Answered step by step

Verified Expert Solution

Question

1 Approved Answer

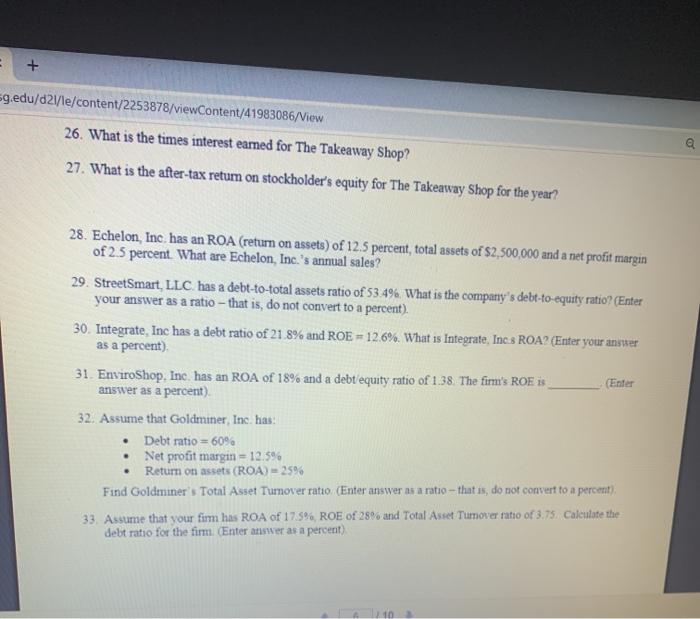

26-33? im confuesd and its not in the chapter we learned. + sg.edu/d2l/le/content/2253878/viewContent/41983086/View 26. What is the times interest earned for The Takeaway Shop? 27.

26-33? im confuesd and its not in the chapter we learned.

+ sg.edu/d2l/le/content/2253878/viewContent/41983086/View 26. What is the times interest earned for The Takeaway Shop? 27. What is the after-tax return on stockholder's equity for The Takeaway Shop for the year? o 28. Echelon, Inc. has an ROA (return on assets) of 12.5 percent, total assets of $2,500,000 and a net profit margin of 2.5 percent. What are Echelon, Inc.'s annual sales? 29. StreetSmart, LLC has a debt-to-total assets ratio of 53.4% What is the company's debt-to-equity ratio? (Enter your answer as a ratio - that is, do not convert to a percent). 30. Integrate, Inc has a debt ratio of 21.8% and ROE = 12.6%. What is integrate, Ines ROA? (Enter your answer as a percent) 31. EnviroShop, Inc. has an ROA of 18% and a debt/equity ratio of 1.38. The firm's ROE is answer as a percent) 32. Assume that Goldminer, Inc. has: Debt ratio = 60% Net profit margin = 12.5% Return on assets (ROA) - 25% Find Goldminer's Total Asset Tumover ratio (Enter answer as a ratio- that is, do not convert to a percent), 33. Assume that your firm has ROA of 17.5% ROE of 28% and Total Asset Turnover ratio of 3.75. Calculate the debt ratio for the firm (Enter aver as a percent) . sg.edu/d21/1e/content/2253878/viewContent/41983086/View 26. What is the times interest earned for The Takeaway Shop? 27. What is the after-tax return on stockholder's equity for The Takeaway Shop for the year? 28. Echelon, Inc. has an ROA (return on assets) of 12.5 percent, total assets of $2,500,000 and a net profit margin of 2.5 percent. What are Echelon, Inc.'s annual sales? 29. StreetSmart, LLC has a debt-to-total assets ratio of 53.4% What is the company's debt-to-equity ratio? (Enter your answer as a ratio- that is, do not convert to a percent). 30. Integrate, Inc has a debt ratio of 21.8% and ROE = 12.6% What is Integrate, Inc. s ROA? (Enter your answer as a percent) 31. EnviroShop, Inc. has an ROA of 18% and a debt equity ratio of 138. The firm's ROE is (Enter answer as a percent) 32. Assume that Goldmmer, Inc. has Debt ratio = 60% Net profit margin = 12.5% Return on assets (ROA) = 25% Find Goldminer's Total Asset Tumover ratio (Enter answer as a ratio -- that is, do not convert to a percent) 33. Assume that your firm has ROA of 17.5% ROE of 28% and Total Asset Tumover ratio of 3.75. Calculate the debt ratio for the firm. (Enter answer as a percent) + sg.edu/d2l/le/content/2253878/viewContent/41983086/View 26. What is the times interest earned for The Takeaway Shop? 27. What is the after-tax return on stockholder's equity for The Takeaway Shop for the year? o 28. Echelon, Inc. has an ROA (return on assets) of 12.5 percent, total assets of $2,500,000 and a net profit margin of 2.5 percent. What are Echelon, Inc.'s annual sales? 29. StreetSmart, LLC has a debt-to-total assets ratio of 53.4% What is the company's debt-to-equity ratio? (Enter your answer as a ratio - that is, do not convert to a percent). 30. Integrate, Inc has a debt ratio of 21.8% and ROE = 12.6%. What is integrate, Ines ROA? (Enter your answer as a percent) 31. EnviroShop, Inc. has an ROA of 18% and a debt/equity ratio of 1.38. The firm's ROE is answer as a percent) 32. Assume that Goldminer, Inc. has: Debt ratio = 60% Net profit margin = 12.5% Return on assets (ROA) - 25% Find Goldminer's Total Asset Tumover ratio (Enter answer as a ratio- that is, do not convert to a percent), 33. Assume that your firm has ROA of 17.5% ROE of 28% and Total Asset Turnover ratio of 3.75. Calculate the debt ratio for the firm (Enter aver as a percent) . sg.edu/d21/1e/content/2253878/viewContent/41983086/View 26. What is the times interest earned for The Takeaway Shop? 27. What is the after-tax return on stockholder's equity for The Takeaway Shop for the year? 28. Echelon, Inc. has an ROA (return on assets) of 12.5 percent, total assets of $2,500,000 and a net profit margin of 2.5 percent. What are Echelon, Inc.'s annual sales? 29. StreetSmart, LLC has a debt-to-total assets ratio of 53.4% What is the company's debt-to-equity ratio? (Enter your answer as a ratio- that is, do not convert to a percent). 30. Integrate, Inc has a debt ratio of 21.8% and ROE = 12.6% What is Integrate, Inc. s ROA? (Enter your answer as a percent) 31. EnviroShop, Inc. has an ROA of 18% and a debt equity ratio of 138. The firm's ROE is (Enter answer as a percent) 32. Assume that Goldmmer, Inc. has Debt ratio = 60% Net profit margin = 12.5% Return on assets (ROA) = 25% Find Goldminer's Total Asset Tumover ratio (Enter answer as a ratio -- that is, do not convert to a percent) 33. Assume that your firm has ROA of 17.5% ROE of 28% and Total Asset Tumover ratio of 3.75. Calculate the debt ratio for the firm. (Enter answer as a percent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started