Answered step by step

Verified Expert Solution

Question

1 Approved Answer

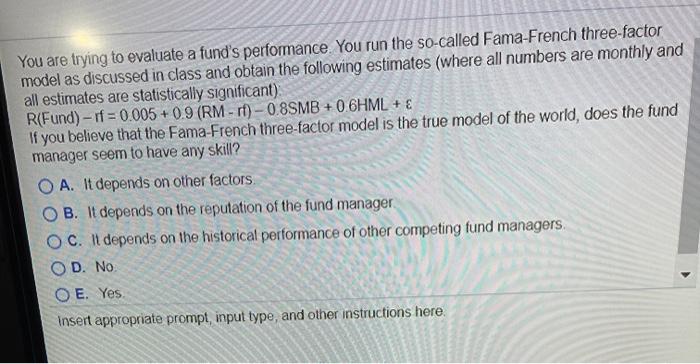

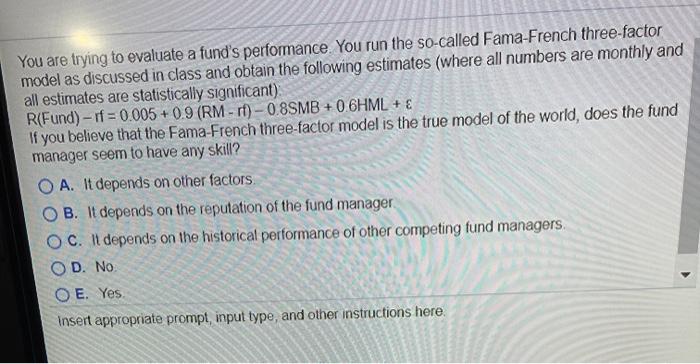

26 You are trying to evaluate a fund's performance You run the so-called Fama French three-factor model as discussed in class and obtain the following

26

You are trying to evaluate a fund's performance You run the so-called Fama French three-factor model as discussed in class and obtain the following estimates (where all numbers are monthly and all estimates are statistically significant) R(Fund) - f = 0.005 +0.9 (RM - rf) - 0.8SMB + 0.6HML + If you believe that the Fama French three-factor model is the true model of the world, does the fund manager seem to have any skill? O A. It depends on other factors O B. It depends on the reputation of the fund manager OC. Il depends on the historical performance of other competing fund managers, OD. No OE. Yes insert appropriate prompt, input type, and other instructions here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started