Answered step by step

Verified Expert Solution

Question

1 Approved Answer

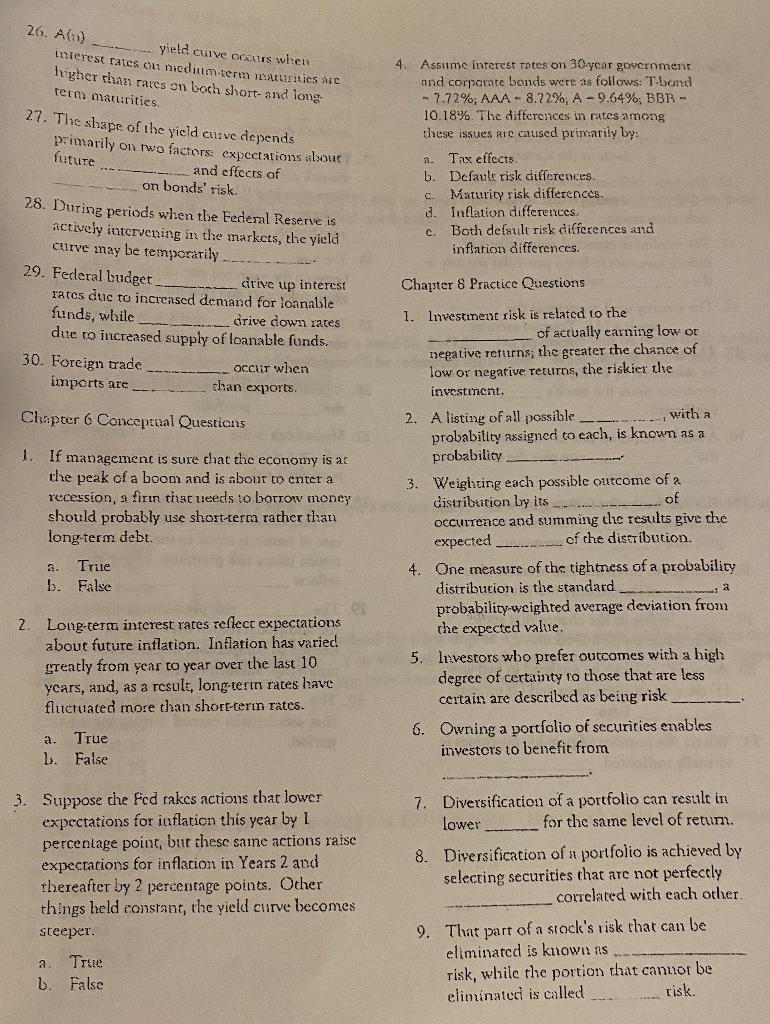

26. A:) yield cuive occurs when interest rates on medium-term maturitics C higher than rates on both short and long. Term maturities 27. The shape

26. A:) yield cuive occurs when interest rates on medium-term maturitics C higher than rates on both short and long. Term maturities 27. The shape of the yield curve depends primarily on two factors: expectations about future ... 4. Assume interest rates on 30ycar government and corporate bonds were as follows: T-bond -7.72%; AAA - 8.72%, A-9.64%; BBB - 10.18%. The differences in rates among these issues are caused primarily by: Tax effects b. Defaule risk differences c. Maturity risk differences. 0. inflation differences. c. Both default risk differences and inflation differences. 1 and effects of on bonds' risk. 28. During periods when the Federal Reserve is actively intervening in the markets, the yield curve may be temporarily 29. Federal budget drive up interest rates due to increased demand for loanable funds, while drive down rates due to increased supply of loanable funds. 30. Foreign trade occur when imperts are than exports Chapter 6 Conceptual Questions - with a 1 If management is sure that the economy is ac the peak of a boom and is about to enter a recession, a firun that veeds to borrow money should probably use short-term rather than long-term debt. a. Trile b. False Chapter 8 Practice Questions 1. Investment risk is related to the of actually earning low or negative returns; the greater the chance of low or negative returns, the riskier the investment. 2. A listing of all possible probability assigned to each, is known as a probability 3. Weighting each possible outcome of a distribution by its ---...-__-of occurrence and summing the results give the expected of the distribution. 4. One measure of the tightness of a probability distribution is the standard probability-weighted average deviation from the expected value 5. Investors who prefer outcomes with a high degree of certainty to those that are less certain are described as being risk 6. Owning a portfolio of securities enables investors to benefit from 2. Long-ters interest rates reflect expectations about future inflation. Inflation has varied! greatly from year to year over the last 10 years, and, as a result, long-terin rates have fluctuated more than short-tern rates. True b. False 3. Suppose the fod takes actions that lower expectations for inflation this year by 1 percentage point, but these saine actions raise expectations for inflation in Years 2 and thereafter by 2 percentage points. Other things held constant, the yield curve becomes steeper. True b. False 7. Diversification of a portfolio can result in lower for the same level of retum. 8. Diversification of a portfolio is achieved by selecting securities that not perfectly correlated with each other 9. That part of a stock's risk that can be eliminated is known as risk, while the portion that cannot be eliminated is called risk. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started