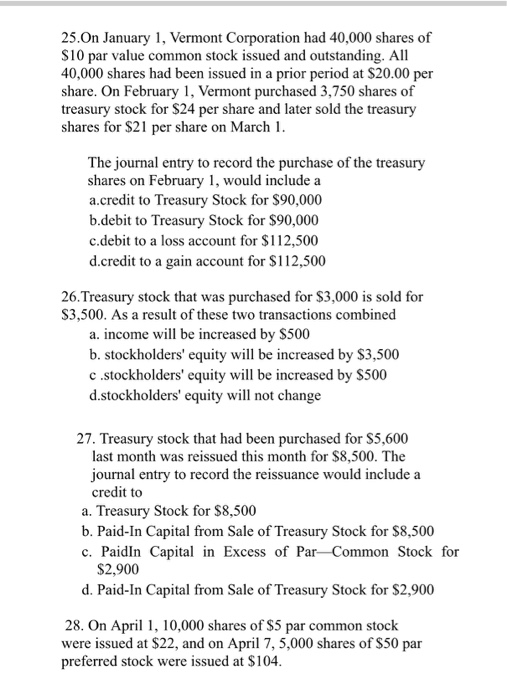

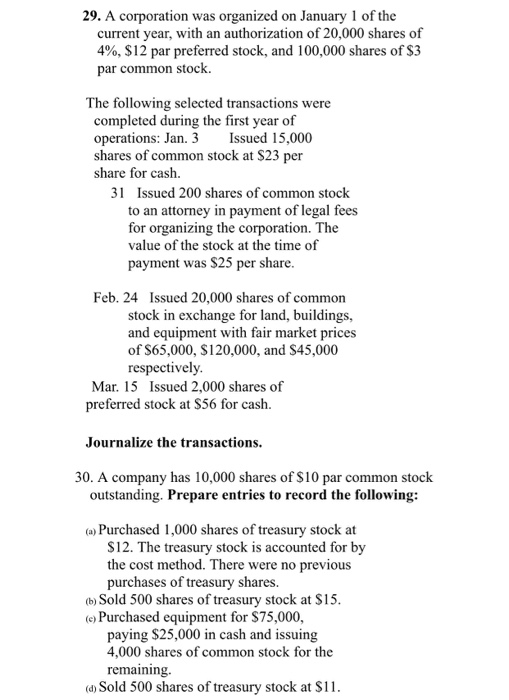

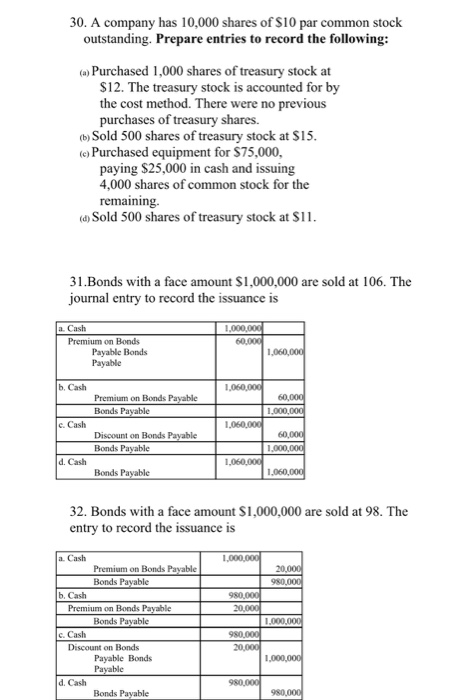

25.On January 1, Vermont Corporation had 40,000 shares of S10 par value common stock issued and outstanding. All 40,000 shares had been issued in a prior period at S20.00 per share. On February 1, Vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on March stted in a prior period at $20 The journal entry to record the purchase of the treasury shares on February , would include a a.credit to Treasury Stock for S90,000 b.debit to Treasury Stock for $90,000 c.debit to a loss account for $112,500 d.credit to a gain account for $112,500 26.Treasury stock that was purchased for $3,000 is sold for S3,500. As a result of these two transactions combined a. income will be increased by S500 b. stockholders' equity will be increased by $3,500 c .stockholders' equity will be increased by S500 d.stockholders' equity will not change 27. Treasury stock that had been purchased for $5,600 last month was reissued this month for $8,500. The journal entry to record the reissuance would include a credit to a. Treasury Stock for $8,500 b. Paid-In Capital from Sale of Treasury Stock for $8,500 c. PaidIn Capital in Excess of Par-Common Stock for $2,900 d. Paid-In Capital from Sale of Treasury Stock for $2,900 28. On April 1, 10,000 shares of $5 par common stock were issued at $22, and on April 7, 5,000 shares of $50 par preferred stock were issued at $104 29. A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of 4%, $12 par preferred stock, and 100,000 shares of $3 par common stock. The following selected transactions were completed during the first year of operations: Jan. 3 Issued 15,000 shares of common stock at $23 per share for cash 31 Issued 200 shares of common stock to an attorney in payment of legal fees for organizing the corporation. The value of the stock at the time of payment was $25 per share. Feb. 24 Issued 20,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of S65,000, S120,000, and S45,000 respectively Mar. 15 Issued 2,000 shares of preferred stock at $56 for cash. Journalize the transactions. 30. A company has 10,000 shares of $10 par common stock outstanding. Prepare entries to record the following (a) Purchased 1,000 shares of treasury stock at S12. The treasury stock is accounted for by the cost method. There were no previous purchases of treasury shares. (b)Sold 500 shares of treasury stock at $15 (e) Purchased equipment for $75,000, paying $25,000 in cash and issuing 4,000 shares of common stock for the remaining d) Sold 500 shares of treasury stock at $11 30. A company has 10,000 shares of S10 par common stock outstanding. Prepare entries to record the following (a) Purchased 1,000 shares of treasury stock at S12. The treasury stock is accounted for by the cost method. There were no previous purchases of treasury shares. b) Sold 500 shares of treasury stock at $15 e) Purchased equipment for $75,000, paying $25,000 in cash and issuing 4,000 shares of common stock for the remaining a) Sold 500 shares of treasury stock at S11 31.Bonds with a face amount $1,000,000 are sold at 106. The journal entry to record the issuance is a. Cash 1,000,00 Premium on Bonds Payable Bonds Payable b, Cash 60 Premium on Bonds Payable Bonds Payable 1,000,00 e. Cash Discount on Bonds Pavable Bonds Pavable 60 1,000,00 d. Cash Bonds 1,060, 32. Bonds with a face amount $1,000,000 are sold at 98. The entry to record the issuance is a. Cash Premium on Bonds Payable Bonds Payable 980,00 b, Cash 980,00 20,00 Premium on Bonds Payable Bonds Payable 1,000,00 Cash Discount on Bonds Payable Bonds Payable d. Cash Bonds Pavable