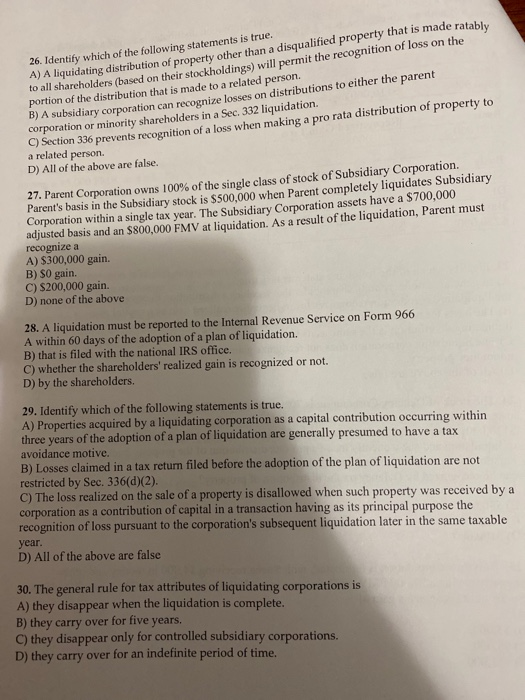

26. Identify which of the following statements is true. A) A liquidating distribution of property other than a disqualified property that is made ratably to all shareholders (based on their stockholdings) will permit the recognition of loss on the portion of the distribution that is made to a related person. B) A subsidiary corporation can recognize losses on distributions to either the parent corporation or minority shareholders in a Sec. 332 liquidation. C) Section 336 prevents recognition of a loss when making a pro rata distribution of property to a related person D) All of the above are false. 27. Parent Corporation owns 100% of the single class of stock of Subsidiary Corporation. Parent's basis in the Subsidiary stock is $500.000 when Parent completely liquidates Subsidiary Corporation within a single tax year. The Subsidiary Corporation assets have a $700,000 adjusted basis and an $800,000 FMV at liquidation. As a result of the liquidation, Parent must recognize a A) $300,000 gain. B) SO gain. C) $200,000 gain. D) none of the above 28. A liquidation must be reported to the Internal Revenue Service on Form 966 A within 60 days of the adoption of a plan of liquidation. B) that is filed with the national IRS office. C) whether the shareholders' realized gain is recognized or not. D) by the shareholders. 29. Identify which of the following statements is true. A) Properties acquired by a liquidating corporation as a capital contribution occurring within three years of the adoption of a plan of liquidation are generally presumed to have a tax avoidance motive. B) Losses claimed in a tax return filed before the adoption of the plan of liquidation are not restricted by Sec. 336(d)(2). C) The loss realized on the sale of a property is disallowed when such property was received by a corporation as a contribution of capital in a transaction having as its principal purpose the recognition of loss pursuant to the corporation's subsequent liquidation later in the same taxable year. D) All of the above are false 30. The general rule for tax attributes of liquidating corporations is A) they disappear when the liquidation is complete. B) they carry over for five years. C) they disappear only for controlled subsidiary corporations. D) they carry over for an indefinite period of time