27a

b

c

d

e

f

g

h

i

j

k

l

m

n

o

p

q

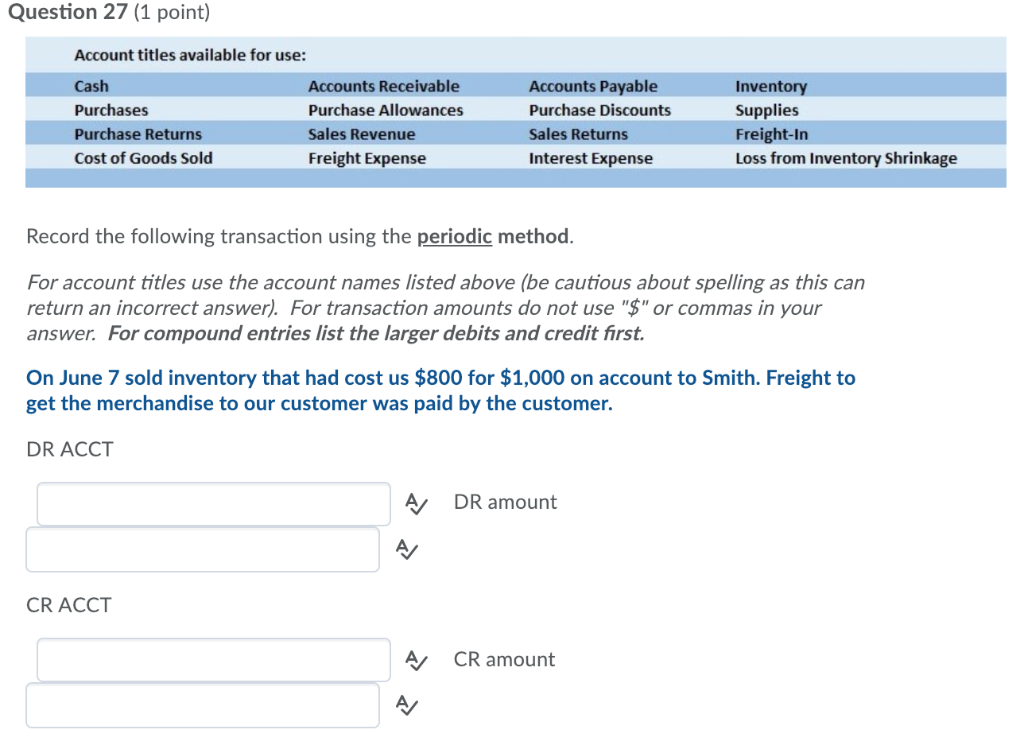

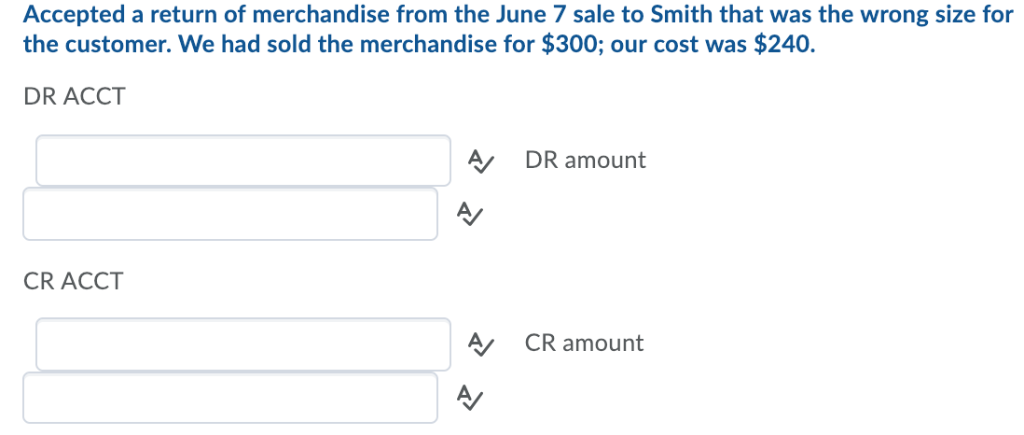

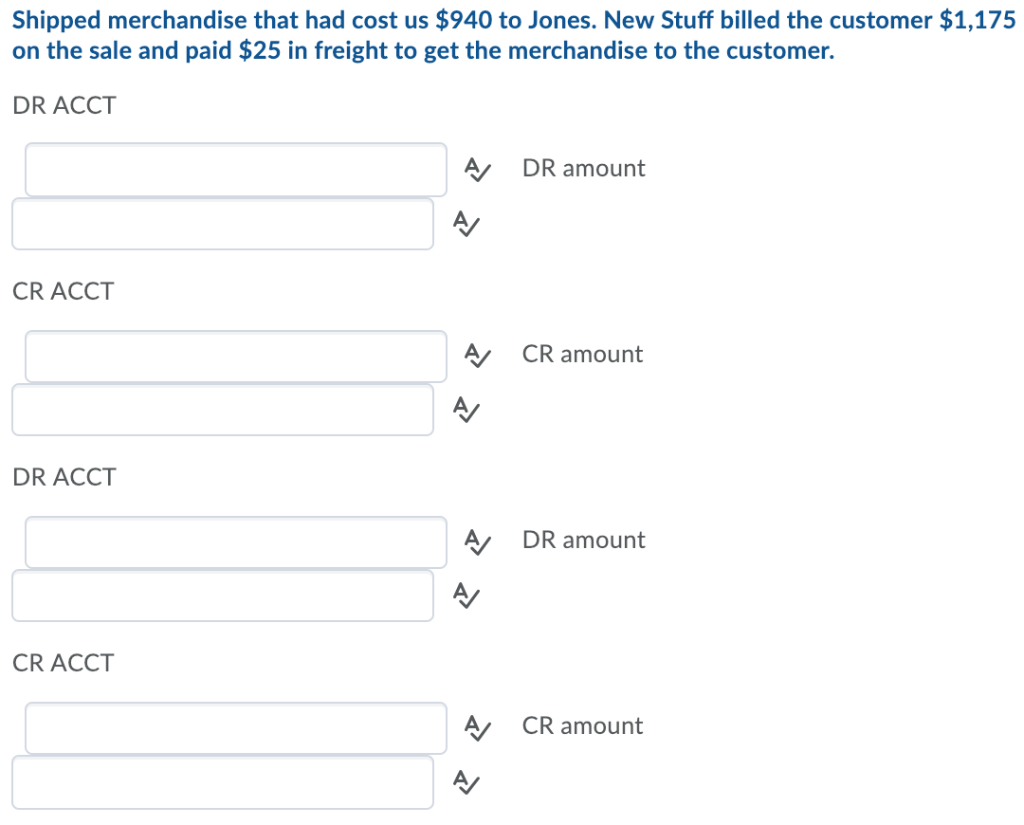

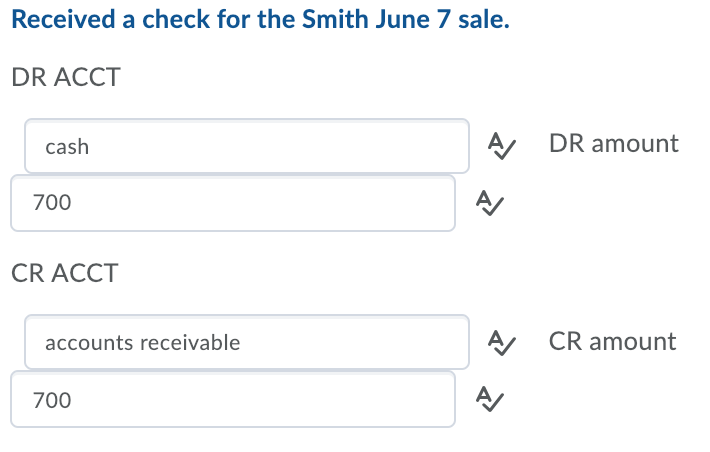

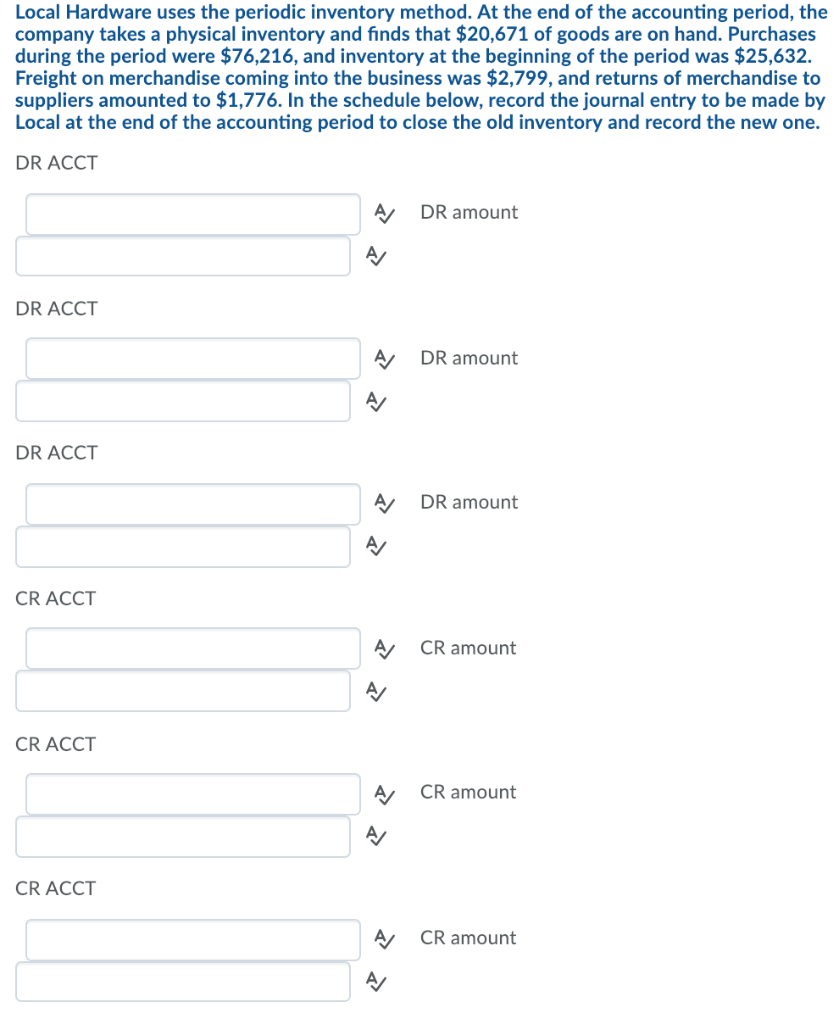

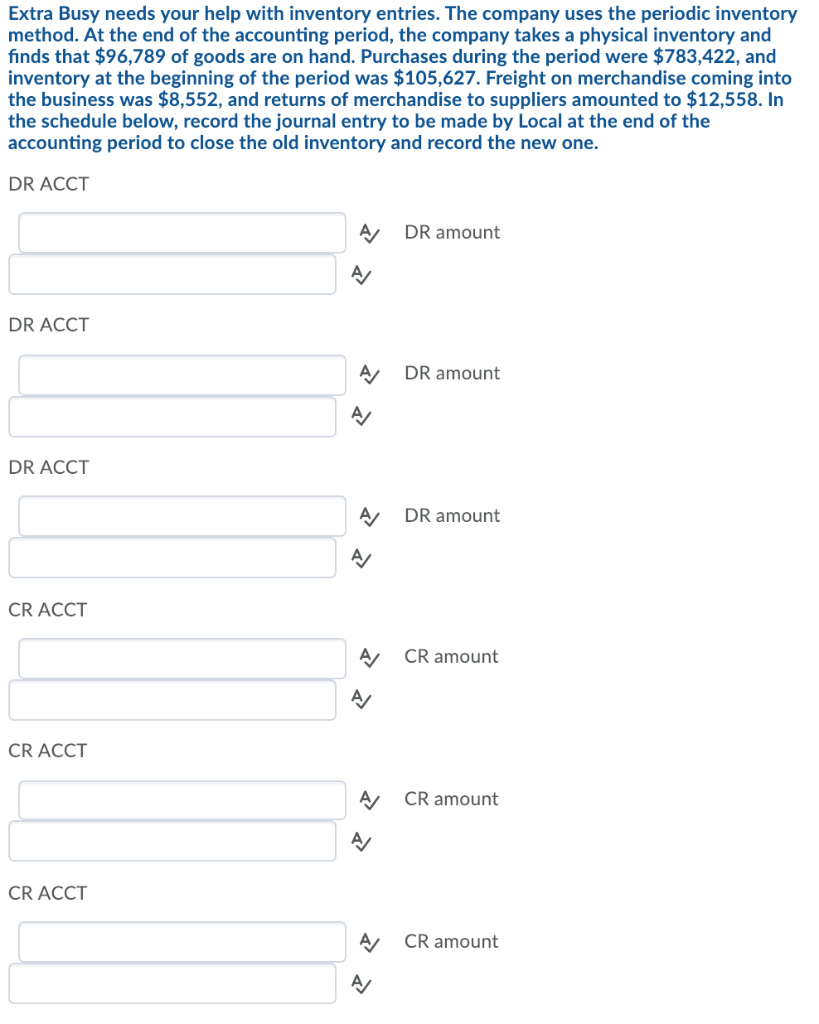

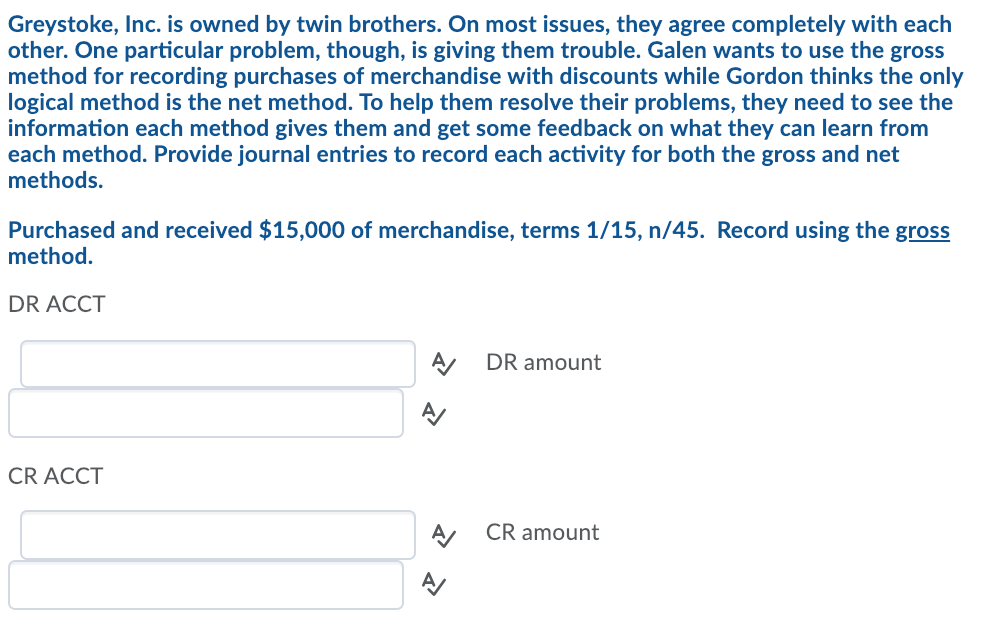

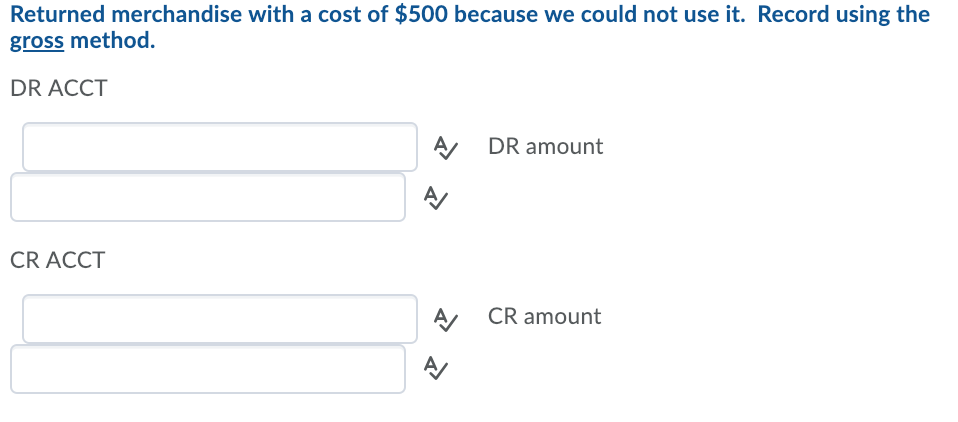

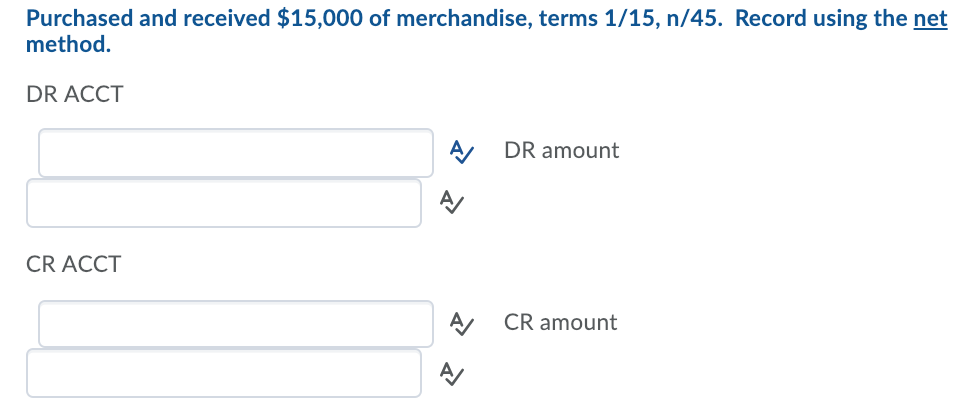

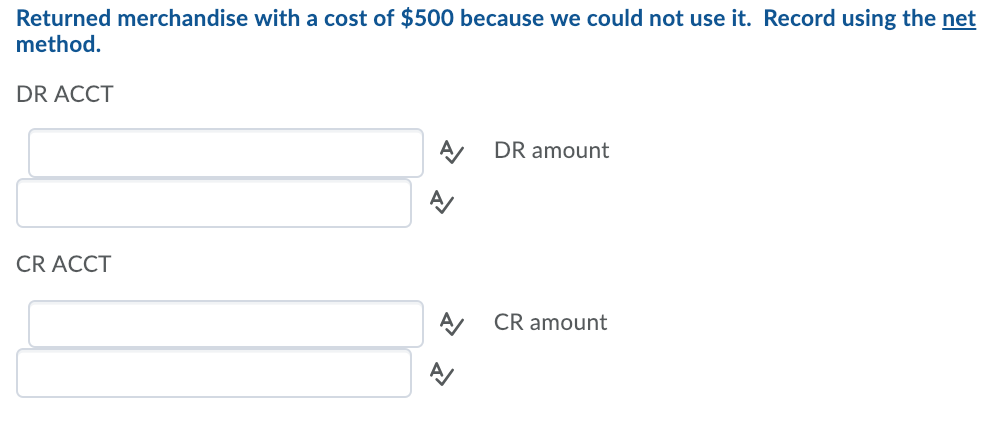

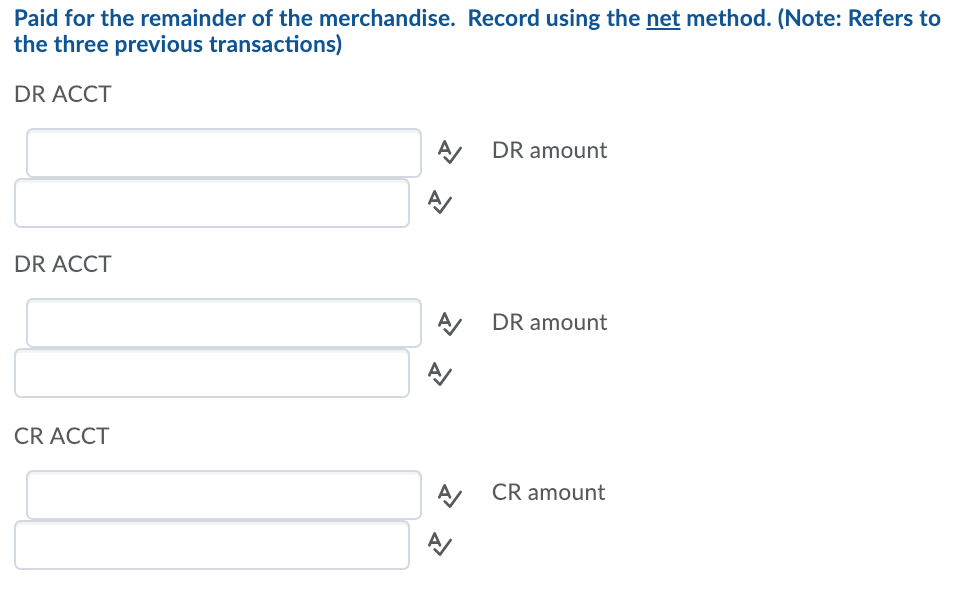

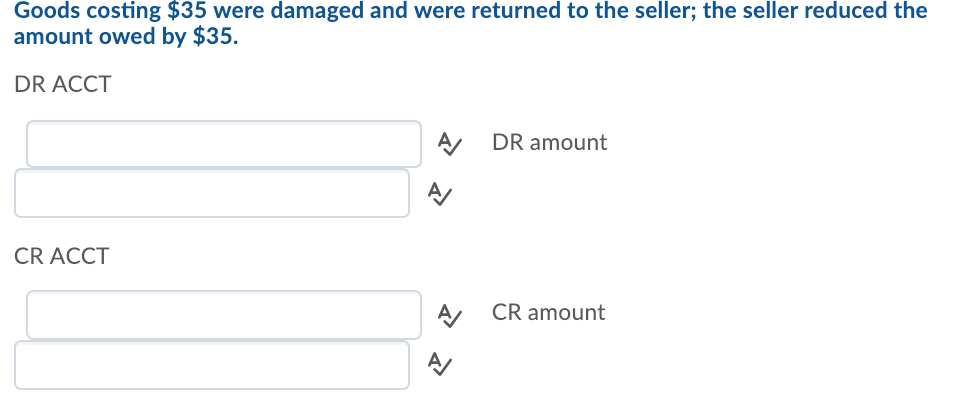

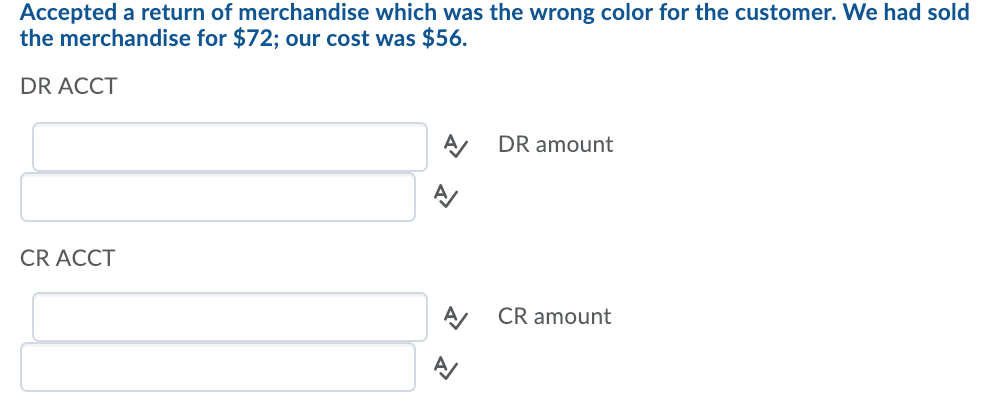

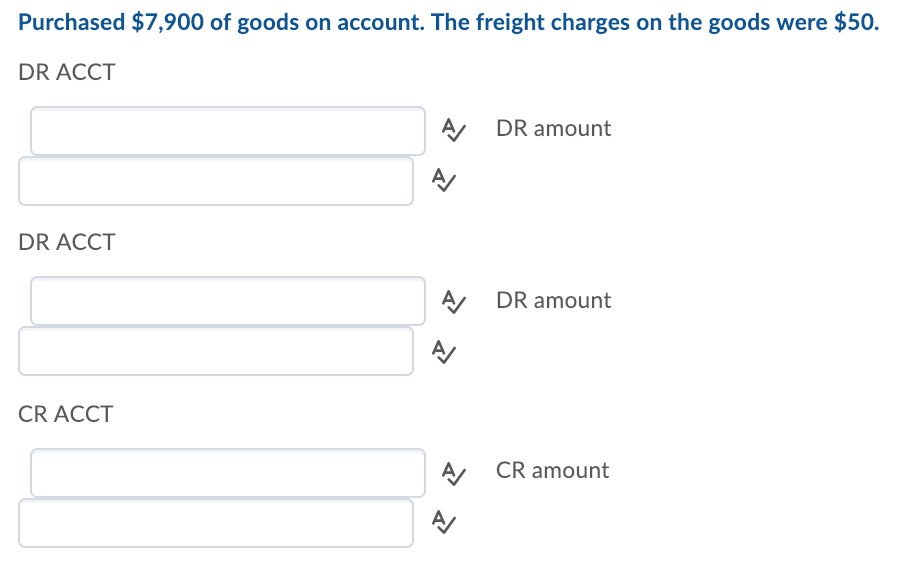

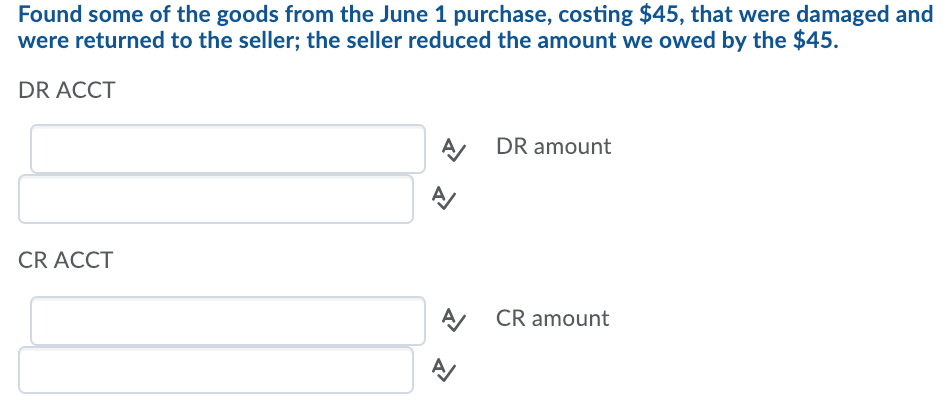

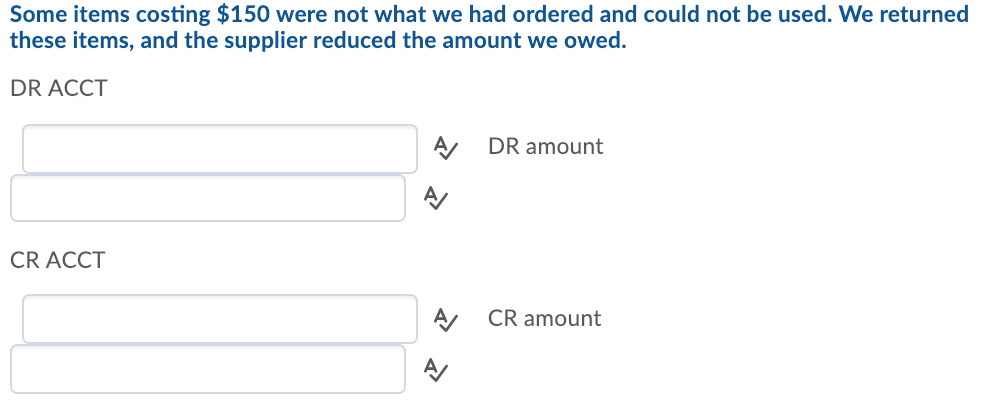

