Answered step by step

Verified Expert Solution

Question

1 Approved Answer

28 25. The following data were provided by the administrator of Pedro who died in 2021: Conjugal real properties Conjugal family home Exclusive properties

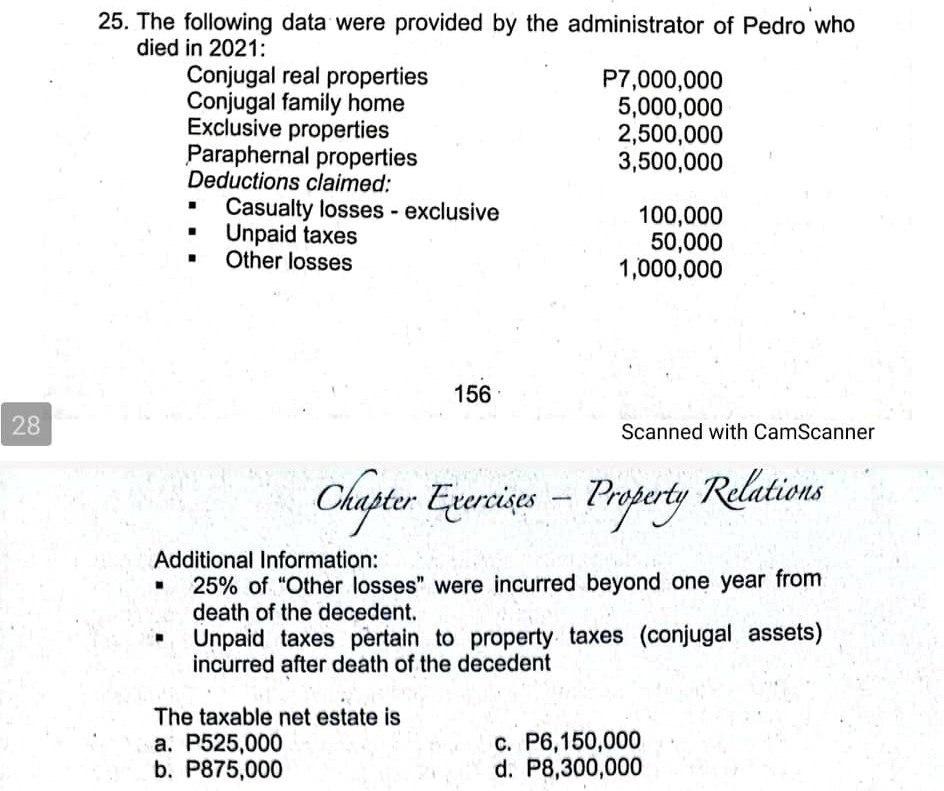

28 25. The following data were provided by the administrator of Pedro who died in 2021: Conjugal real properties Conjugal family home Exclusive properties Paraphernal properties Deductions claimed: Casualty losses - exclusive Unpaid taxes Other losses 156 P7,000,000 5,000,000 2,500,000 3,500,000 100,000 50,000 1,000,000 The taxable net estate is a. P525,000 b. P875,000 Scanned with CamScanner Chapter Exercises - Property Relations Additional Information: 25% of "Other losses" were incurred beyond one year from death of the decedent. Unpaid taxes pertain to property taxes (conjugal assets) incurred after death of the decedent c. P6,150,000 d. P8,300,000

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

In the calculation we do not include conjugal property or asset as it is belonging to a couple ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started