Answered step by step

Verified Expert Solution

Question

1 Approved Answer

26. You are the owner of Comfortable Paradise, an energy supplier. Today is February. You currently own 4,000,000 barrels of crude oil that you will

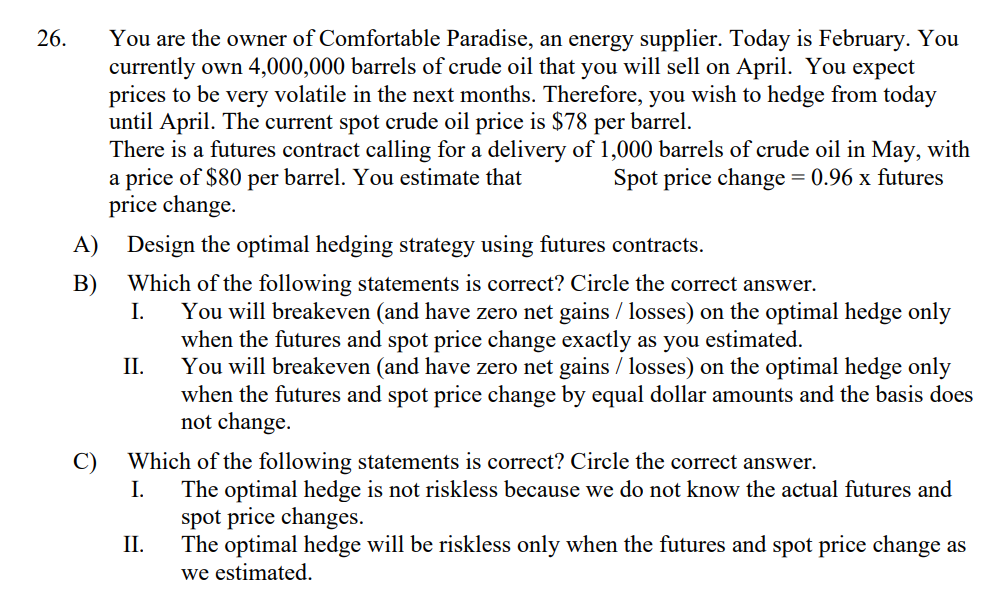

26. You are the owner of Comfortable Paradise, an energy supplier. Today is February. You currently own 4,000,000 barrels of crude oil that you will sell on April. You expect prices to be very volatile in the next months. Therefore, you wish to hedge from today until April. The current spot crude oil price is $78 per barrel. There is a futures contract calling for a delivery of 1,000 barrels of crude oil in May, with a price of $80 per barrel. You estimate that Spot price change =0.96 futures price change. A) Design the optimal hedging strategy using futures contracts. B) Which of the following statements is correct? Circle the correct answer. I. You will breakeven (and have zero net gains / losses) on the optimal hedge only when the futures and spot price change exactly as you estimated. II. You will breakeven (and have zero net gains / losses) on the optimal hedge only when the futures and spot price change by equal dollar amounts and the basis does not change. C) Which of the following statements is correct? Circle the correct answer. I. The optimal hedge is not riskless because we do not know the actual futures and spot price changes. II. The optimal hedge will be riskless only when the futures and spot price change as we estimated

26. You are the owner of Comfortable Paradise, an energy supplier. Today is February. You currently own 4,000,000 barrels of crude oil that you will sell on April. You expect prices to be very volatile in the next months. Therefore, you wish to hedge from today until April. The current spot crude oil price is $78 per barrel. There is a futures contract calling for a delivery of 1,000 barrels of crude oil in May, with a price of $80 per barrel. You estimate that Spot price change =0.96 futures price change. A) Design the optimal hedging strategy using futures contracts. B) Which of the following statements is correct? Circle the correct answer. I. You will breakeven (and have zero net gains / losses) on the optimal hedge only when the futures and spot price change exactly as you estimated. II. You will breakeven (and have zero net gains / losses) on the optimal hedge only when the futures and spot price change by equal dollar amounts and the basis does not change. C) Which of the following statements is correct? Circle the correct answer. I. The optimal hedge is not riskless because we do not know the actual futures and spot price changes. II. The optimal hedge will be riskless only when the futures and spot price change as we estimated Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started