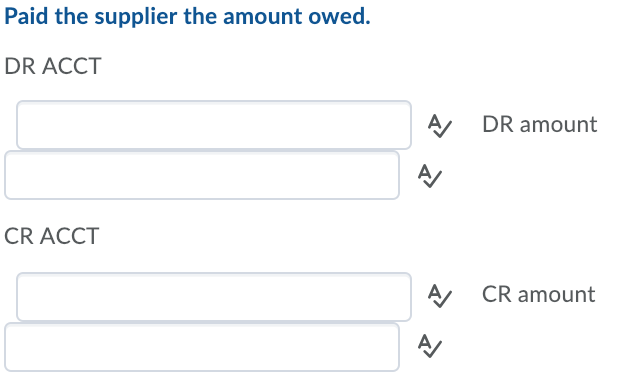

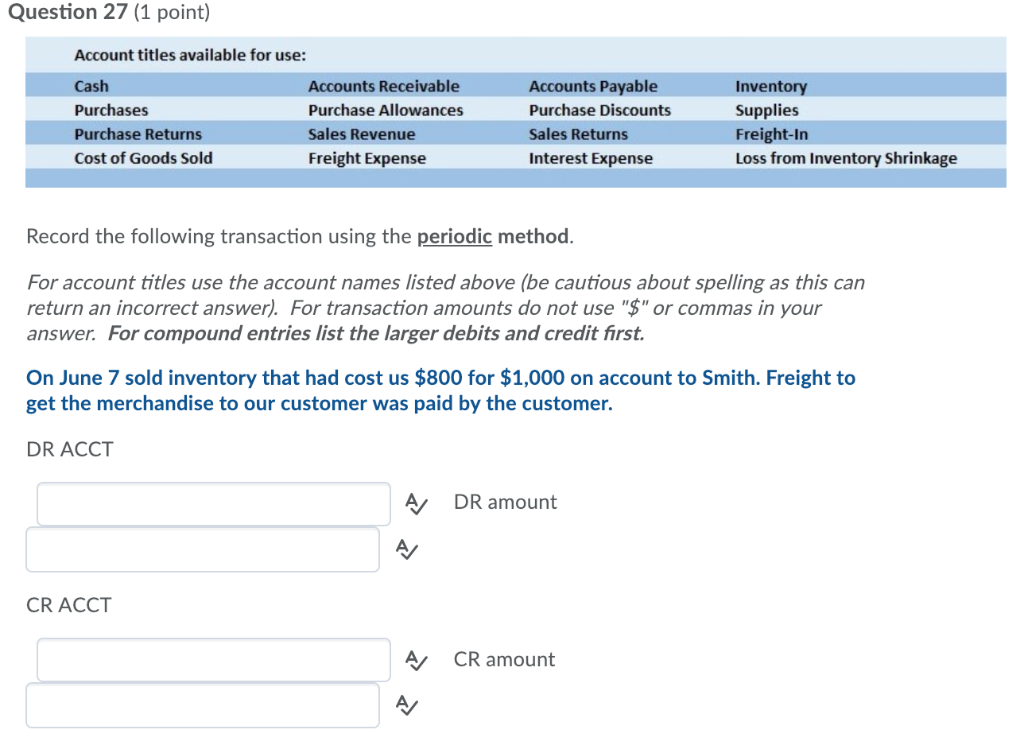

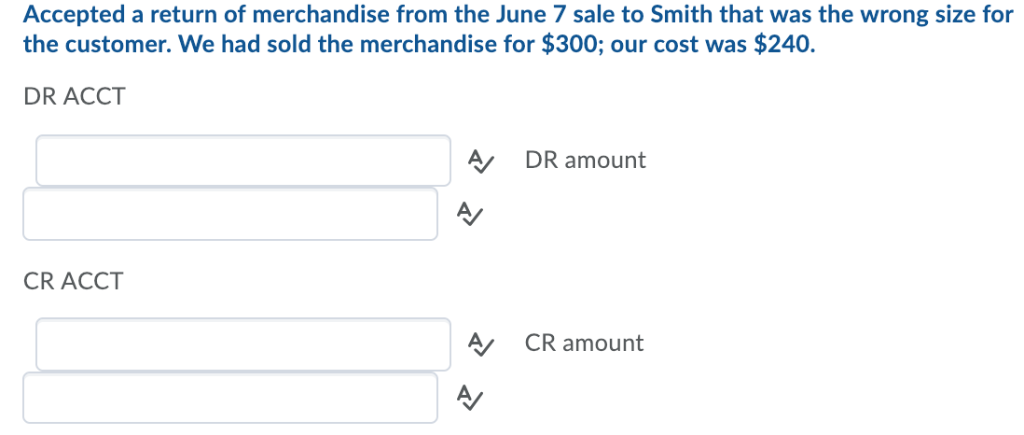

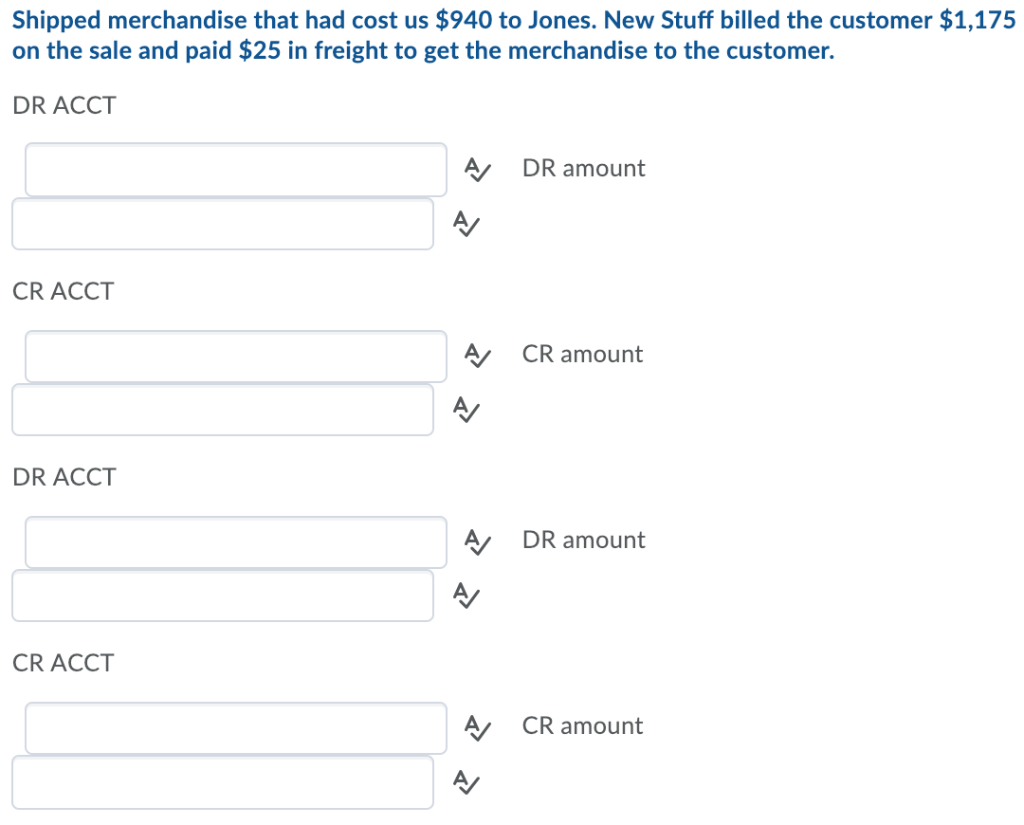

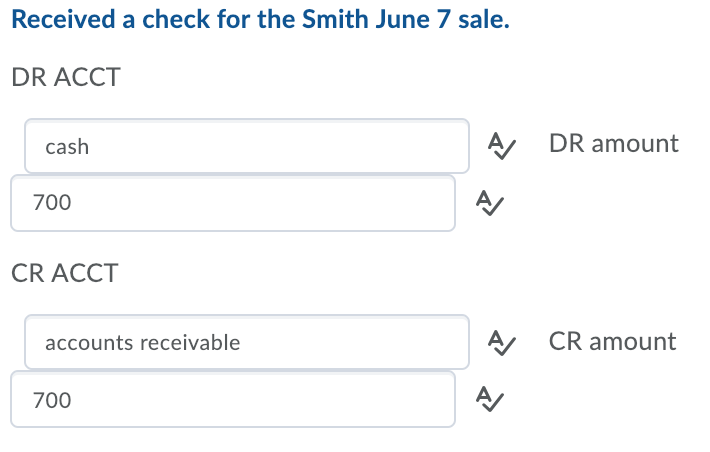

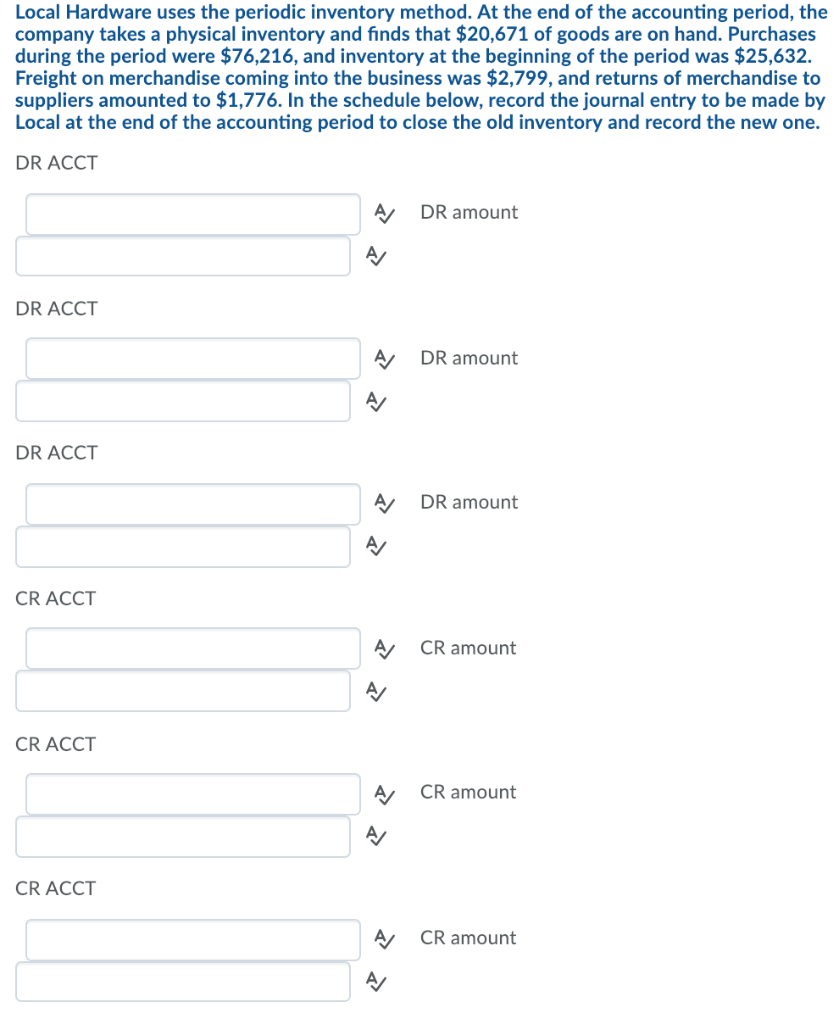

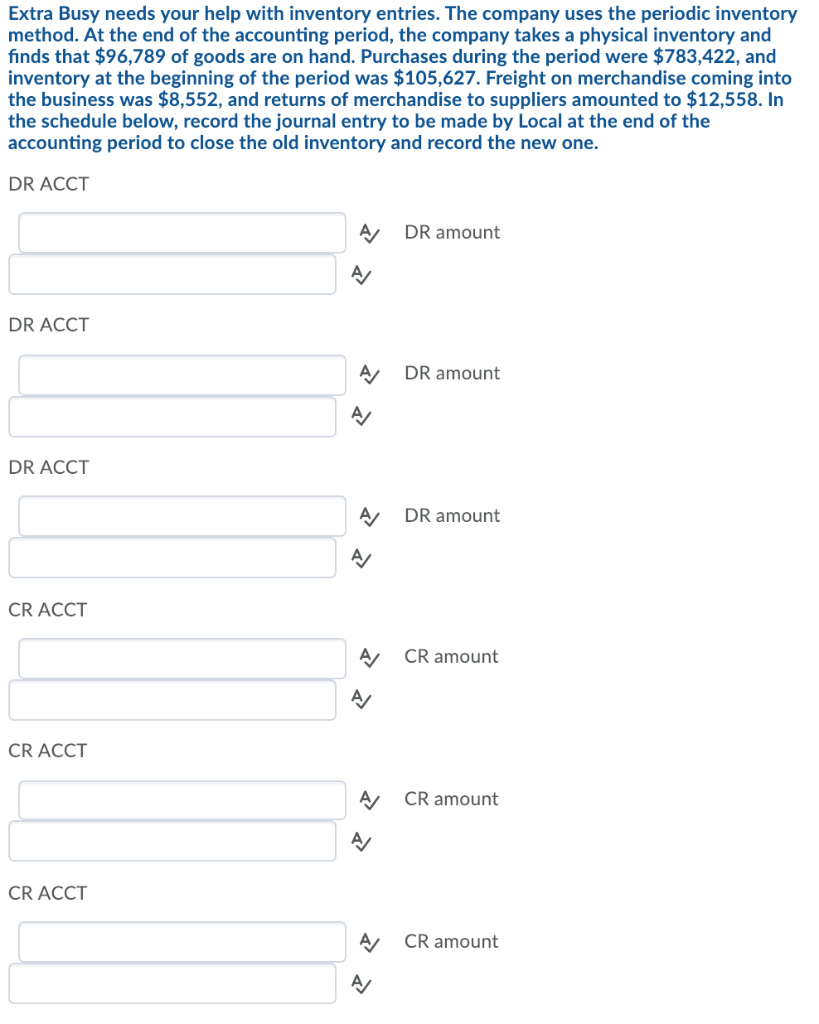

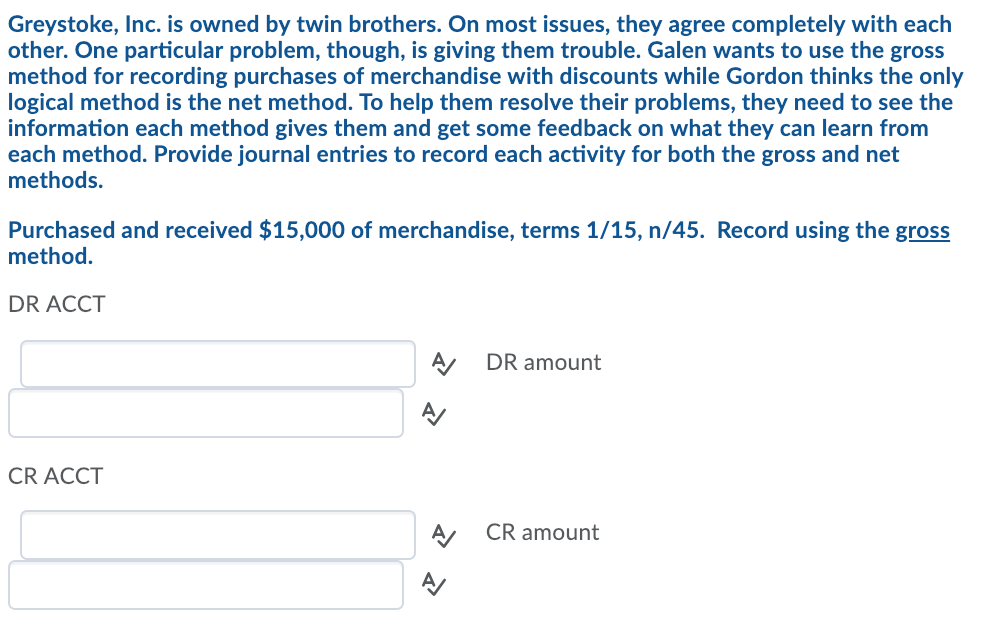

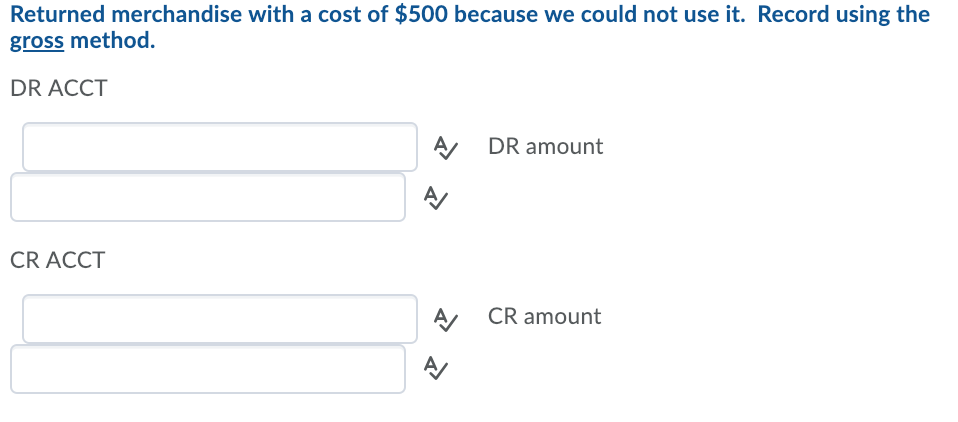

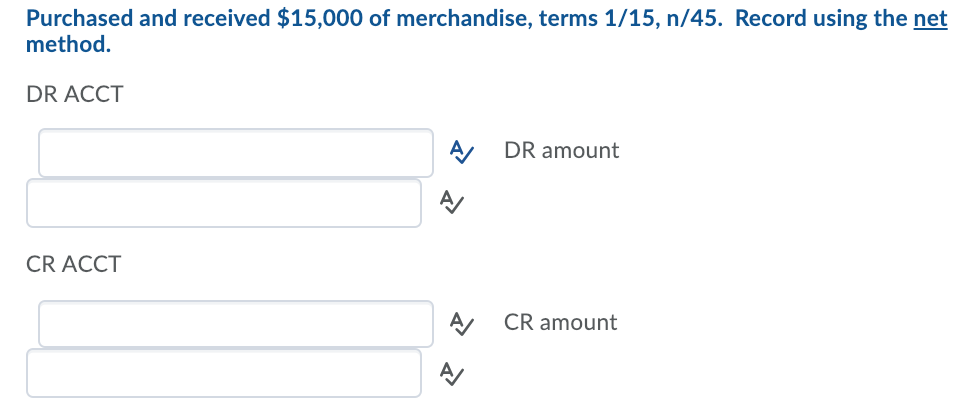

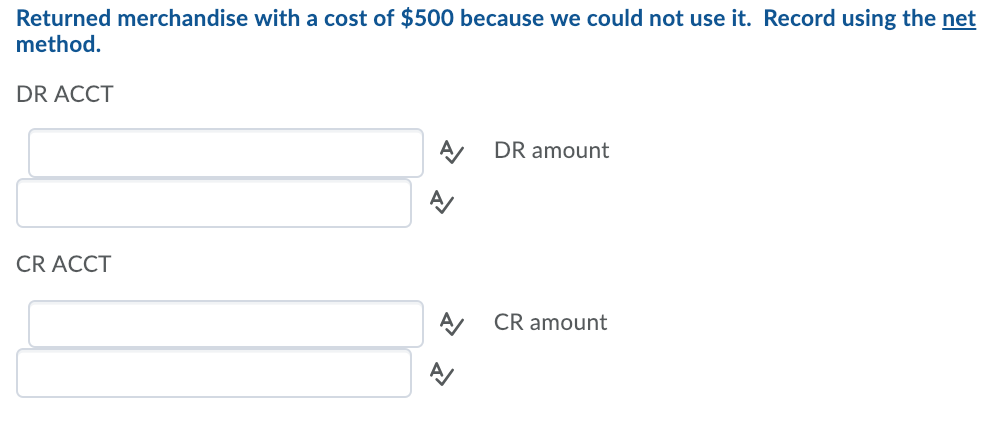

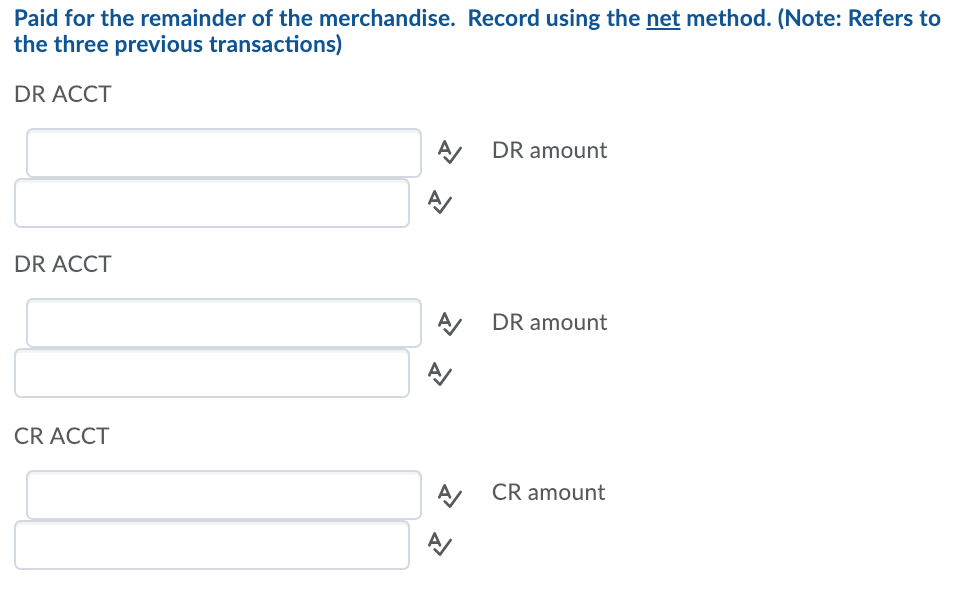

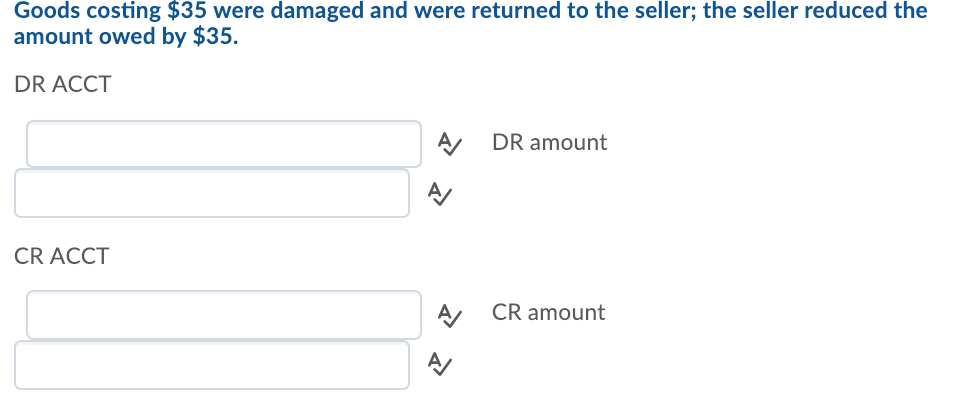

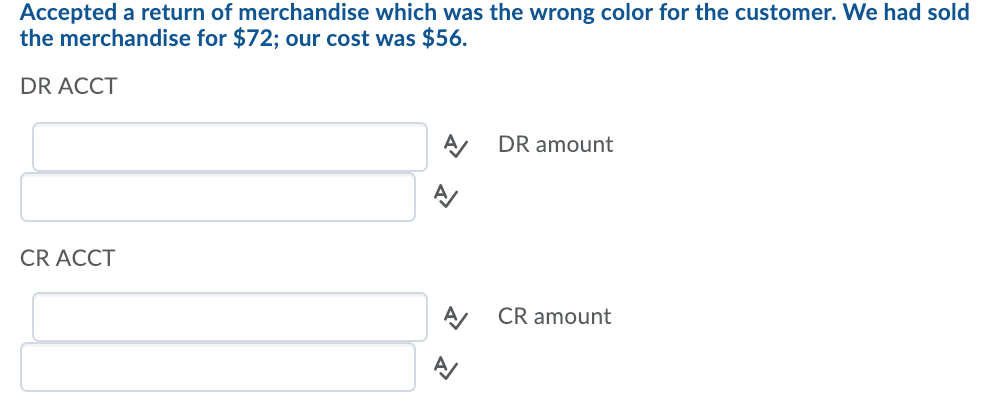

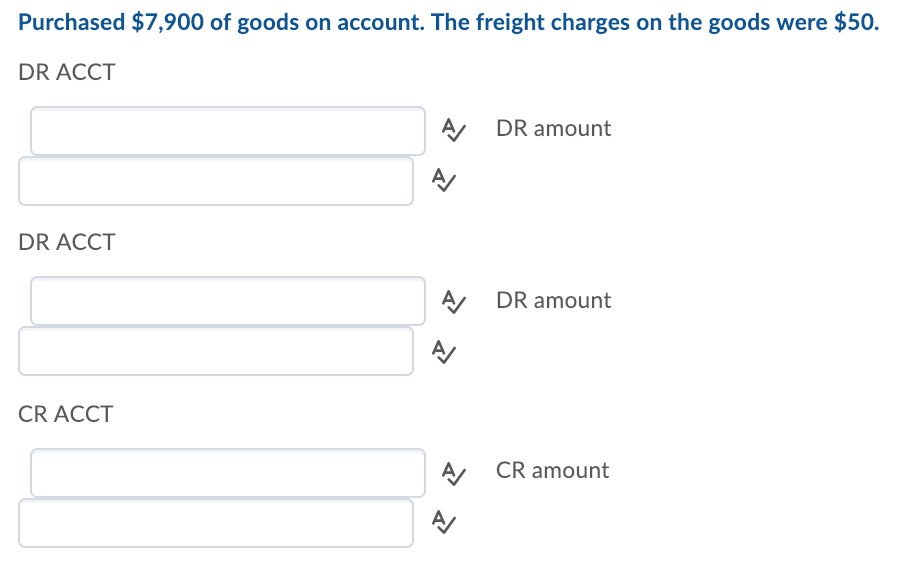

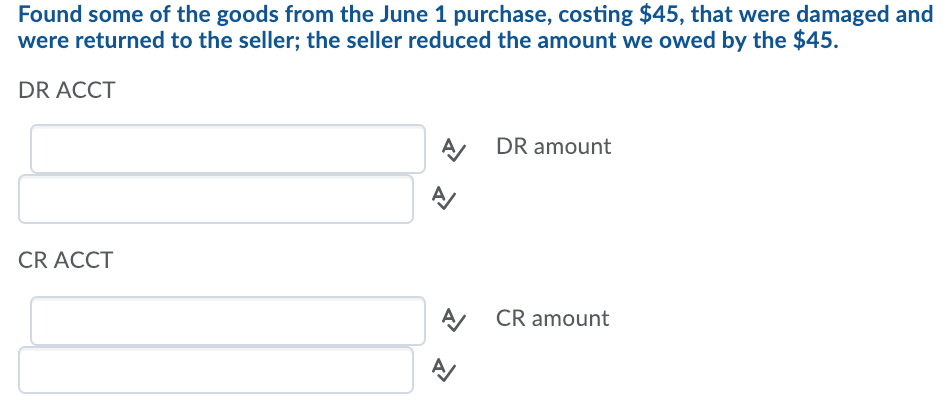

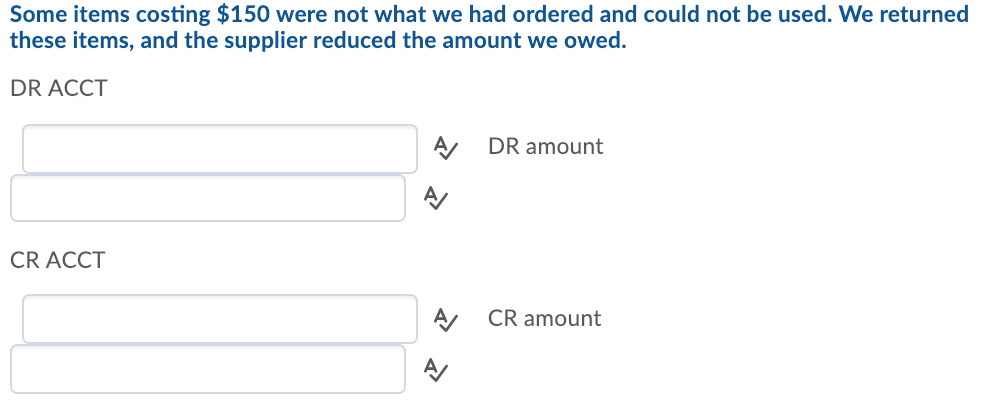

