Question

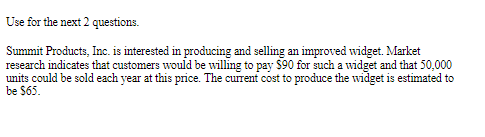

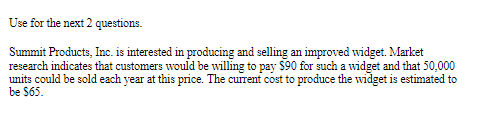

.25) Use the information below for the next 2 questions. See attached. If Summit Products requires a 25% return on sales to undertake production, what

.25)Use the information below for the next 2 questions. See attached. If Summit Products requires a 25% return on sales to undertake production, what is the target cost for the new widget?  Select the correct one

Select the correct one

a. $80 b. $65.00 c. some other amount d. .$67.50 26. SEE ATTACHED FOR INFORMATION TO ANSWER THIS. Summit has learned that a competitor plans to introduce a similar widget at a price of $80. In response, Summit may reduce its selling price to $80. If Summit requires a 25% return on sales, what is the target cost for the new widget?

Select the correct one

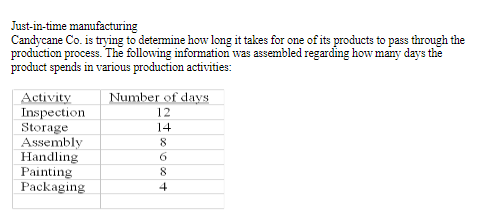

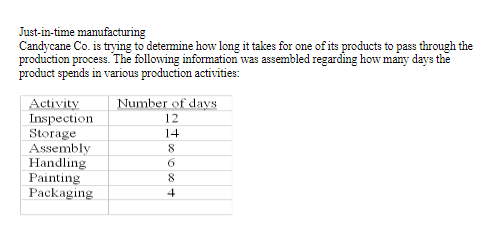

a. $60 b. $20 c. $80 d. $23.75 27. Use the information ATTACHED for the next 3 questions for the Candycane Co. What is the number of days above which are value-added activities?  Select the correct one

Select the correct one

a. 20 days b. 52 days c. Some other amount d. 32 days 28) See attached for Candycane Co. What is Candycane's total cycle time?  Select the correct one

Select the correct one

a. Some other amount b. 26 days c. 52 days d. 20 days 29) See attached for Candycane Co. Determine Candycane's manufacturing efficiency ratio.

select the correct one a. 100% b. 50% c. 38.5% d. 61.5% 30) If the unit sales price is $14, variable costs are $7 per unit and fixed costs are $42,000, how many units must be sold to earn an income of $250,000?

Select the correct one

a. 52,142. b. 41,715. c. 34,762. d. 29,796.

31) Management expects total sales of $40 million, a margin of safety of $10 million, and a contribution margin ratio of 45%. Which of the following estimated amounts is not consistent with this information? Select the correct one

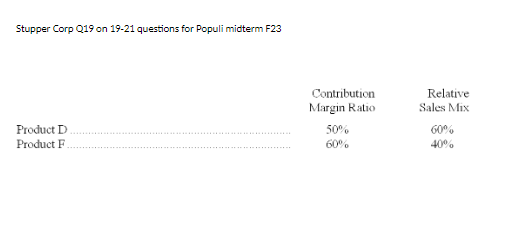

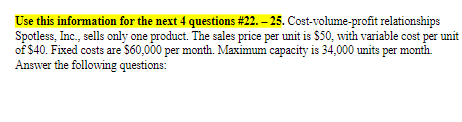

a. Fixed costs, $13.5 million. b. Variable costs, $22 million c. Operating income, $6 million. d. Break-even sales volume, $30 million. 32. Raymond & Sons generates an average contribution margin ratio of 45% on its sales. Management estimates that by spending $3,500 more per month to rent additional facilities, the business will be able to increase operating income by $10,000 per month. Management must feel that the additional facilities will increase monthly sales volume (in dollars) by: Select the correct one a. $13,500. b. $8,775. c. $30,000. d. $4,725. 33. Stupper Corporation manufactures two products; data are shown in the attachment. If Stupper's monthly fixed costs average $200,000, what is its break-even point expressed in sales dollars?  Select the correct one a. $250,000. b. $152,632. c. $370,370. d. $320,000. 34. To break-even, how many units must Spotless, sell per month?

Select the correct one a. $250,000. b. $152,632. c. $370,370. d. $320,000. 34. To break-even, how many units must Spotless, sell per month?

Select the correct one

a. 17,000 units b. 1,500 units c. 1,200 units d. 6,000 units 35. If Spotless, Inc., sold 25,000 units, what would be its operating income for the month?

Select the correct one

Select the correct one

a. $280,000 b. $ 190,000 c. $ 1,250,000 d. Some other amount 36. At present capacity, what is the maximum operating income Spotless, can expect to earn per month?

Select the correct one

Select the correct one

a. $1,700,000 b. $190,000 c. Some other amount d. $280,000 PLEASE ANSWER ALL 12 AS THEY ARE FROM THE SAME SET ( I dont need explanation just the right answers are enough please)

Just-in-time manufacturing Candycane Co. is trying to determine how long it takes for one of its products to pass through the production process. The following information was assembled regarding how many days the product spends in various production activities: Use for the next 2 questions. Summit Products, Inc. is interested in producing and selling an improved widget. Market research indicates that customers would be willing to pay $90 for such a widget and that 50,000 units could be sold each year at this price. The current cost to produce the widget is estimated to be $65. Use this information for the next 4 questions \#22. 25. Cost-volume-profit relationships Spotless, Inc., sells only one product. The sales price per unit is $50, with variable cost per unit of $40. Fixed costs are $60,000 per month. Maximum capacity is 34,000 units per month. Answer the following questions: Stupper Corp Q19 on 19-21 questions for Populi midterm F23 Use this information for the next 4 questions $22.25. Cost-volume-profit relationships Spotless, Inc., sells only one product. The sales price per unit is $50, with variable cost per unit of $40. Fixed costs are $60,000 per month. Maximum capacity is 34,000 units per month Answer the following questions: Just-in-time manufacturing Candycane Co. is trying to determine how long it takes for one of its products to pass through the production process. The following information was assembled regarding how many days the product spends in various production activities: Use for the next 2 questions. Summit Products, Inc. is interested in producing and selling an improved widget. Market research indicates that customers would be willing to pay $90 for such a widget and that 50,000 units could be sold each year at this price. The current cost to produce the widget is estimated to be $65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started