Answered step by step

Verified Expert Solution

Question

1 Approved Answer

28) based on the adjusted trial balance for highlight styling and the adjusting information given below, 1.Prepare the adjusting journal entries for highlight styling 2.

28) based on the adjusted trial balance for highlight styling and the adjusting information given below,

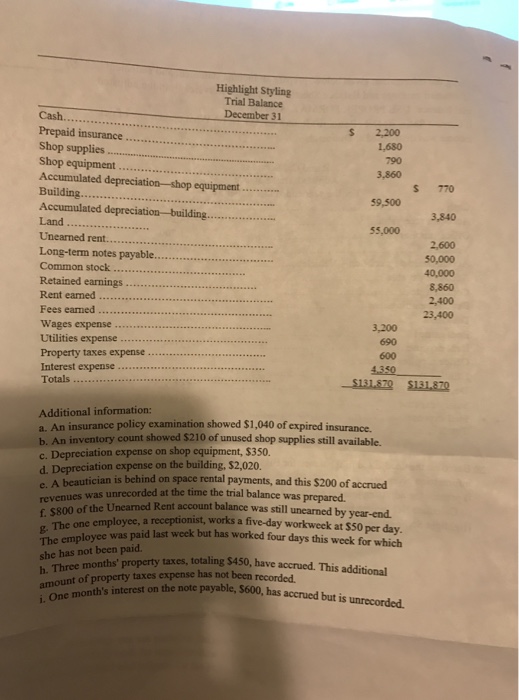

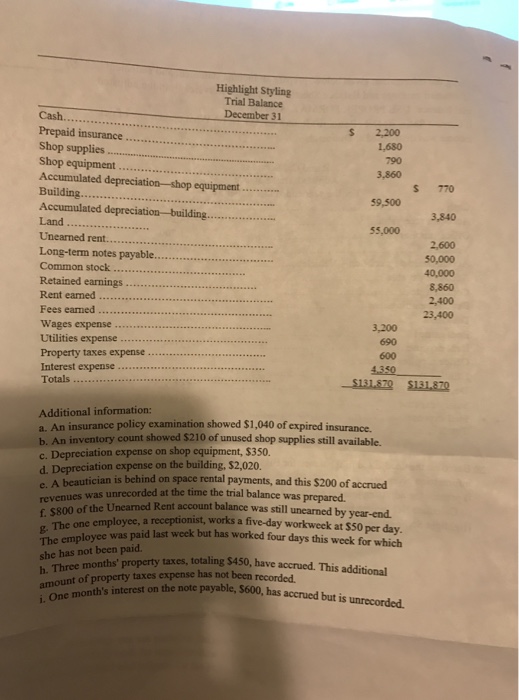

Highlight Styling Trial Balance December 31 Cash.. Prepaid insurance Shop supplies S 2,200 1,680 790 3,860 Shop equipment Accumulated depreciation-shop equipment Building.. Accumulated depreciation-building. Land s 770 59,500 55,000 Long-term notes payable Common stock 50,000 40,000 8,860 2,400 23,400 Rent eaned Fees earned .. Wages expense Utilities expense Property taxes expense... Interest expense Totals 3,200 690 600 $131.570 $131.870 Additional information: a. An insuran policy examination showed $1,040 of expired insurance. b. An inventory count showed $210 of unused shop supplies still available. c. Depreciation expense on shop equipment, $350 d. Depreciation expense on the building, $2,020. s A beautician is behind on space rental payments, and this $200 of accrued ues was unrecorded at the time the trial balance was prepared f. $800 of g. The one empl The employce was pa she has not been paid the Unearned Rent account balance was still unearned by year-end. ovee, a receptionist, works a five-day workweek at $50 per day id last week but has worked four days this week for which taxes, totaling $450, have accrued. This additional of property tane payable, S600, has accrued but is unrecorded. armoun monti's interest on the note payable, $600,has accrued but is 1.Prepare the adjusting journal entries for highlight styling

2. Calculate net infom before and after adjustments

Highlight styling unadjusted trial balance for the current year follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started