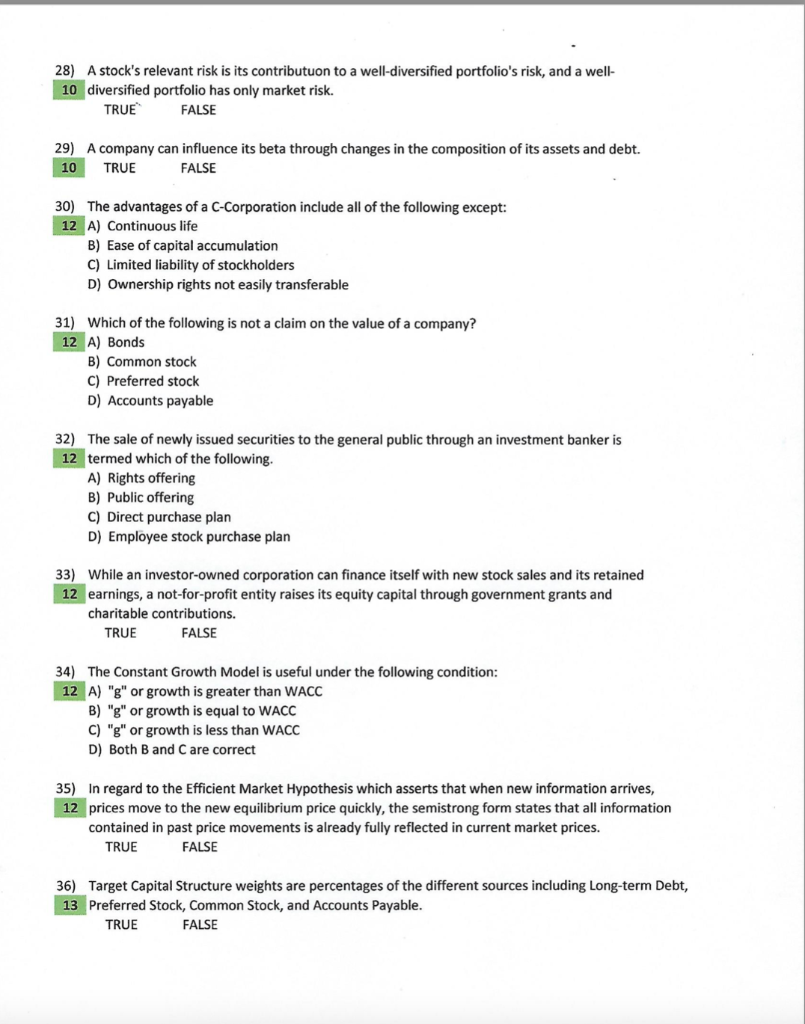

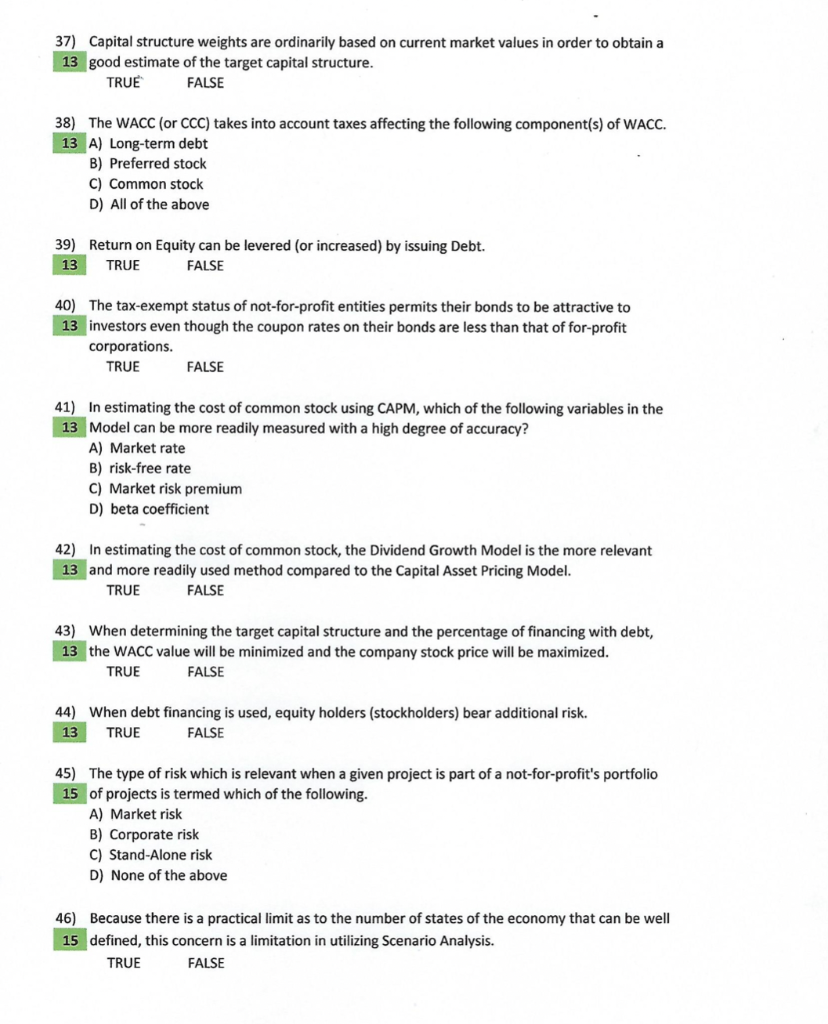

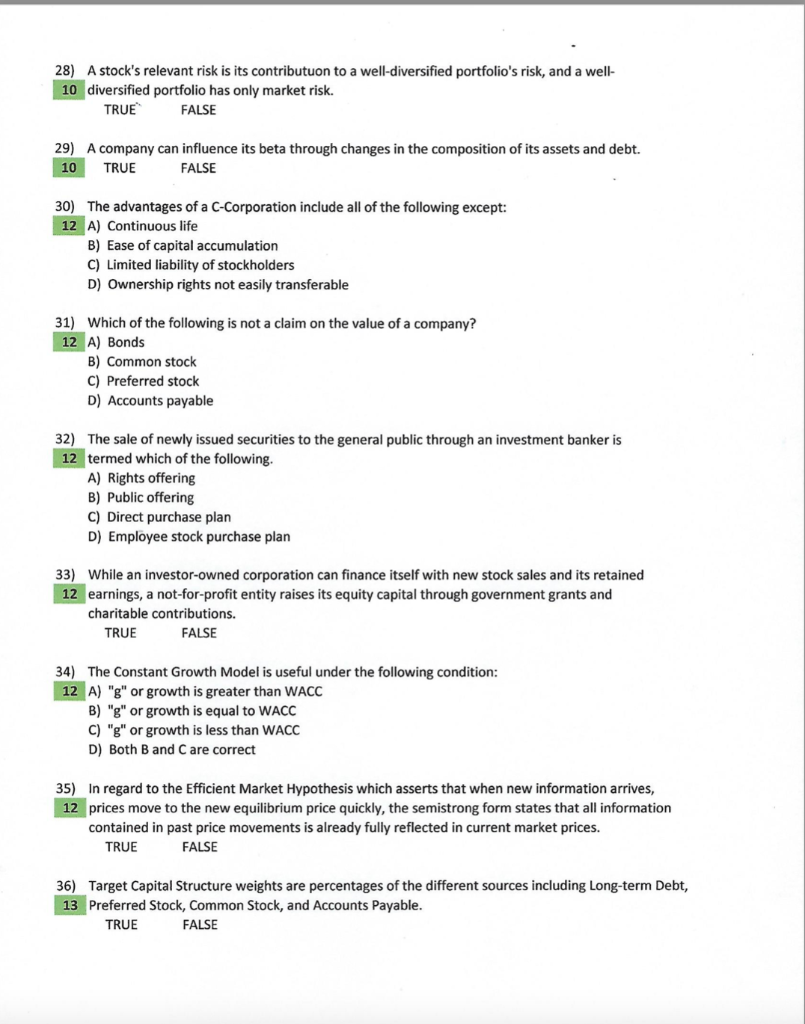

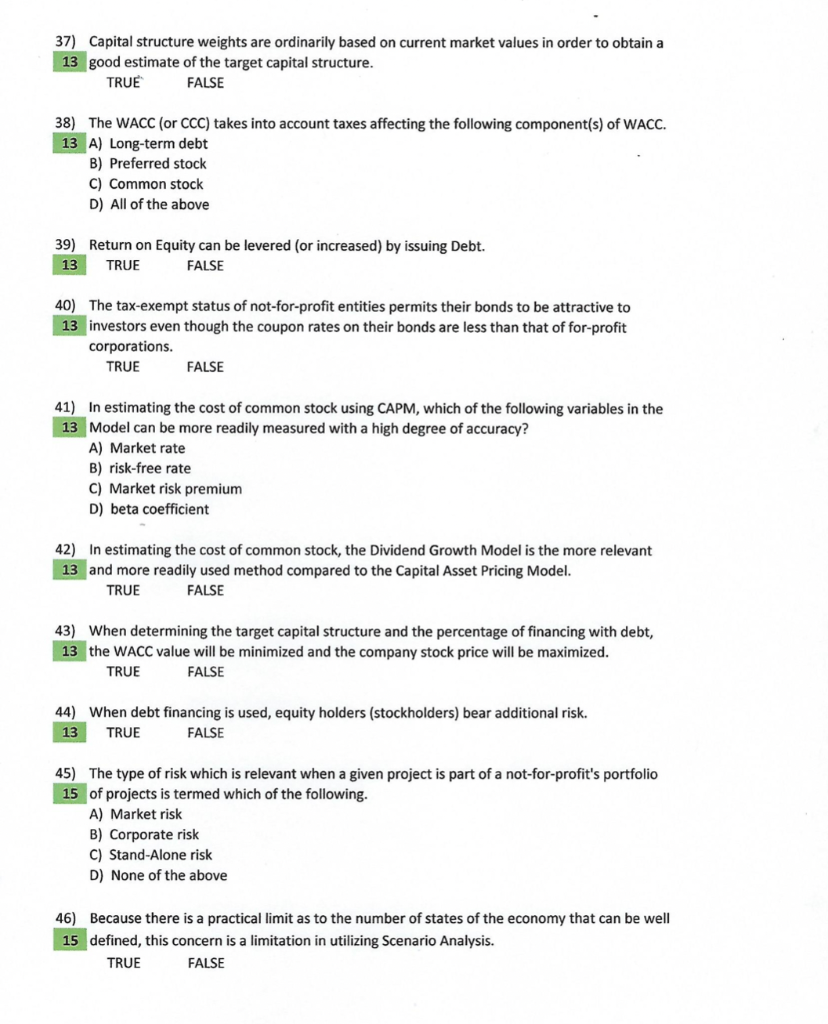

28) A stock's relevant risk is its contributuon to a well-diversified portfolio's risk, and a well- 10 diversified portfolio has only market risk. TRUE FALSE 29) A company can influence its beta through changes in the composition of its assets and debt. 10 TRUE FALSE 30) The advantages of a C-Corporation include all of the following except: 12 A) Continuous life B) Ease of capital accumulation C) Limited liability of stockholders D) Ownership rights not easily transferable 31) Which of the following is not a claim on the value of a company? 12 A) Bonds B) Common stock C) Preferred stock D) Accounts payable 32) The sale of newly issued securities to the general public through an investment banker is 12 termed which of the following, A) Rights offering B) Public offering C) Direct purchase plan D) Employee stock purchase plan 33) While an investor-owned corporation can finance itself with new stock sales and its retained 12 earnings, a not-for-profit entity raises its equity capital through government grants and charitable