Answered step by step

Verified Expert Solution

Question

1 Approved Answer

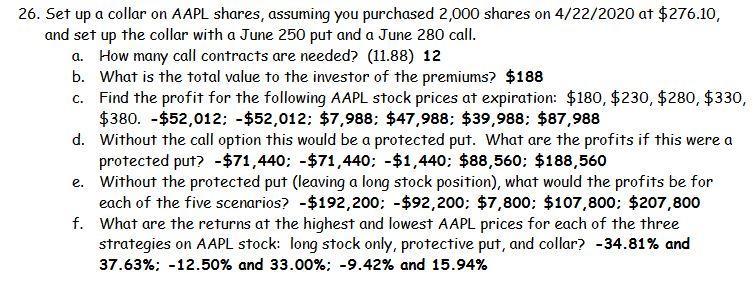

26. Set up a collar on AAPL shares, assuming you purchased 2,000 shares on 4/22/2020 at $276.10, and set up the collar with a

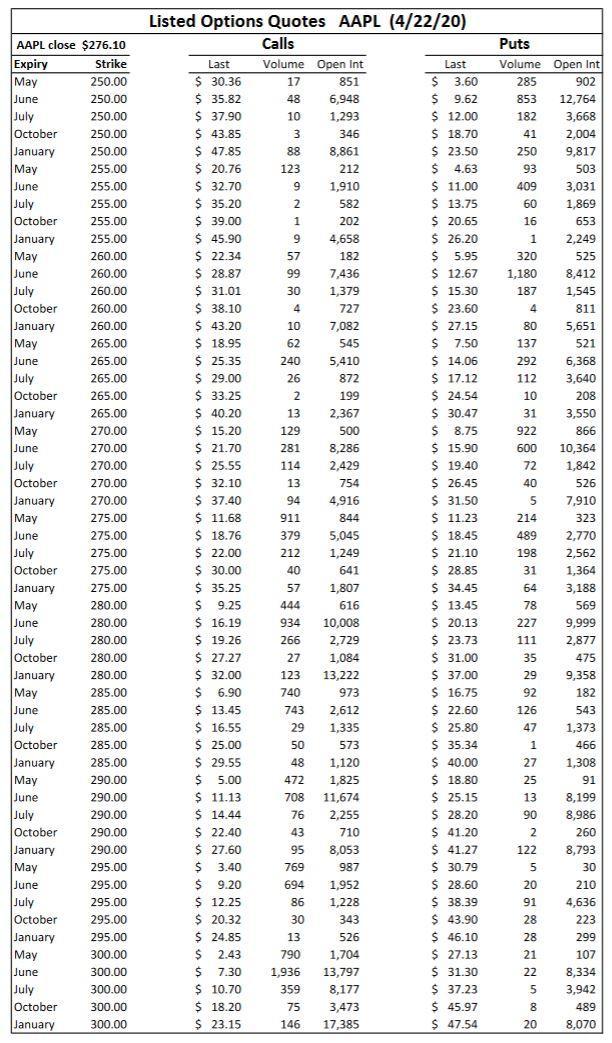

26. Set up a collar on AAPL shares, assuming you purchased 2,000 shares on 4/22/2020 at $276.10, and set up the collar with a June 250 put and a June 280 call. a. How many call contracts are needed? (11.88) 12 b. What is the total value to the investor of the premiums? $188 c. Find the profit for the following AAPL stock prices at expiration: $180, $230, $280, $330, $380. -$52,012; -$52,012; $7,988; $47,988; $39,988; $87,988 d. Without the call option this would be a protected put. What are the profits if this were a protected put? -$71,440; -$71,440; -$1,440; $88,560; $188,560 e. Without the protected put (leaving a long stock position), what would the profits be for each of the five scenarios? -$192,200; -$92,200; $7,800; $107,800; $207,800 f. What are the returns at the highest and lowest AAPL prices for each of the three strategies on AAPL stock: long stock only, protective put, and collar? -34.81% and 37.63%; -12.50% and 33.00%; -9.42% and 15.94% Listed Options Quotes AAPL (4/22/20) AAPL close $276.10 Calls Puts Expiry Strike Last Volume Open Int Last Volume Open Int May 250.00 $ 30.36 17 851 $ 3.60 285 902 June 250.00 $ 35.82 48 6,948 $ 9.62 853 12,764 July 250.00 $ 37.90 10 1,293 $ 12.00 182 3,668 October 250.00 $ 43.85 3 346 $ 18.70 41 2,004 January 250.00 $ 47.85 88 8,861 $ 23.50 250 9,817 May 255.00 $ 20.76 123 212 $ 4.63 93 503 June 255.00 $ 32.70 9 1,910 $ 11.00 409 3,031 July 255.00 $ 35.20 2 582 $ 13.75 60 1,869 October 255.00 $ 39.00 1 202 $ 20.65 16 653 January 255.00 $ 45.90 9 4,658 $ 26.20 1 2,249 May 260.00 $ 22.34 57 182 $ 5.95 320 525 June 260.00 $ 28.87 99 7,436 $ 12.67 1,180 8,412 July 260.00 $ 31.01 30 1,379 $ 15.30 187 1,545 October 