Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2:5 (Working with an income statement and balance sheet) Prepare an income statement and a balance sheet from the scrambled list of items in the

2:5

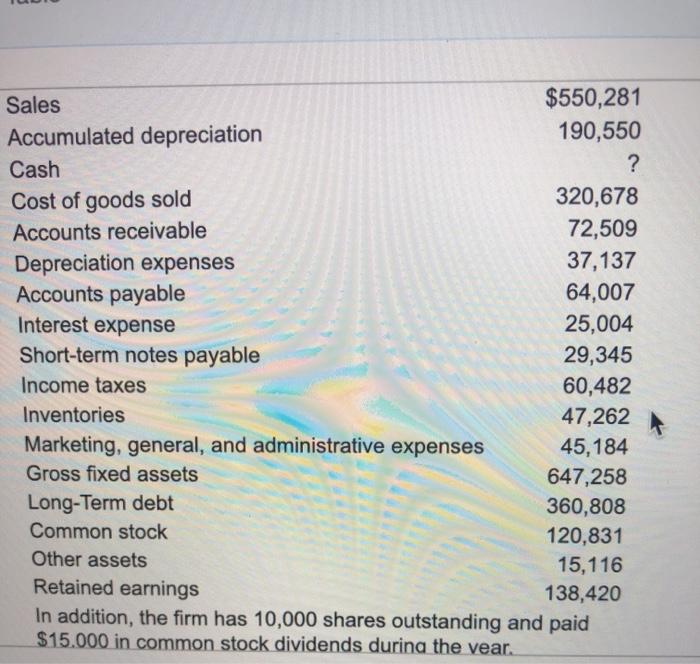

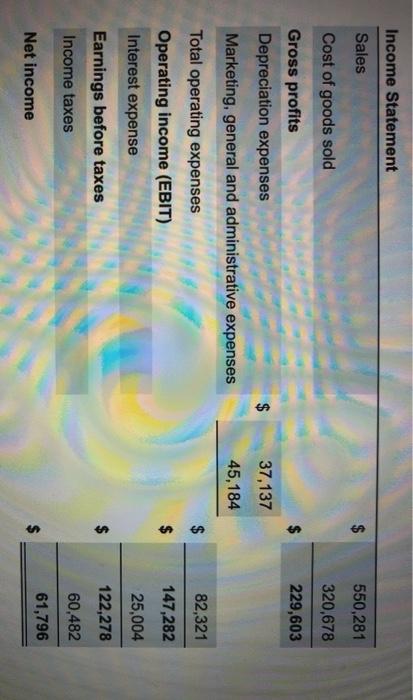

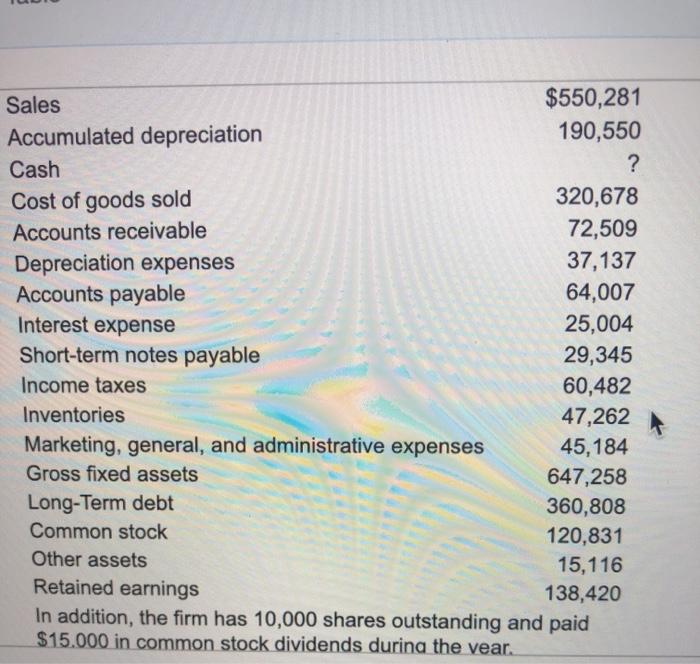

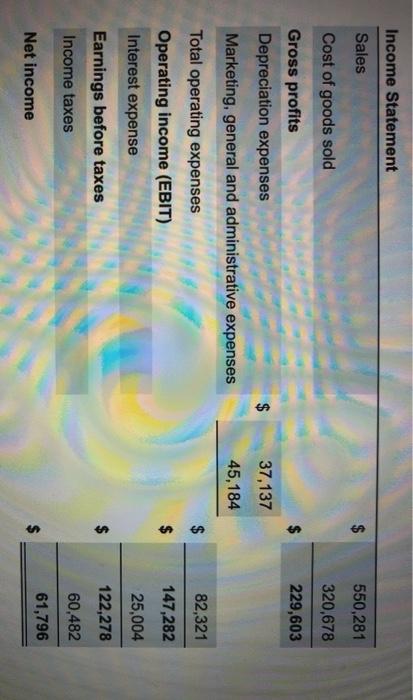

(Working with an income statement and balance sheet) Prepare an income statement and a balance sheet from the scrambled list of items in the popup window, What is the firm's net working capital and debt ratio? Sales $550,281 Accumulated depreciation 190,550 Cash ? Cost of goods sold 320,678 Accounts receivable 72,509 Depreciation expenses 37,137 Accounts payable 64,007 Interest expense 25,004 Short-term notes payable 29,345 Income taxes 60,482 Inventories 47,262 Marketing, general, and administrative expenses 45,184 Gross fixed assets 647,258 Long-Term debt 360,808 Common stock 120,831 Other assets 15,116 Retained earnings 138,420 In addition, the firm has 10,000 shares outstanding and paid $15.000 in common stock dividends during the vear. Income Statement Sales en 550,281 320,678 229,603 Cost of goods sold Gross profits Depreciation expenses Marketing, general and administrative expenses 37,137 45,184 82,321 $ 147,282 Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes Income taxes 25,004 122,278 60,482 61,796 Net income (Working with an income statement and balance sheet) Prepare an income statement and a b= ratio? Marketing, general and administrative expenses 45,184 $ 82,321 Total operating expenses Operating income (EBIT) 147,282 Interest expense 25,004 $ Earnings before taxes Income taxes 122,278 60,482 Net income 61,796 10,000 $ Number of common shares outstanding Earnings per share Dividends paid to stockholders Dividends per share 15,000 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started