contributions. TRUE FALSE 34) The Constant Growth Model is useful under the following condition: 12 A) "g" or growth is greater than WACC B) "g" or growth is equal to WACC C) "g" or growth is less than WACC D) Both and C are correct 35) In regard to the Efficient Market Hypothesis which asserts that when new information arrives, 12 prices move to the new equilibrium price quickly, the semistrong form states that all information contained in past price movements is already fully reflected in current market prices. TRUE FALSE 36) Target Capital Structure weights are percentages of the different sources including Long-term Debt, 13 Preferred Stock, Common Stock, and Accounts Payable. TRUE FALSE 37) Capital structure weights are ordinarily based on current market values in order to obtain a 13 good estimate of the target capital structure. TRUE FALSE 38) The WACC (or CCC) takes into account taxes affecting the following component(s) of WACC. 13 A) Long-term debt B) Preferred stock C) Common stock D) All of the above 39) Return on Equity can be levered (or increased) by issuing Debt. 13 TRUE FALSE 40) The tax-exempt status of not-for-profit entities permits their bonds to be attractive to 13 investors even though the coupon rates on their bonds are less than that of for-profit corporations. TRUE FALSE 41) In estimating the cost of common stock using CAPM, which of the following variables in the 13 Model can be more readily measured with a high degree of accuracy? A) Market rate B) risk-free rate C) Market risk premium D) beta coefficient 42) In estimating the cost of common stock, the Dividend Growth Model is the more relevant 13 and more readily used method compared to the Capital Asset Pricing Model. TRUE FALSE 43) When determining the target capital structure and the percentage of financing with debt, 13 the WACC value will be minimized and the company stock price will be maximized. TRUE FALSE 44) When debt financing is used, equity holders (stockholders) bear additional risk. 13 TRUE FALSE 45) The type of risk which is relevant when a given project is part of a not-for-profit's portfolio 15 of projects is termed which of the following. A) Market risk B) Corporate risk C) Stand-Alone risk D) None of the above 46) Because there is a practical limit as to the number of states of the economy that can be well 15 defined, this concern is a limitation in utilizing Scenario Analysis. TRUE FALSE