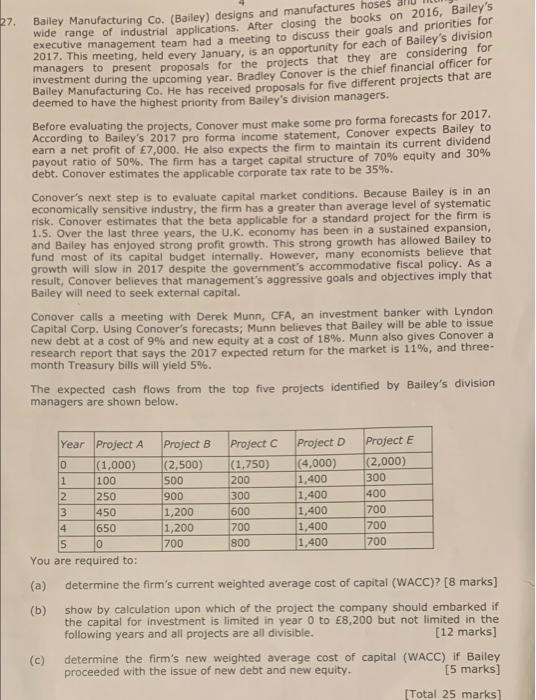

27. Bailey Manufacturing Co. (Bailey) designs and manufactures hoses wide range of industrial applications. After closing the books on 2016, Bailey's executive management team had a meeting to discuss their goals and priorities for 2017. This meeting, held every January, is an opportunity for each of Bailey's division managers to present proposals for the projects that they are considering for investment during the upcoming year. Bradley Conover is the chief financial officer for Bailey Manufacturing Co. He has received proposals for five different projects that are deemed to have the highest priority from Bailey's division managers. Before evaluating the projects, Conover must make some pro forma forecasts for 2017 According to Bailey's 2017 pro forma income statement, Conover expects Bailey to earn a net profit of 7,000. He also expects the firm to maintain its current dividend payout ratio of 50%. The firm has a target capital structure of 70% equity and 30% debt. Conover estimates the applicable corporate tax rate to be 35%. Conover's next step is to evaluate capital market conditions. Because Bailey is in an economically sensitive industry, the firm has a greater than average level of systematic risk. Conover estimates that the beta applicable for a standard project for the firm is 1.5. Over the last three years, the U.K. economy has been in a sustained expansion, and Bailey has enjoyed strong profit growth. This strong growth has allowed Bailey to fund most of its capital budget internally. However, many economists believe that growth will slow in 2017 despite the government's accommodative fiscal policy. As a result. Conover believes that management's aggressive goals and objectives imply that Bailey will need to seek external capital. Conover calls a meeting with Derek Munn, CFA, an investment banker with Lyndon Capital Corp. Using Conover's forecasts; Munn believes that Bailey will be able to issue new debt at a cost of 9% and new equity at a cost of 18%. Munn also gives Conover a research report that says the 2017 expected return for the market is 11%, and three- month Treasury bills will yield 5%. The expected cash flows from the top five projects identified by Bailey's division managers are shown below. 0 Year Project A Project B Project Project D Project E (1,000) (2,500) (1,750) (4,000) (2.000) 1 100 500 200 1,400 300 2 250 900 300 1,400 400 3 450 1,200 600 1,400 700 4 650 1,200 700 1,400 700 5 0 700 800 1,400 700 You are required to: (a) determine the firm's current weighted average cost of capital (WACC)? (8 marks] (b) show by calculation upon which of the project the company should embarked if the capital for investment is limited in year 0 to 8,200 but not limited in the following years and all projects are all divisible. [12 marks] (c) determine the firm's new weighted average cost of capital (WACC) if Bailey proceeded with the issue of new debt and new equity. [5 marks] (C) [Total 25 marks