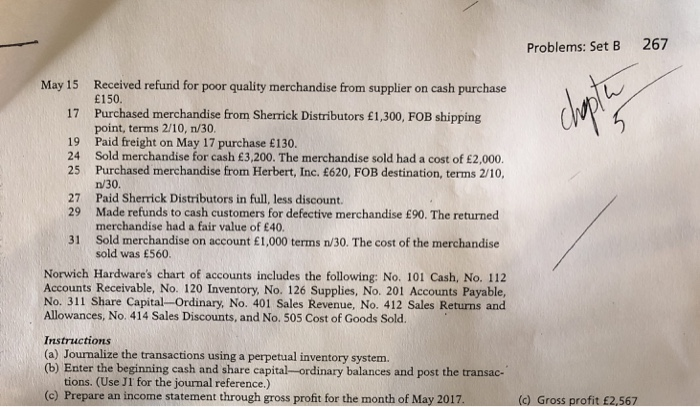

267 Problems: Set B Received refund for poor quality merchandise from supplier on cash purchase 150. Purchased merchandise from Sherrick Distributors 1,300, FOB shipping point, terms 2/10, n/30 May 15 17 19 Paid freight on May 17 purchase 130 24 Sold merchandise for cash 3,200. The merchandise sold had a cost of 2,000. 25 Purchased merchandise from Herbert, Inc. 620, FOB destination, terms 2/10, n/30 27 Paid Sherrick Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise 90. The returned merchandise had a fair value of 40. Sold merchandise on account 1,000 terms n/30. The cost of the merchandise sold was 560. 31 Norwich Hardware's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No. 311 Share Capital-Ordinary, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Instructions (a) Journalize the transactions using a perpetual inventory system. (b) Enter the beginning cash and share capital-ordinary balances and post the transac- tions. (Use JI for the journal reference.) (c) Prepare an income statement through gross profit for the month of May 2017 (c) Gross profit 2.567 267 Problems: Set B Received refund for poor quality merchandise from supplier on cash purchase 150. Purchased merchandise from Sherrick Distributors 1,300, FOB shipping point, terms 2/10, n/30 May 15 17 19 Paid freight on May 17 purchase 130 24 Sold merchandise for cash 3,200. The merchandise sold had a cost of 2,000. 25 Purchased merchandise from Herbert, Inc. 620, FOB destination, terms 2/10, n/30 27 Paid Sherrick Distributors in full, less discount. 29 Made refunds to cash customers for defective merchandise 90. The returned merchandise had a fair value of 40. Sold merchandise on account 1,000 terms n/30. The cost of the merchandise sold was 560. 31 Norwich Hardware's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No. 311 Share Capital-Ordinary, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold. Instructions (a) Journalize the transactions using a perpetual inventory system. (b) Enter the beginning cash and share capital-ordinary balances and post the transac- tions. (Use JI for the journal reference.) (c) Prepare an income statement through gross profit for the month of May 2017 (c) Gross profit 2.567