Answered step by step

Verified Expert Solution

Question

1 Approved Answer

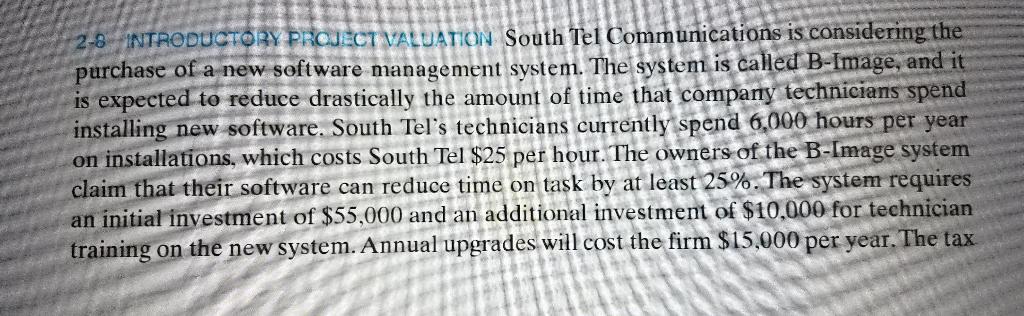

2-8 INTRODUCTORY PROJECT VALUATION South Tel Communications is considering the purchase of a new software management system. The system is called B-Image, and it is

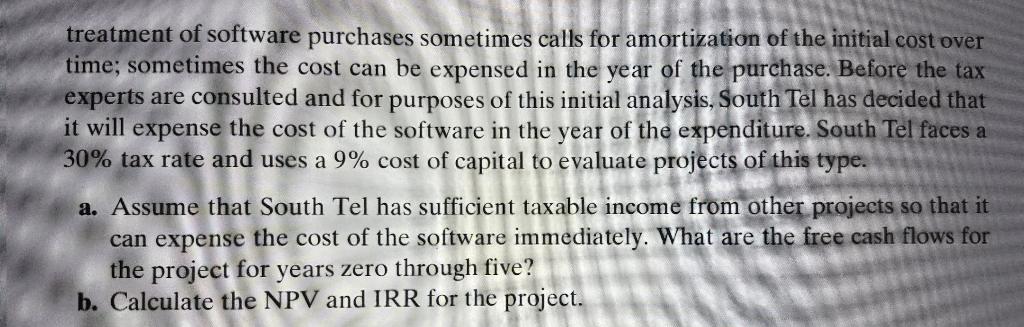

2-8 INTRODUCTORY PROJECT VALUATION South Tel Communications is considering the purchase of a new software management system. The system is called B-Image, and it is expected to reduce drastically the amount of time that company technicians spend installing new software. South Tel's technicians currently spend 6,000 hours per year on installations, which costs South Tel $25 per hour. The owners of the B-Image system claim that their software can reduce time on task by at least 25%. The system requires an initial investment of $55,000 and an additional investment of $10,000 for technician training on the new system. Annual upgrades will cost the firm $15,000 per year. The tax treatment of software purchases sometimes calls for amortization of the initial cost over time; sometimes the cost can be expensed in the year of the purchase. Before the tax experts are consulted and for purposes of this initial analysis, South Tel has decided that it will expense the cost of the software in the year of the expenditure. South Tel faces a 30% tax rate and uses a 9% cost of capital to evaluate projects of this type. a. Assume that South Tel has sufficient taxable income from other projects so that it can expense the cost of the software immediately. What are the free cash flows for the project for years zero through five? b. Calculate the NPV and IRR for the project. 2-8 INTRODUCTORY PROJECT VALUATION South Tel Communications is considering the purchase of a new software management system. The system is called B-Image, and it is expected to reduce drastically the amount of time that company technicians spend installing new software. South Tel's technicians currently spend 6,000 hours per year on installations, which costs South Tel $25 per hour. The owners of the B-Image system claim that their software can reduce time on task by at least 25%. The system requires an initial investment of $55,000 and an additional investment of $10,000 for technician training on the new system. Annual upgrades will cost the firm $15,000 per year. The tax treatment of software purchases sometimes calls for amortization of the initial cost over time; sometimes the cost can be expensed in the year of the purchase. Before the tax experts are consulted and for purposes of this initial analysis, South Tel has decided that it will expense the cost of the software in the year of the expenditure. South Tel faces a 30% tax rate and uses a 9% cost of capital to evaluate projects of this type. a. Assume that South Tel has sufficient taxable income from other projects so that it can expense the cost of the software immediately. What are the free cash flows for the project for years zero through five? b. Calculate the NPV and IRR for the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started