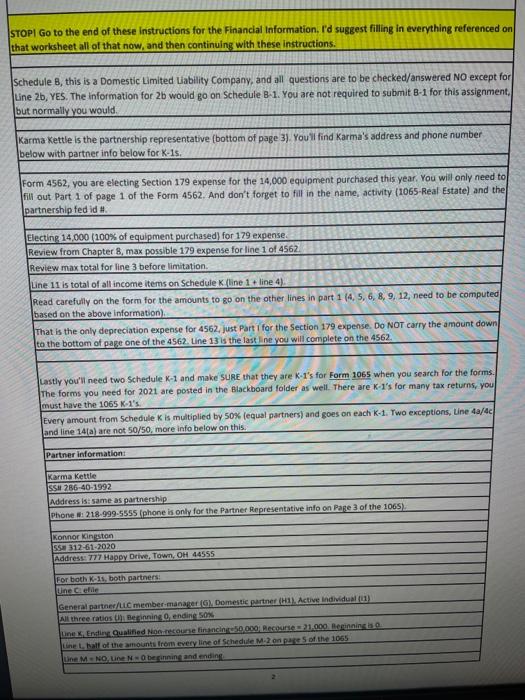

2/6 1001 + B Gemeinde geringen has won the room Donecon 165. The word we becue ht com YOU. 14.000 of them 562 de pe BOSS th LE Othe hati Path 1. WWW STOPI Go to the end of these instructions for the Financial Information. I'd suggest filling in everything referenced on that worksheet all of that now, and then continuing with these instructions. Schedule B, this is a Domestic Limited Liability Company, and all questions are to be checked/answered NO except for Line 2b, YES. The information for 2b would go on Schedule B-1. You are not required to submit 8-1 for this assignment, but normally you would Karma Kettle is the partnership representative (bottom of page 3). You'll find Karma's address and phone number below with partner info below for K-1s. Form 4562, you are electing Section 179 expense for the 14,000 equipment purchased this year. You will only need to fill out Part 1 of page 1 of the Form 4562. And don't forget to fill in the name, activity (1065-Real Estate) and the partnership fed id # Electing 14,000/200% of equipment purchased) for 179 expense. Review from Chapter 8 max possible 179 expense for line 1 of 4562 Review max total for line 3 before limitation Line 11 is total of all income items on Schedule K (line 1 + line 4) Read carefully on the form for the amounts to go on the other lines in part 1 (4, 5, 6, 8, 9, 12, need to be computed based on the above information) That is the only depreciation expense for 4562. just Part 1 for the Section 179 expense. Do NOT carry the amount down to the bottom of page one of the 4562. Line 13 is the last line you will complete on the 4562. Lastly you'll need two Schedule K-1 and make SURE that they are K-1's for Form 1065 when you search for the forms. The forms you need for 2021 are posted in the Blackboard folder as well. There are K-1's for many tax returns, you must have the 1065 K-1's. Every amount from Schedule K is multiplied by 50% (equal partners) and goes on each K-1. Two exceptions, Line 4/4 and line 141a) are not 50/50, more info below on this Partner information: Karma Kettle ISSN 286-40-1992 Address is: same as partnership Phone : 218.999.5555 (phone is only for the Partner Representative info on Page 3 of the 1065) Konnor Kingston SS312-61-2020 Address: 777 Happy Drive Town, OH 44555 For both K-1s, both partners necefile General partner/LC member-manager) Domestic partner (H1. Active Individual All three ratios. Benning endine SOX Endi Qualified coune financin.000 Recore 21.000 Beginning half of the amounts from every line of Schedule M.2 on pages of the 1055 Line M-NO LINO Finning and ending 2/6 1001 + B Gemeinde geringen has won the room Donecon 165. The word we becue ht com YOU. 14.000 of them 562 de pe BOSS th LE Othe hati Path 1. WWW STOPI Go to the end of these instructions for the Financial Information. I'd suggest filling in everything referenced on that worksheet all of that now, and then continuing with these instructions. Schedule B, this is a Domestic Limited Liability Company, and all questions are to be checked/answered NO except for Line 2b, YES. The information for 2b would go on Schedule B-1. You are not required to submit 8-1 for this assignment, but normally you would Karma Kettle is the partnership representative (bottom of page 3). You'll find Karma's address and phone number below with partner info below for K-1s. Form 4562, you are electing Section 179 expense for the 14,000 equipment purchased this year. You will only need to fill out Part 1 of page 1 of the Form 4562. And don't forget to fill in the name, activity (1065-Real Estate) and the partnership fed id # Electing 14,000/200% of equipment purchased) for 179 expense. Review from Chapter 8 max possible 179 expense for line 1 of 4562 Review max total for line 3 before limitation Line 11 is total of all income items on Schedule K (line 1 + line 4) Read carefully on the form for the amounts to go on the other lines in part 1 (4, 5, 6, 8, 9, 12, need to be computed based on the above information) That is the only depreciation expense for 4562. just Part 1 for the Section 179 expense. Do NOT carry the amount down to the bottom of page one of the 4562. Line 13 is the last line you will complete on the 4562. Lastly you'll need two Schedule K-1 and make SURE that they are K-1's for Form 1065 when you search for the forms. The forms you need for 2021 are posted in the Blackboard folder as well. There are K-1's for many tax returns, you must have the 1065 K-1's. Every amount from Schedule K is multiplied by 50% (equal partners) and goes on each K-1. Two exceptions, Line 4/4 and line 141a) are not 50/50, more info below on this Partner information: Karma Kettle ISSN 286-40-1992 Address is: same as partnership Phone : 218.999.5555 (phone is only for the Partner Representative info on Page 3 of the 1065) Konnor Kingston SS312-61-2020 Address: 777 Happy Drive Town, OH 44555 For both K-1s, both partners necefile General partner/LC member-manager) Domestic partner (H1. Active Individual All three ratios. Benning endine SOX Endi Qualified coune financin.000 Recore 21.000 Beginning half of the amounts from every line of Schedule M.2 on pages of the 1055 Line M-NO LINO Finning and ending