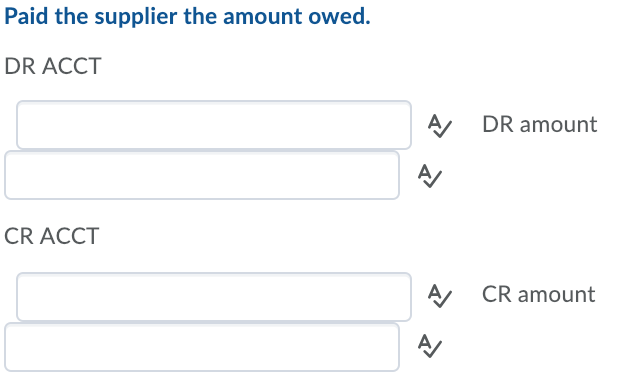

Question 27 (1 point) Account titles available for use: Cash Purchases Purchase Returns Cost of Goods Sold Accounts Receivable Purchase Allowances Sales Revenue Freight Expense Accounts Payable Purchase Discounts Sales Returns Interest Expense Inventory Supplies Freight-In Loss from Inventory Shrinkage Record the following transaction using the periodic method. For account titles use the account names listed above (be cautious about spelling as this can return an incorrect answer). For transaction amounts do not use "$"or commas in your answer. For compound entries list the larger debits and credit first. On June 7 sold inventory that had cost us $800 