Answered step by step

Verified Expert Solution

Question

1 Approved Answer

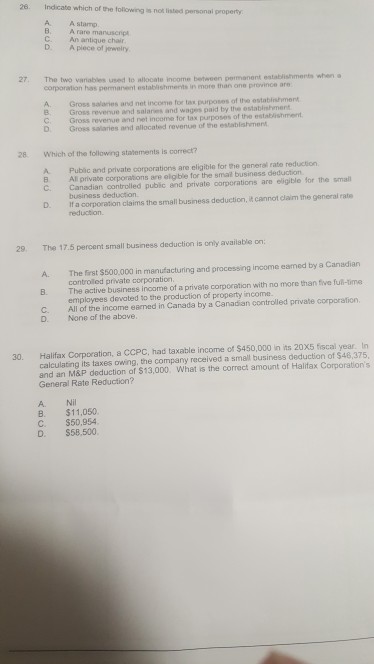

26. Indicate which of the tollowing is not listed personal property A A stamp. B. Arare manuscrip C An antique chair D A plece of

26. Indicate which of the tollowing is not listed personal property A A stamp. B. Arare manuscrip C An antique chair D A plece of yewelry 27. The two vanables used to allocate income between permanent establishments when a corporation pemmarwyl establishments in moro than ono province ore A Gross salaries and net incone for tax purposes of the establishment B. Gross revenue and salanes and wages paid by the ostablishment C Gross revenue and net income for tax purposes of the D. Gross salaries and allocated revenue of the establishment establishment 28. Which of the following statements is correct? A Pubic and private corporations are eligible for the general rate reduction B Al private corporations are olgible for the smai? business deduction C. Canadian controlled public and private corporations are eligible for the smal business deduction D. If a corporation ciaims the small business deduction,it cannot claim the general rate reduction 29. The 17.5 percent small business deduction is onily available on: A. The first $500.000 in manufacturing and processing income eamed by a Canadian B The active business income of a private corporation with no more than five full-time C. All of the income eamed in Canada by a Canadian controlled private corporation. controlled private corporation employees devated so the production of property income D None of the above 30. Halifax Corporation, a CCPC, had taxable income of $450,000 in its 20X5 fiscal year. In calculating its taxes owing, the company received a small business deduction of $48,375, and an M&P deduction of $13,000, What is the correct amount of Halifax Corporation's General Rate Reduction? A Nil B $11,050 C $50,954 D. $58,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started