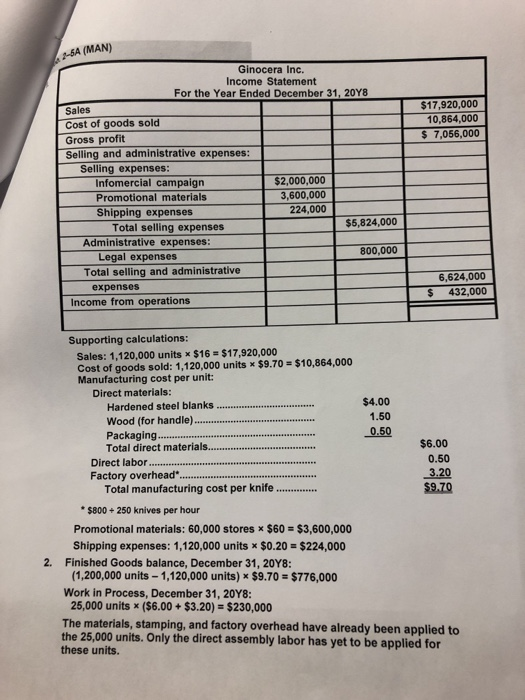

2-6A (MAN) $17,920,000 10,864,000 $ 7,056,000 Ginocera Inc. Income Statement For the Year Ended December 31, 2048 Sales Cost of goods sold Gross profit Selling and administrative expenses: Selling expenses: Infomercial campaign $2,000,000 Promotional materials 3,600,000 Shipping expenses 224,000 Total selling expenses $5,824,000 Administrative expenses: Legal expenses 800,000 Total selling and administrative expenses Income from operations 6,624,000 $ 432,000 ++++ Supporting calculations: Sales: 1,120,000 units * $16 = $17,920,000 Cost of goods sold: 1,120,000 units X $9.70 = $10,864,000 Manufacturing cost per unit: Direct materials: Hardened steel blanks $4.00 Wood (for handle). 1.50 Packaging 0.50 Total direct materials. $6.00 Direct labor 0.50 Factory overhead 3.20 Total manufacturing cost per knife $9.70 * $800 + 250 knives per hour Promotional materials: 60,000 stores * $60 = $3,600,000 Shipping expenses: 1,120,000 units * $0.20 = $224,000 2. Finished Goods balance, December 31, 20Y8: (1,200,000 units -1,120,000 units) * $9.70 = $776,000 Work in Process, December 31, 2048: 25,000 units * ($6.00 + $3.20) = $230,000 The materials, stamping, and factory overhead have already been applied to the 25,000 units. Only the direct assembly labor has yet to be applied for these units. 2-6A (MAN) $17,920,000 10,864,000 $ 7,056,000 Ginocera Inc. Income Statement For the Year Ended December 31, 2048 Sales Cost of goods sold Gross profit Selling and administrative expenses: Selling expenses: Infomercial campaign $2,000,000 Promotional materials 3,600,000 Shipping expenses 224,000 Total selling expenses $5,824,000 Administrative expenses: Legal expenses 800,000 Total selling and administrative expenses Income from operations 6,624,000 $ 432,000 ++++ Supporting calculations: Sales: 1,120,000 units * $16 = $17,920,000 Cost of goods sold: 1,120,000 units X $9.70 = $10,864,000 Manufacturing cost per unit: Direct materials: Hardened steel blanks $4.00 Wood (for handle). 1.50 Packaging 0.50 Total direct materials. $6.00 Direct labor 0.50 Factory overhead 3.20 Total manufacturing cost per knife $9.70 * $800 + 250 knives per hour Promotional materials: 60,000 stores * $60 = $3,600,000 Shipping expenses: 1,120,000 units * $0.20 = $224,000 2. Finished Goods balance, December 31, 20Y8: (1,200,000 units -1,120,000 units) * $9.70 = $776,000 Work in Process, December 31, 2048: 25,000 units * ($6.00 + $3.20) = $230,000 The materials, stamping, and factory overhead have already been applied to the 25,000 units. Only the direct assembly labor has yet to be applied for these units