for $1,000 on account to Smith. Freight to get the merchandise to our customer was paid by the customer. DR ACCT DR amount CR ACCT CR amount Accepted a return of merchandise from the June 7 sale to Smith that was the wrong size for the customer. We had sold the merchandise for $300; our cost was $240. DR ACCT DR amount CR ACC CR amount Shipped merchandise that had cost us $940 to Jones. New Stuff billed the customer $1,175 on the sale and paid $25 in freight to get the merchandise to the customer. DR ACCT A DR amount CR ACCT CR amount DR ACCT DR amount CR ACCT ACR amount Received a check for the Smith June 7 sale. DR ACCT cash DR amount 700 CR ACCT accounts receivable A CR amount 700 Local Hardware uses the periodic inventory method. At the end of the accounting period, the company takes a physical inventory and finds that $20,671 of goods are on hand. Purchases during the period were $76,216, and inventory at the beginning of the period was $25,632. Freight on merchandise coming into the business was $2,799, and returns of merchandise to suppliers amounted to $1,776. In the schedule below, record the journal entry to be made by Local at the end of the accounting period to close the old inventory and record the new one. 4 9 DR ACCT DR amount DR ACCT DR amount DR ACCT DR amount CR ACCT CR amount CR ACCT A CR amount CR ACCT CR amount Extra Busy needs your help with inventory entries. The company uses the