260.00 $ 38.10 4 727 $ 23.60 4 811 January 260.00 $ 43.20 10 7,082 $ 27.15 80 5,651 May 265.00 $ 18.95 62 545 $ 7.50 137 521 June 265.00 $ 25.35 240 5,410 $ 14.06 292 6,368 July 265.00 $ 29.00 26 872 $ 17.12 112 3,640 October 265.00 $ 33.25 2 199 $ 24.54 10 208 January 265.00 $ 40.20 13 2,367 $ 30.47 31 3,550 May 270.00 $ 15.20 129 500 $ 8.75 922 866 June 270.00 $ 21.70 281 8,286 $ 15.90 600 10,364 July 270.00 $ 25.55 114 2,429 $ 19.40 72 1,842. October 270.00 $ 32.10 13 754 $ 26.45 40 526 January 270.00 $ 37.40 94 4,916 $ 31.50 5 7,910 May 275.00 $ 11.68 911 844 $ 11.23 214 323 June 275.00 $ 18.76 379 5,045 $ 18.45 489 2,770 July 275.00 $ 22.00 212 1,249 $ 21.10 198 2,562 October 275.00 $ 30.00 40 641 $ 28.85 31 1,364 January 275.00 $ 35.25 57 1,807 $ 34.45 64 3,188 May 280.00 $ 9.25 444 616 $ 13.45 78 569 June 280.00 $ 16.19 934 10,008 $ 20.13 227 9,999 July 280.00 $ 19.26 266 2,729 $ 23.73 111 2,877 October 280.00 $ 27.27 27 1,084 $ 31.00 35 475 January 280.00 $ 32.00 123 13,222 $ 37.00 29 9,358 May 285.00 $ 6.90 740 973 $ 16.75 92 182 June 285.00 $ 13.45 743 2,612 $ 22.60 126 543 July 285.00 $ 16.55 29 1,335 $ 25.80 47 1,373 October 285.00 $ 25.00 50 573 $ 35.34 1 466 January 285.00 $ 29.55 48 1,120 $ 40.00 27 1,308 May 290.00 $ 5.00 472 1,825 $ 18.80 25 91 June 290.00 $ 11.13 708 11,674 $ 25.15 13 8,199 July 290.00 $ 14.44 76 2,255 $ 28.20 90 8,986 October 290.00 $ 22.40 43 710 $ 41.20 2 260 January 290.00 $ 27.60 95 8,053 $ 41.27 122 8,793 May June 295.00 $ 3.40 769 987 $ 30.79 5 30 July 295.00 295.00 $ 9.20 $ 12.25 October 295.00 $ 20.32 January 295.00 $ 24.85 May 300.00 $ 2.43 June 300.00 July 300.00 $ 7.30 1,936 $ 10.70 October 300.00 $ 18.20 January 300.00 $ 23.15 694 1,952 $ 28.60 20 210 86 1,228 $ 38.39 91 4,636 30 343 $ 43.90 28 223 526 $ 46.10 28 299 790 1,704 $ 27.13 21 107 13,797 $ 31.30 22 8,334 359 8,177 $ 37.23 5 3,942 75 3,473 $ 45.97 8 489 146 17,385 $ 47.54 20 8,070

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started