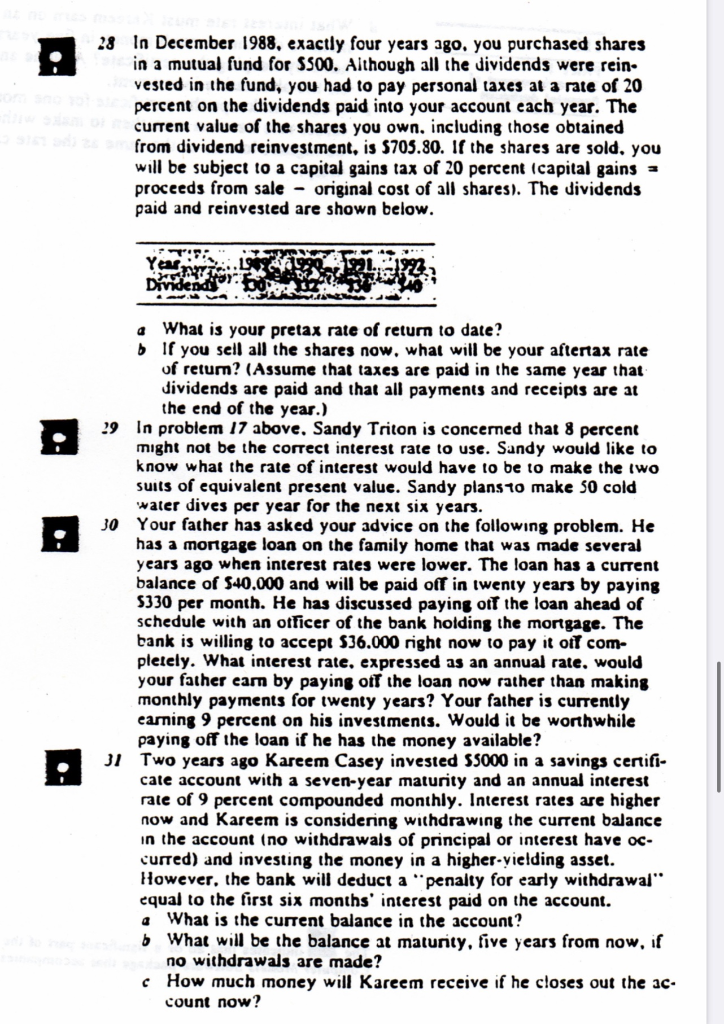

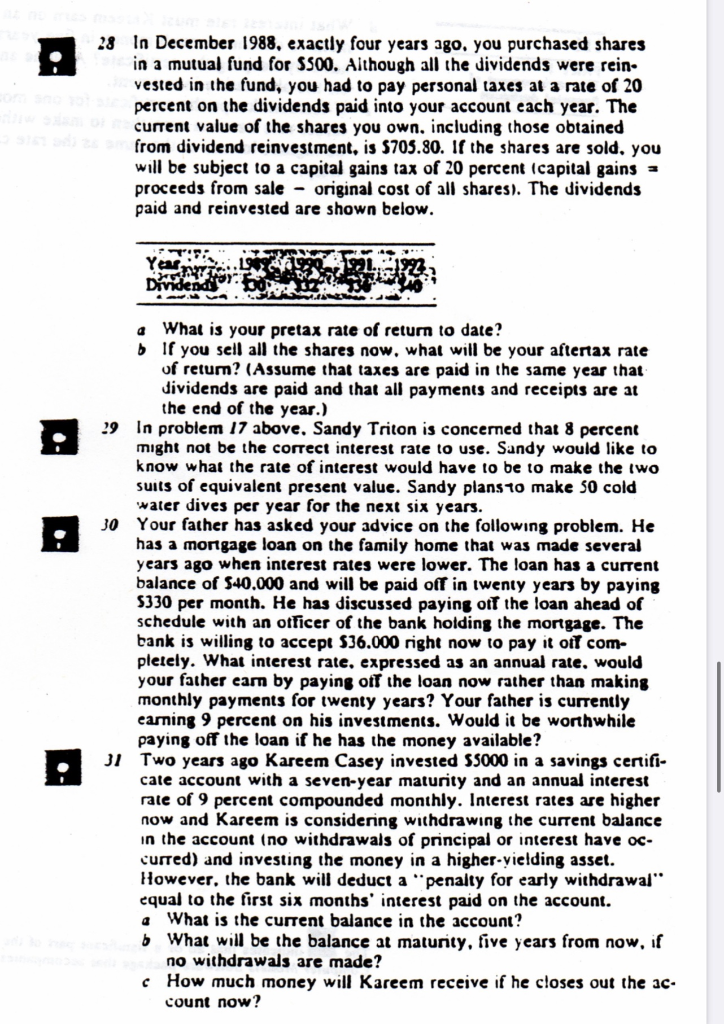

28 In December 1988, exactly four years ago, you purchased shares in a mutual fund for $500. Although all the dividends were rein. vested in the fund, you had to pay personal taxes at a rate of 20 percent on the dividends paid into your account each year. The current value of the shares you own, including those obtained from dividend reinvestment, is $705.80. If the shares are sold, you will be subject to a capital gains tax of 20 percent (capital gains - proceeds from sale - original cost of all shares). The dividends paid and reinvested are shown below. Year 20 1 2 a What is your pretax rate of return to date? b If you sell all the shares now, what will be your aftertax rate of retum? (Assume that taxes are paid in the same year that dividends are paid and that all payments and receipts are at the end of the year.) 29 In problem 17 above, Sandy Triton is concerned that 8 percent might not be the correct interest rate to use. Sandy would like to know what the rate of interest would have to be to make the two suits of equivalent present value. Sandy plans to make 50 cold water dives per year for the next six years. Your father has asked your advice on the following problem. He has a mortgage loan on the family home that was made several years ago when interest rates were lower. The loan has a current balance of $40,000 and will be paid off in twenty years by paying 5330 per month. He has discussed paying off the loan ahead of schedule with an officer of the bank holding the mortgage. The bank is willing to accept 536.000 right now to pay it oil com- pletely. What interest rate, expressed as an annual rate, would your father cam by paying off the loan now rather than making monthly payments for twenty years? Your father is currently earning 9 percent on his investments. Would it be worthwhile paying off the loan if he has the money available? Two years ago Kareem Casey invested 55000 in a savings certifi- cate account with a seven-year maturity and an annual interest rate of 9 percent compounded monthly. Interest rates are higher now and Kareem is considering withdrawing the current balance in the account (no withdrawals of principal or interest have oc- curred) and investing the money in a higher yielding asset. However, the bank will deduct a "penalty for early withdrawal" equal to the first six months' interest paid on the account. What is the current balance in the account? b What will be the balance at maturity, five years from now, if no withdrawals are made? How much money will Kareem