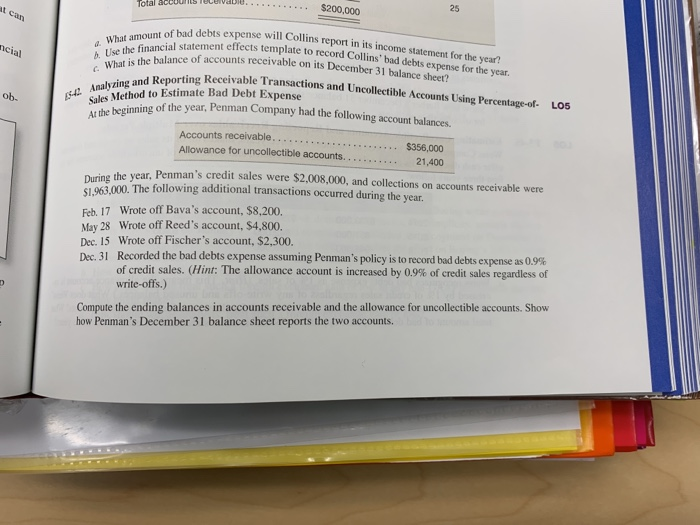

25 Total accounts t can nt of bad debts expense will Collins report in its income statement for the year? atement effects template to record Collins' bad debts expense for the year. of accounts receivable on its December 31 balance sheet? at amount te ncial b. Use the financial What is the balance ing Receivable Transactions and Uncollectible Accounts Using Percentage-of. LO5 , Analyzing and Reporting st- sales Methps of the year, Penman Company had the followving account balances. Ar the beginni ob. Accounts receivable... $356,000 ..21,400 ear, Penman's credit sales were $2,008,000, and collections on accounts receivable were The following additional transactions occurred during the year. During S1.963,000. Feb. 17 Wrote off Bava's account, $8.200. May 28 Wrote off Reed's account, $4.800. Dec. 15 Wrote off Fischer's account, $2,300. Dec. 31 Recorded the bad debts expense assuming Penman s policy is to record bad debt expense as 0.9% of credit sales. (Hint: The allowance account is increased by 0.9% of credit sales regardless of write-offs.) Compute the ending balances in accounts receivable and the allowance for uncollectible accounts. Show how Penman's December 31 balance sheet reports the two accounts. g and Reporting Receivalble Transactions and Uncollectible Accounts Using Percentage-ot LOS 4a Method to Estimate Bad Debt Expense of the year, Penman Company had the following account balances. the At the beginning Allowance for During the year, Penman's credit sales were $2,008,000, and collections on accou S1.963,000. The following additional transactions occurred during the year. Feb. 17 Wrote off Bava's account, $8,200. May 28 Wrote off Reed's account, $4,800 Dec. 15 Wrote off Fischer's account, $2,300 Dec. 31 Recorded the bad debts expense assuming Penman's policy is to record bad debts expense as 0.9% of credit sales. (Hint: The allowance account is increased by 0.9% of credit sales regardless of write-offs.) Compute the ending balances in accounts receivable and the allowance for uncollectible accounts. Show how Penman's December 31 balance sheet reports the two accounts