periodic inventory method. At the end of the accounting period, the company takes a physical inventory and finds that $96,789 of goods are on hand. Purchases during the period were $783,422, and inventory at the beginning of the period was $105,627. Freight on merchandise coming into the business was $8,552, and returns of merchandise to suppliers amounted to $12,558. In the schedule below, record the journal entry to be made by Local at the end of the accounting period to close the old inventory and record the new one. DR ACCT A DR amount DR ACCT A DR amount DR ACCT DR amount CR ACCT A CR amount CR ACCT CR amount CR ACCT A CR amount Returned merchandise with a cost of $500 because we could not use it. Record using the gross method. DR ACCT DR amount CR ACCT A, CR amount Purchased and received $15,000 of merchandise, terms 1/15, n/45. Record using the net method. DR ACCT DR amount CR ACCT A CR amount Returned merchandise with a cost of $500 because we could not use it. Record using the net method. DR ACCT A DR amount CR ACCT CR amount Paid for the remainder of the merchandise. Record using the net method. (Note: Refers to the three previous transactions) DR ACCT DR amount DR ACCT DR amount CR ACC A CR amount Goods costing $35 were damaged and were returned to the seller; the seller reduced the amount owed by $35. DR ACCT A DR amount CR ACCT A CR amount Accepted a return of merchandise which was the wrong color for the customer. We had sold the merchandise for $72; our cost was $56 DR ACCT DR amount CR ACCT A CR amount Purchased $7,900 of goods on account. The freight charges on the goods were $50. DR ACCT A DR amount DR ACCT A DR amount CR ACCT A CR amount Found some of the goods from the June 1 purchase, costing $45, that were damaged and were returned to the seller; the seller reduced the amount we owed by the $45. DR ACCT DR amount CR ACCT A CR amount Some items costing $150 were not what we had ordered and could not be used. We returned these items, and the supplier reduced the amount we owed. DR ACCT DR amount CR ACCT A CR amount Paid the supplier the amount owed. DR ACCT DR amount CR ACCT CR amount