Answered step by step

Verified Expert Solution

Question

1 Approved Answer

26 Middlesex Company provided the following share information for the current year. 3 (Click the icon to view the share information for the current year.)

26

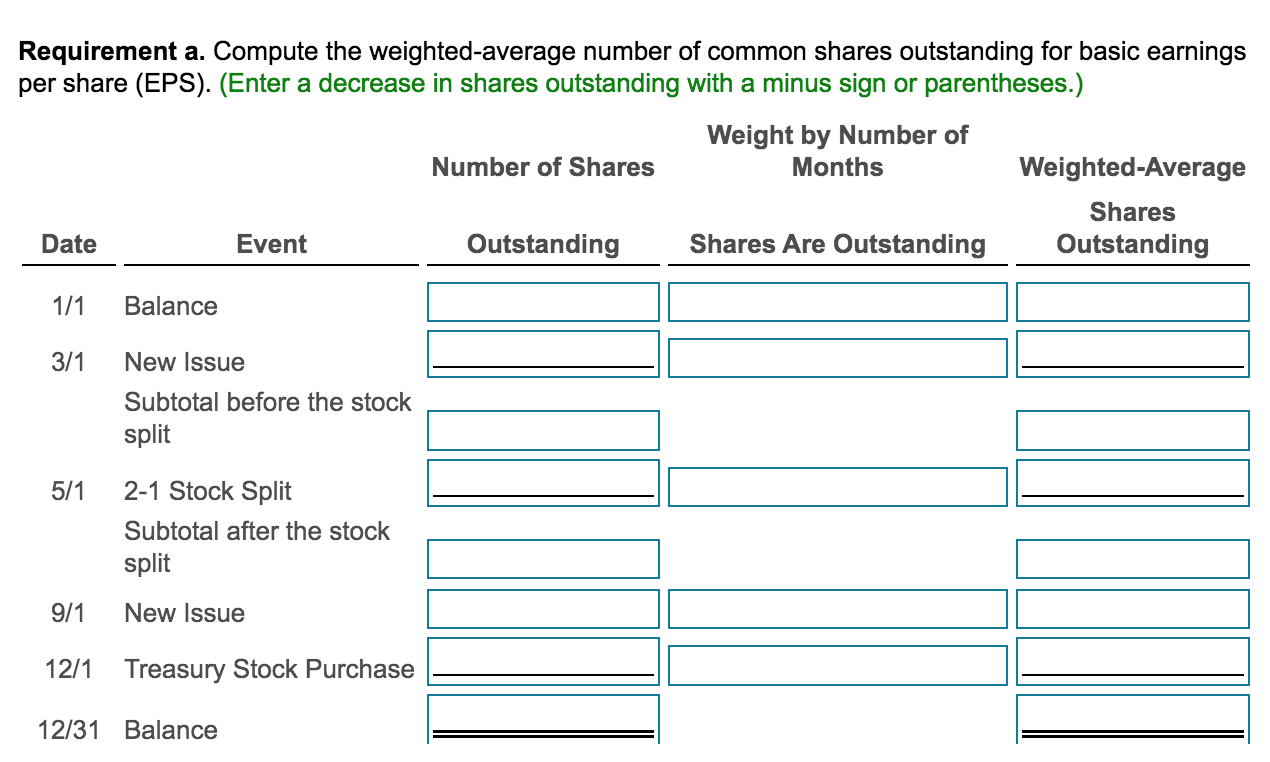

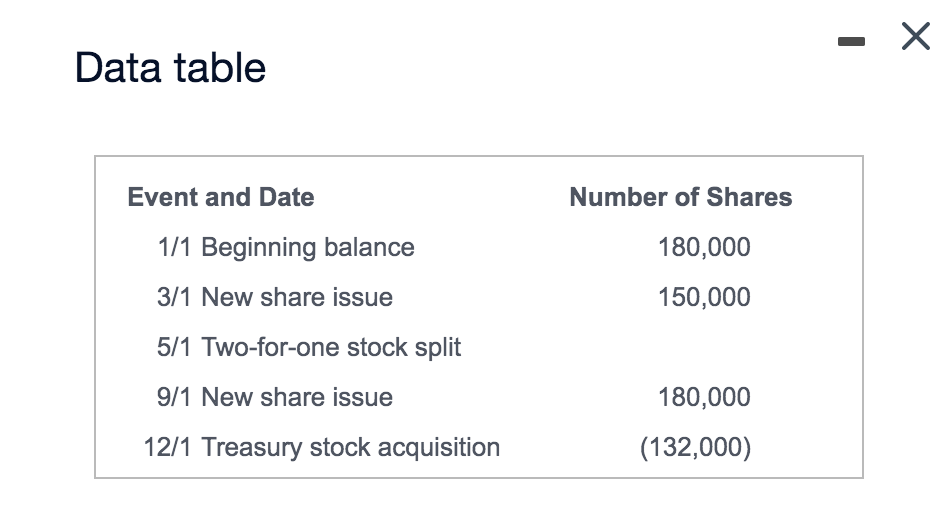

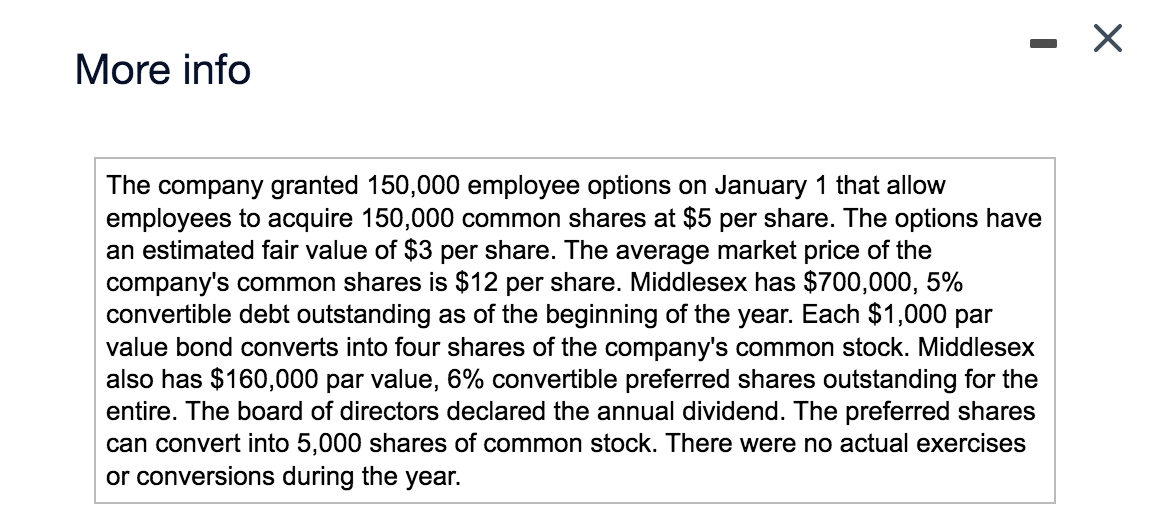

Middlesex Company provided the following share information for the current year. 3 (Click the icon to view the share information for the current year.) i (Click the icon to view the additional information.) Read the requirements. Middlesex reported income from continuing operations of $2,000,000 and a $400,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. Requirement a. Compute the weighted-average number of common shares outstanding for basic earnings per share (EPS). (Enter a decrease in shares outstanding with a minus sign or parentheses.) Weight by Number of Number of Shares Months Weighted-Average Shares Date Event Outstanding Shares Are Outstanding Outstanding 1/1 Balance 3/1 New Issue Subtotal before the stock split 5/1 2-1 Stock Split Subtotal after the stock split 9/1 New Issue 12/1 Treasury Stock Purchase 12/31 Balance Data table Event and Date 1/1 Beginning balance 3/1 New share issue Number of Shares 180,000 150,000 5/1 Two-for-one stock split 9/1 New share issue 180,000 12/1 Treasury stock acquisition (132,000) More info The company granted 150,000 employee options on January 1 that allow employees to acquire 150,000 common shares at $5 per share. The options have an estimated fair value of $3 per share. The average market price of the company's common shares is $12 per share. Middlesex has $700,000, 5% convertible debt outstanding as of the beginning of the year. Each $1,000 par value bond converts into four shares of the company's common stock. Middlesex also has $160,000 par value, 6% convertible preferred shares outstanding for the entire. The board of directors declared the annual dividend. The preferred shares can convert into 5,000 shares of common stock. There were no actual exercises or conversions during the year. Requirements a. Compute the weighted average number of common shares outstanding for basic earnings per share. b. Determine whether any securities are antidilutive, and compute basic and diluted earnings per share. Show all computations. c. Prepare all required disclosures beginning with income from continuing operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started