Question

26. 26. I need the answers and how to work them!! THANKS You have saved $22,213.00 for a three-year vacation to Germany. You will keep

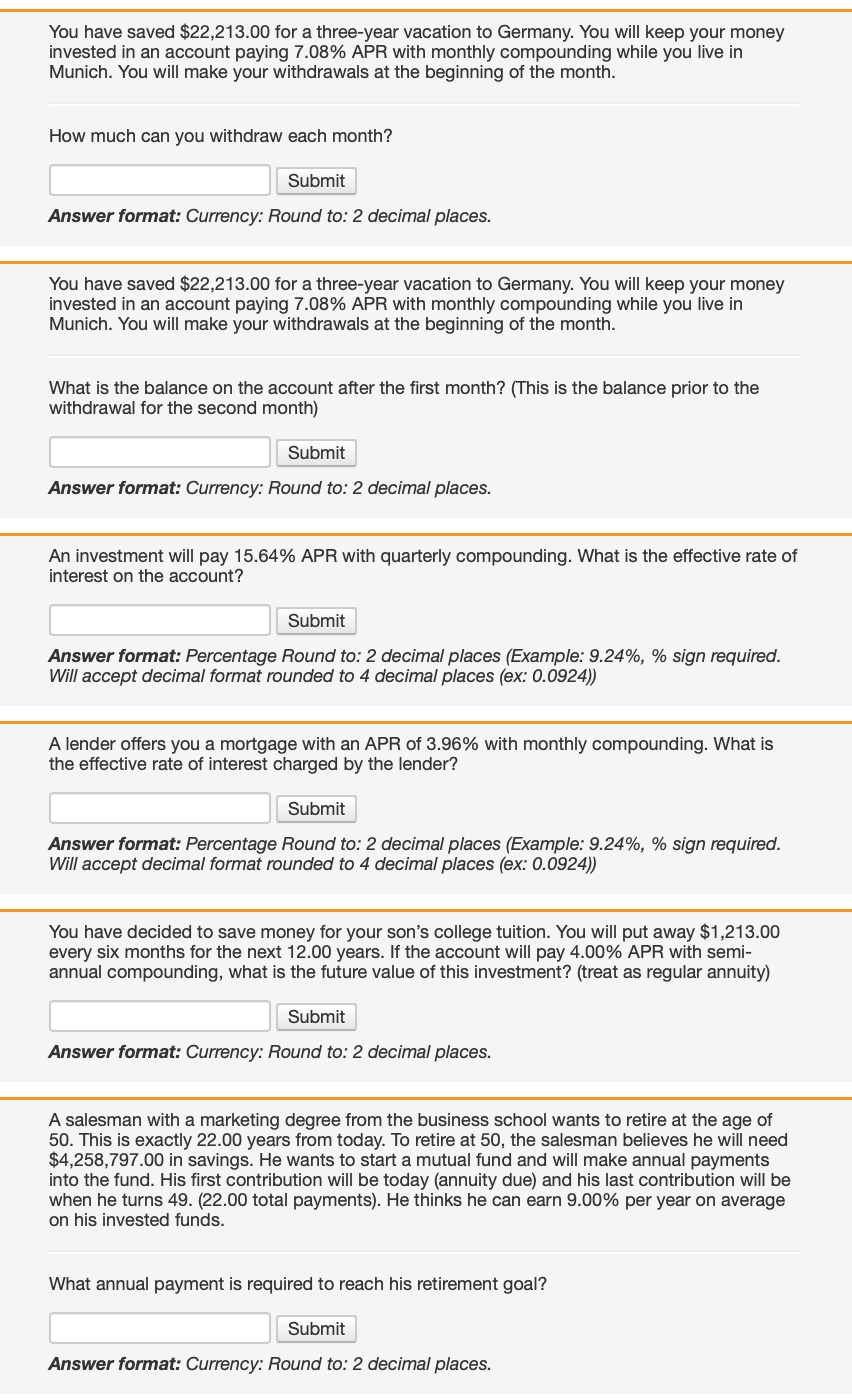

26. 26. I need the answers and how to work them!! THANKS  You have saved $22,213.00 for a three-year vacation to Germany. You will keep your money invested in an account paying 7.08% APR with monthly compounding while you live in Munich. You will make your withdrawals at the beginning of the month. How much can you withdraw each month? Answer format: Currency: Round to: 2 decimal places. You have saved $22,213.00 for a three-year vacation to Germany. You will keep your money invested in an account paying 7.08% APR with monthly compounding while you live in Munich. You will make your withdrawals at the beginning of the month. What is the balance on the account after the first month? (This is the balance prior to the withdrawal for the second month) Answer format: Currency: Round to: 2 decimal places. An investment will pay 15.64% APR with quarterly compounding. What is the effective rate of interest on the account? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A lender offers you a mortgage with an APR of 3.96% with monthly compounding. What is the effective rate of interest charged by the lender? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) You have decided to save money for your son's college tuition. You will put away \$1,213.00 every six months for the next 12.00 years. If the account will pay 4.00% APR with semiannual compounding, what is the future value of this investment? (treat as regular annuity) Answer format: Currency: Round to: 2 decimal places. A salesman with a marketing degree from the business school wants to retire at the age of 50. This is exactly 22.00 years from today. To retire at 50 , the salesman believes he will need $4,258,797.00 in savings. He wants to start a mutual fund and will make annual payments into the fund. His first contribution will be today (annuity due) and his last contribution will be when he turns 49. (22.00 total payments). He thinks he can earn 9.00% per year on average on his invested funds. What annual payment is required to reach his retirement goal

You have saved $22,213.00 for a three-year vacation to Germany. You will keep your money invested in an account paying 7.08% APR with monthly compounding while you live in Munich. You will make your withdrawals at the beginning of the month. How much can you withdraw each month? Answer format: Currency: Round to: 2 decimal places. You have saved $22,213.00 for a three-year vacation to Germany. You will keep your money invested in an account paying 7.08% APR with monthly compounding while you live in Munich. You will make your withdrawals at the beginning of the month. What is the balance on the account after the first month? (This is the balance prior to the withdrawal for the second month) Answer format: Currency: Round to: 2 decimal places. An investment will pay 15.64% APR with quarterly compounding. What is the effective rate of interest on the account? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) A lender offers you a mortgage with an APR of 3.96% with monthly compounding. What is the effective rate of interest charged by the lender? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) You have decided to save money for your son's college tuition. You will put away \$1,213.00 every six months for the next 12.00 years. If the account will pay 4.00% APR with semiannual compounding, what is the future value of this investment? (treat as regular annuity) Answer format: Currency: Round to: 2 decimal places. A salesman with a marketing degree from the business school wants to retire at the age of 50. This is exactly 22.00 years from today. To retire at 50 , the salesman believes he will need $4,258,797.00 in savings. He wants to start a mutual fund and will make annual payments into the fund. His first contribution will be today (annuity due) and his last contribution will be when he turns 49. (22.00 total payments). He thinks he can earn 9.00% per year on average on his invested funds. What annual payment is required to reach his retirement goal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started