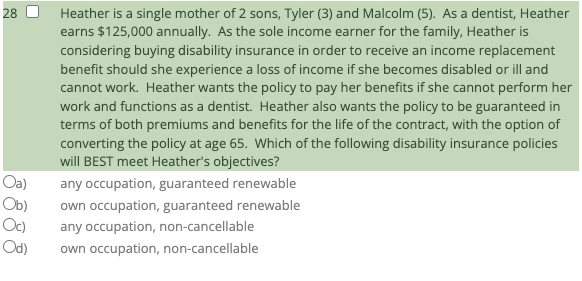

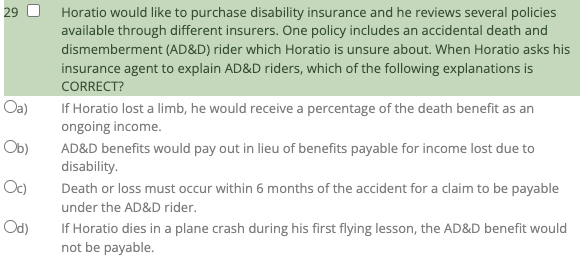

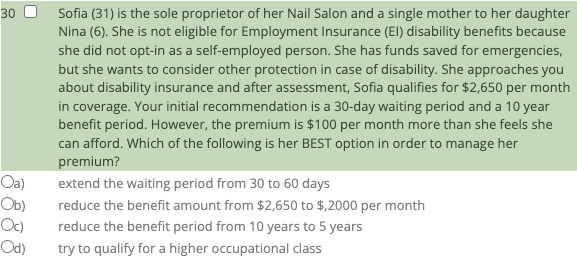

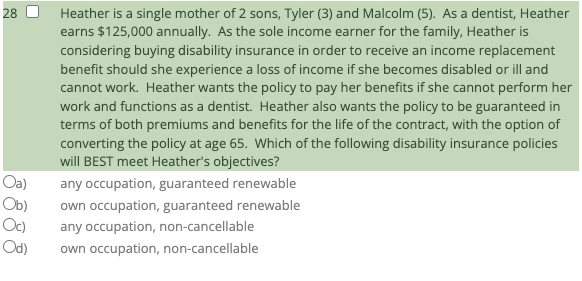

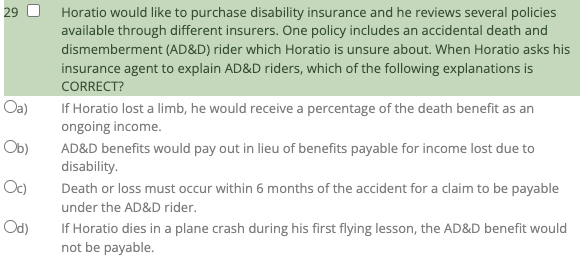

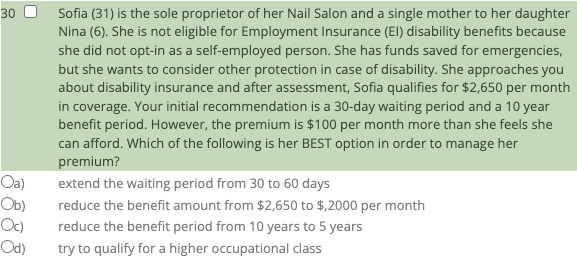

28 0 Heather is a single mother of 2 sons, Tyler (3) and Malcolm (5). As a dentist, Heather earns $125,000 annually. As the sole income earner for the family, Heather is considering buying disability insurance in order to receive an income replacement benefit should she experience a loss of income if she becomes disabled or ill and cannot work. Heather wants the policy to pay her benefits if she cannot perform her work and functions as a dentist. Heather also wants the policy to be guaranteed in terms of both premiums and benefits for the life of the contract, with the option of converting the policy at age 65. Which of the following disability insurance policies will BEST meet Heather's objectives? any occupation, guaranteed renewable own occupation, guaranteed renewable any occupation, non-cancellable own occupation, non-cancellable Oa) Ob) Oc) Od) 29 Oa) Horatio would like to purchase disability insurance and he reviews several policies available through different insurers. One policy includes an accidental death and dismemberment (AD&D) rider which Horatio is unsure about. When Horatio asks his insurance agent to explain AD&D riders, which of the following explanations is CORRECT? If Horatio lost a limb, he would receive a percentage of the death benefit as an ongoing income. AD&D benefits would pay out in lieu of benefits payable for income lost due to disability Death or loss must occur within 6 months of the accident for a claim to be payable under the AD&D rider. If Horatio dies in a plane crash during his first flying lesson, the AD&D benefit would not be payable. Ob) Oc) Od) 30 Sofia (31) is the sole proprietor of her Nail Salon and a single mother to her daughter Nina (6). She is not eligible for Employment Insurance (El) disability benefits because she did not opt-in as a self-employed person. She has funds saved for emergencies, but she wants to consider other protection in case of disability. She approaches you about disability insurance and after assessment, Sofia qualifies for $2,650 per month in coverage. Your initial recommendation is a 30-day waiting period and a 10 year benefit period. However, the premium is $100 per month more than she feels she can afford. Which of the following is her BEST option in order to manage her premium? extend the waiting period from 30 to 60 days reduce the benefit amount from $2,650 to $,2000 per month reduce the benefit period from 10 years to 5 years try to qualify for a higher occupational class Oa) Ob) Oc) Od)