Answered step by step

Verified Expert Solution

Question

1 Approved Answer

26. Suppose an investor buy a European call option at price c, K is the strike price and ST is the spot price of

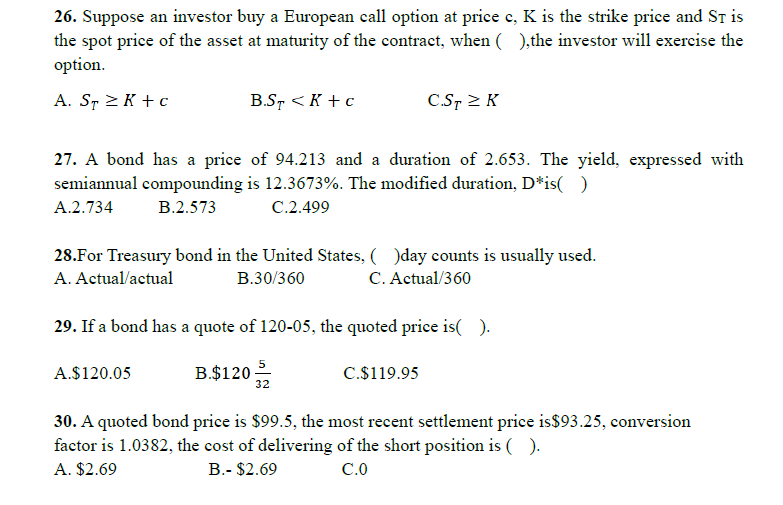

26. Suppose an investor buy a European call option at price c, K is the strike price and ST is the spot price of the asset at maturity of the contract, when ( ),the investor will exercise the option. A. ST > K + c B.ST < K + c C.ST K 27. A bond has a price of 94.213 and a duration of 2.653. The yield, expressed with semiannual compounding is 12.3673%. The modified duration, D*is( ) A.2.734 B.2.573 C.2.499 28.For Treasury bond in the United States, ( )day counts is usually used. A. Actual/actual B.30/360 C. Actual/360 29. If a bond has a quote of 120-05, the quoted price is(). A.$120.05 B.$120 32 C.$119.95 30. A quoted bond price is $99.5, the most recent settlement price is$93.25, conversion factor is 1.0382, the cost of delivering of the short position is ( ). A. $2.69 B.- $2.69 C.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started