Answered step by step

Verified Expert Solution

Question

1 Approved Answer

27 Spot check has a biweekly payroll with an average monthly remittance for the second preceding calendar year exceeding $100,000.00. The payroll deductions are listed

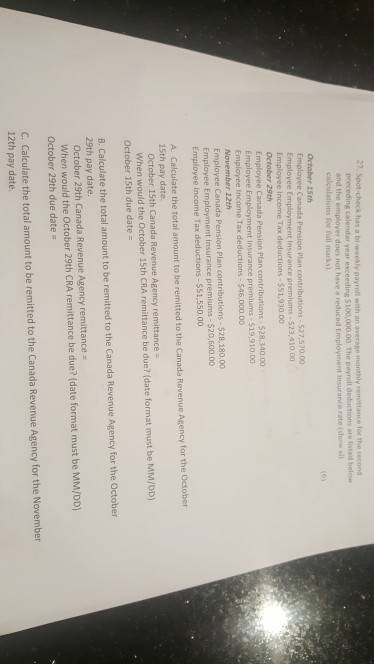

27 Spot check has a biweekly payroll with an average monthly remittance for the second preceding calendar year exceeding $100,000.00. The payroll deductions are listed below and the employer does not have a reduced Employment insurance rate (shew all calculations for all marks) October 15th Employee Canada Pension Plan contributions - 527.570.00 Employee Employment Insurance premiums - $23,410,00 Employee Income Tax deductions - $51.930,00 October 29th Employee Canada Pension Plan contributions 528,340.00 Employee Employment Insurance premiums $19,910,00 Employee Income Tax deductions - 546,000.00 November 12th Employee Canada Pension Plan contributions - $28,180.00 Employee Employment Insurance premiums - $20,600.00 Employee Income Tax deductions - $51,550.00 A Calculate the total amount to be remitted to the Canada Revenue Agency for the October 15th pay date October 15th Canada Revenue Agency remittance When would the October 15th CRA remittance be due? (date format must be MM/DD) October 15th due date a B. Calculate the total amount to be remitted to the Canada Revenue Agency for the October 29th pay date October 29th Canada Revenue Agency remittance = When would the October 29th CRA remittance be due? (date format must be MM/DD) October 29th due date C. Calculate the total amount to be remitted to the Canada Revenue Agency for the November 12th pay date. November 12th Canada Revenue Agency remittance = When would the November 12th CRA remittance be due? (date format must be MM/DD) November 12th due date = 27 Spot check has a biweekly payroll with an average monthly remittance for the second preceding calendar year exceeding $100,000.00. The payroll deductions are listed below and the employer does not have a reduced Employment insurance rate (shew all calculations for all marks) October 15th Employee Canada Pension Plan contributions - 527.570.00 Employee Employment Insurance premiums - $23,410,00 Employee Income Tax deductions - $51.930,00 October 29th Employee Canada Pension Plan contributions 528,340.00 Employee Employment Insurance premiums $19,910,00 Employee Income Tax deductions - 546,000.00 November 12th Employee Canada Pension Plan contributions - $28,180.00 Employee Employment Insurance premiums - $20,600.00 Employee Income Tax deductions - $51,550.00 A Calculate the total amount to be remitted to the Canada Revenue Agency for the October 15th pay date October 15th Canada Revenue Agency remittance When would the October 15th CRA remittance be due? (date format must be MM/DD) October 15th due date a B. Calculate the total amount to be remitted to the Canada Revenue Agency for the October 29th pay date October 29th Canada Revenue Agency remittance = When would the October 29th CRA remittance be due? (date format must be MM/DD) October 29th due date C. Calculate the total amount to be remitted to the Canada Revenue Agency for the November 12th pay date. November 12th Canada Revenue Agency remittance = When would the November 12th CRA remittance be due? (date format must be MM/DD) November 12th due date =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started