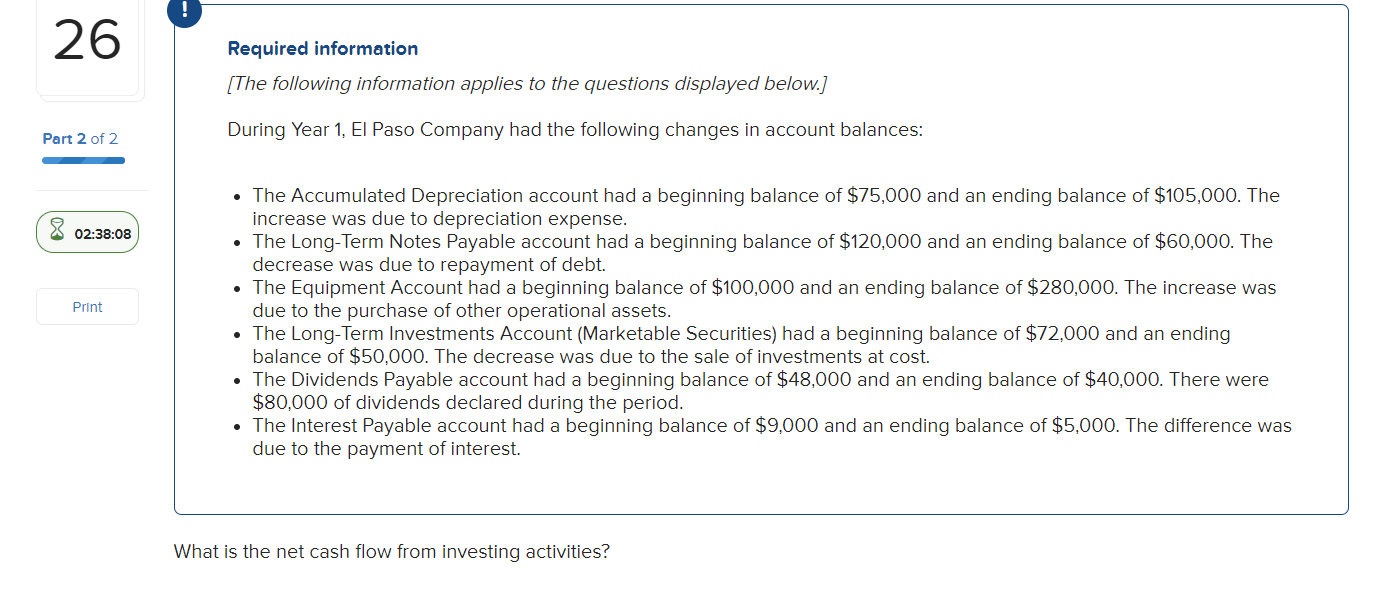

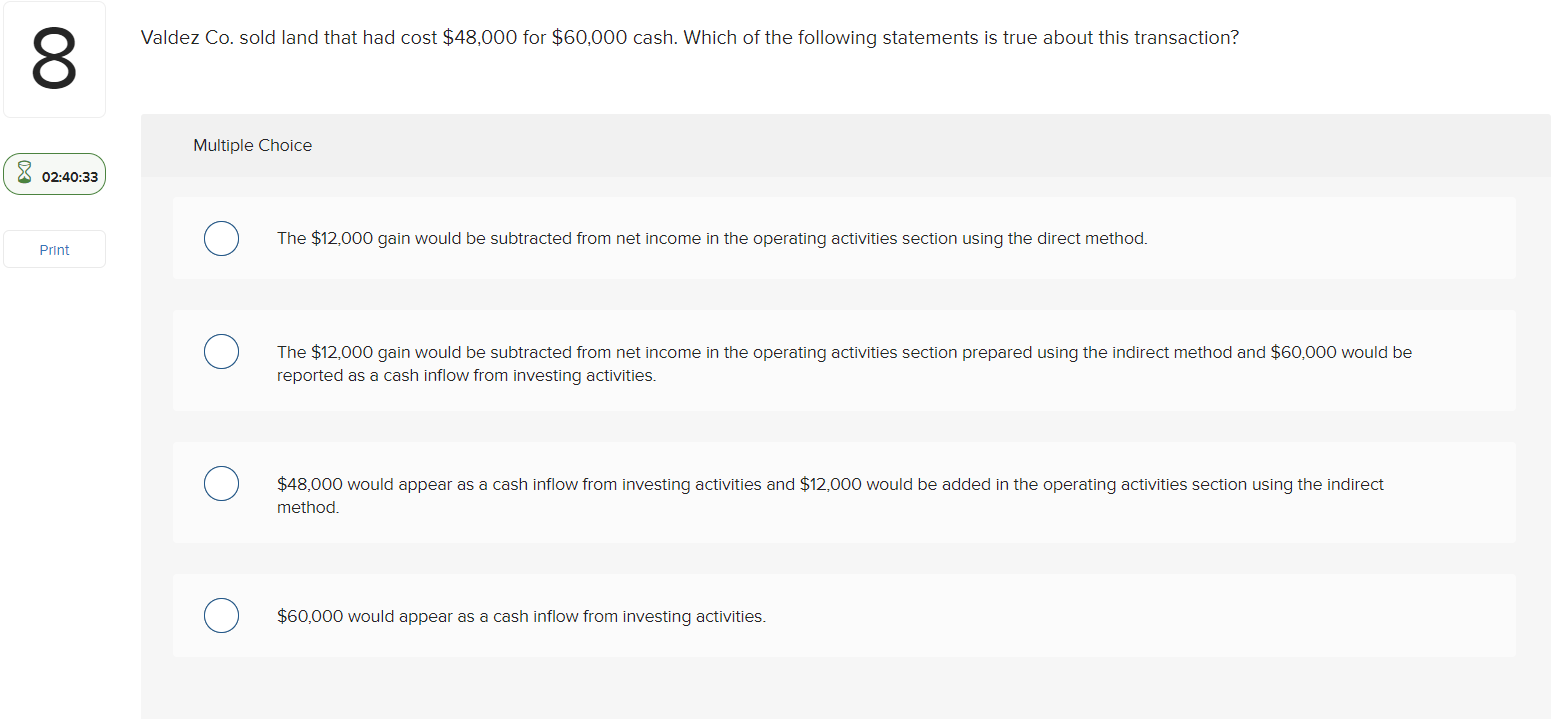

! 25 Required information (The following information applies to the questions displayed below.) Part 1 of 2 During Year 1, El Paso Company had the following changes in account balances: 8 02:38:14 Print The Accumulated Depreciation account had a beginning balance of $75,000 and an ending balance of $105,000. The increase was due to depreciation expense. The Long-Term Notes Payable account had a beginning balance of $120,000 and an ending balance of $60,000. The decrease was due to repayment of debt. The Equipment Account had a beginning balance of $100,000 and an ending balance of $280,000. The increase was due to the purchase of other operational assets. The Long-Term Investments Account (Marketable Securities) had a beginning balance of $72,000 and an ending balance of $50,000. The decrease was due to the sale of investments at cost. The Dividends Payable account had a beginning balance of $48,000 and an ending balance of $40,000. There were $80,000 of dividends declared during the period. The Interest Payable account had a beginning balance of $9,000 and an ending balance of $5,000. The difference was due to the payment of interest. What is the net cash flow from financing activities? 26 Required information [The following information applies to the questions displayed below.] During Year 1, El Paso Company had the following changes in account balances: Part 2 of 2 8 02:38:08 Print The Accumulated Depreciation account had a beginning balance of $75,000 and an ending balance of $105,000. The increase was due to depreciation expense. The Long-Term Notes Payable account had a beginning balance of $120,000 and an ending balance of $60,000. The decrease was due to repayment of debt. The Equipment Account had a beginning balance of $100,000 and an ending balance of $280,000. The increase was due to the purchase of other operational assets. The Long-Term Investments Account (Marketable Securities) had a beginning balance of $72,000 and an ending balance of $50,000. The decrease was due to the sale of investments at cost. The Dividends Payable account had a beginning balance of $48,000 and an ending balance of $40,000. There were $80,000 of dividends declared during the period. The Interest Payable account had a beginning balance of $9,000 and an ending balance of $5,000. The difference was due to the payment of interest. What is the net cash flow from investing activities? Valdez Co. sold land that had cost $48,000 for $60,000 cash. Which of the following statements is true about this transaction? 00 Multiple Choice 02:40:33 The $12,000 gain would be subtracted from net income in the operating activities section using the direct method. Print The $12,000 gain would be subtracted from net income in the operating activities section prepared using the indirect method and $60,000 would be reported as a cash inflow from investing activities. $48,000 would appear as a cash inflow from investing activities and $12,000 would be added in the operating activities section using the indirect method. $60,000 would appear as a cash inflow from investing activities