Answered step by step

Verified Expert Solution

Question

1 Approved Answer

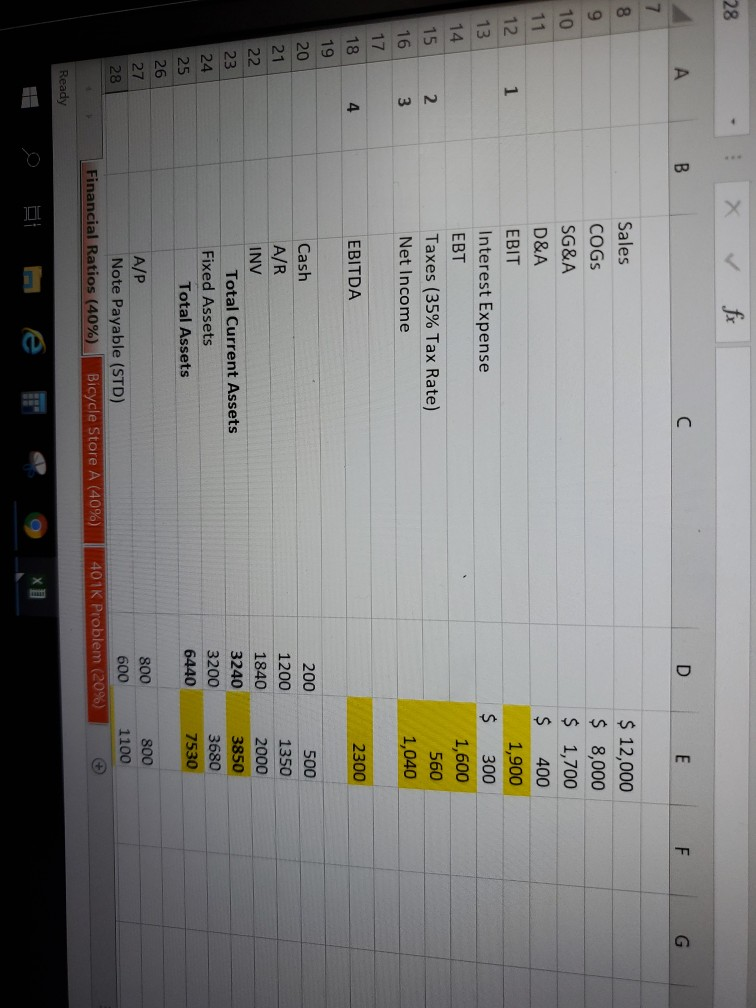

28 A B C D E F G 7. 8 9 $ 12,000 $ 8,000 $ 1,700 $ 400 10 1 Sales COGS SG&A D&A

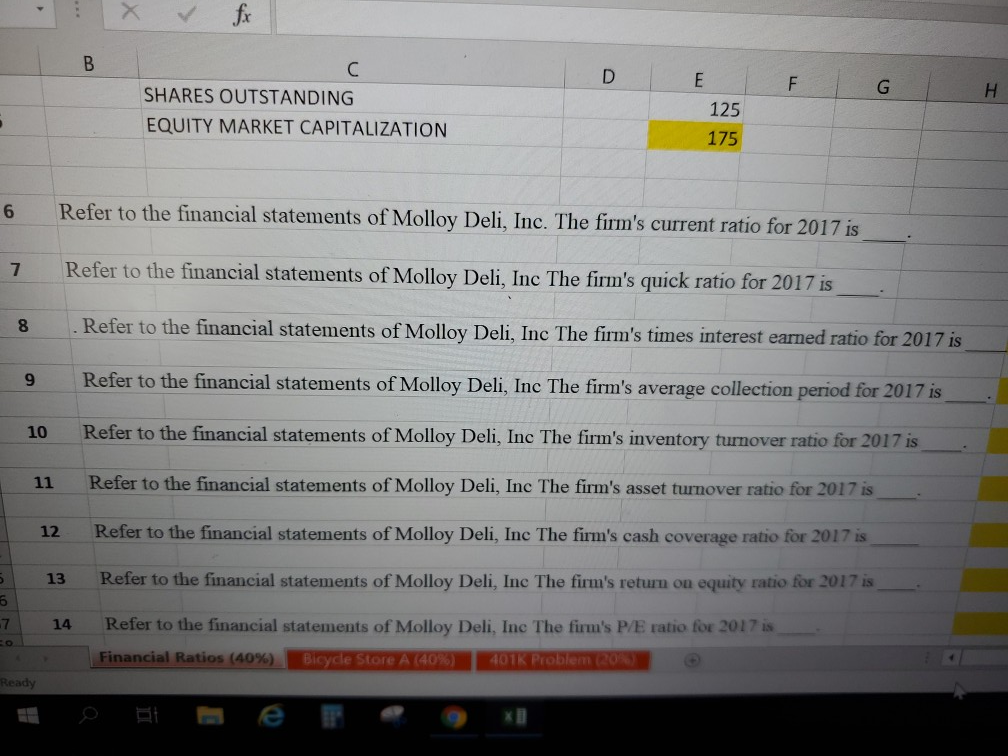

28 A B C D E F G 7. 8 9 $ 12,000 $ 8,000 $ 1,700 $ 400 10 1 Sales COGS SG&A D&A EBIT Interest Expense EBT Taxes (35% Tax Rate) Net Income 11 12 13 14 1,900 $ 300 1,600 560 1,040 15 16 17 18 4 EBITDA 2300 200 1200 1840 19 20 21 22 23 24 25 26 Cash A/R INV Total Current Assets Fixed Assets Total Assets 500 1350 2000 3850 3680 7530 3240 3200 6440 27 28 A/P Note Payable (STD) Financial Ratios (40%) Bicycle Store A (40%) 800 1100 800 600 401K Problem (20%) Ready fx B D E F G C SHARES OUTSTANDING EQUITY MARKET CAPITALIZATION H 125 . 175 6 Refer to the financial statements of Molloy Deli, Inc. The firm's current ratio for 2017 is 7 Refer to the financial statements of Molloy Deli, Inc The firm's quick ratio for 2017 is 8 Refer to the financial statements of Molloy Deli, Inc The firm's times interest earned ratio for 2017 is 9 Refer to the financial statements of Molloy Deli, Inc The firm's average collection period for 2017 is 10 Refer to the financial statements of Molloy Deli, Inc The firm's inventory turnover ratio for 2017 is 11 Refer to the financial statements of Molloy Deli, Inc The firm's asset turnover ratio for 2017 is 12 Refer to the financial statements of Molloy Deli, Inc The firm's cash coverage ratio for 2017 is 5 13 Refer to the financial statements of Molloy Deli, Inc The firm's return on equity ratio for 2017 is 6 7 14 Refer to the financial statements of Molloy Deli, Ine The firm's P/E ratio for 2017 is Financial Ratios (40%) Bicyde Store A (40%) 401K Problem 203 Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started