receive if he closes out the ac. count now? 28 In December 1988, exactly four years ago, you purchased shares in a mutual fund for $500. Although all the dividends were rein. vested in the fund, you had to pay personal taxes at a rate of 20 percent on the dividends paid into your account each year. The current value of the shares you own, including those obtained from dividend reinvestment, is $705.80. If the shares are sold, you will be subject to a capital gains tax of 20 percent (capital gains - proceeds from sale - original cost of all shares). The dividends paid and reinvested are shown below. Year 20 1 2 a What is your pretax rate of return to date? b If you sell all the shares now, what will be your aftertax rate of retum? (Assume that taxes are paid in the same year that dividends are paid and that all payments and receipts are at the end of the year.) 29 In problem 17 above, Sandy Triton is concerned that 8 percent might not be the correct interest rate to use. Sandy would like to know what the rate of interest would have to be to make the two suits of equivalent present value. Sandy plans to make 50 cold water dives per year for the next six years. Your father has asked your advice on the following problem. He has a mortgage loan on the family home that was made several years ago when interest rates were lower. The loan has a current balance of $40,000 and will be paid off in twenty years by paying 5330 per month. He has discussed paying off the loan ahead of schedule with an officer of the bank holding the mortgage. The bank is willing to accept 536.000 right now to pay it oil com- pletely. What interest rate, expressed as an annual rate, would your father cam by paying off the loan now rather than making monthly payments for twenty years? Your father is currently earning 9 percent on his investments. Would it be worthwhile paying off the loan if he has the money available? Two years ago Kareem Casey invested 55000 in a savings certifi- cate account with a seven-year maturity and an annual interest rate of 9 percent compounded monthly. Interest rates are higher now and Kareem is considering withdrawing the current balance in the account (no withdrawals of principal or interest have oc- curred) and investing the money in a higher yielding asset. However, the bank will deduct a "penalty for early withdrawal" equal to the first six months' interest paid on the account. What is the current balance in the account? b What will be the balance at maturity, five years from now, if no withdrawals are made? How much money will Kareem receive if he closes out the ac. count now