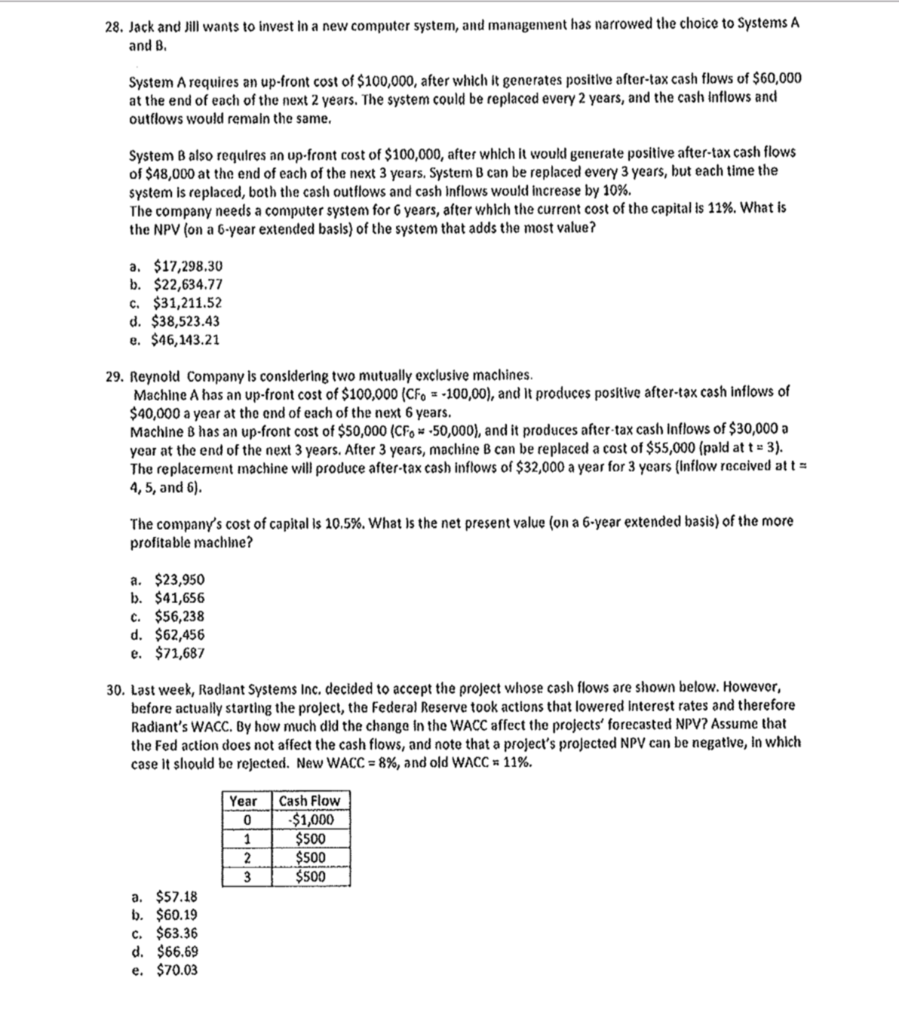

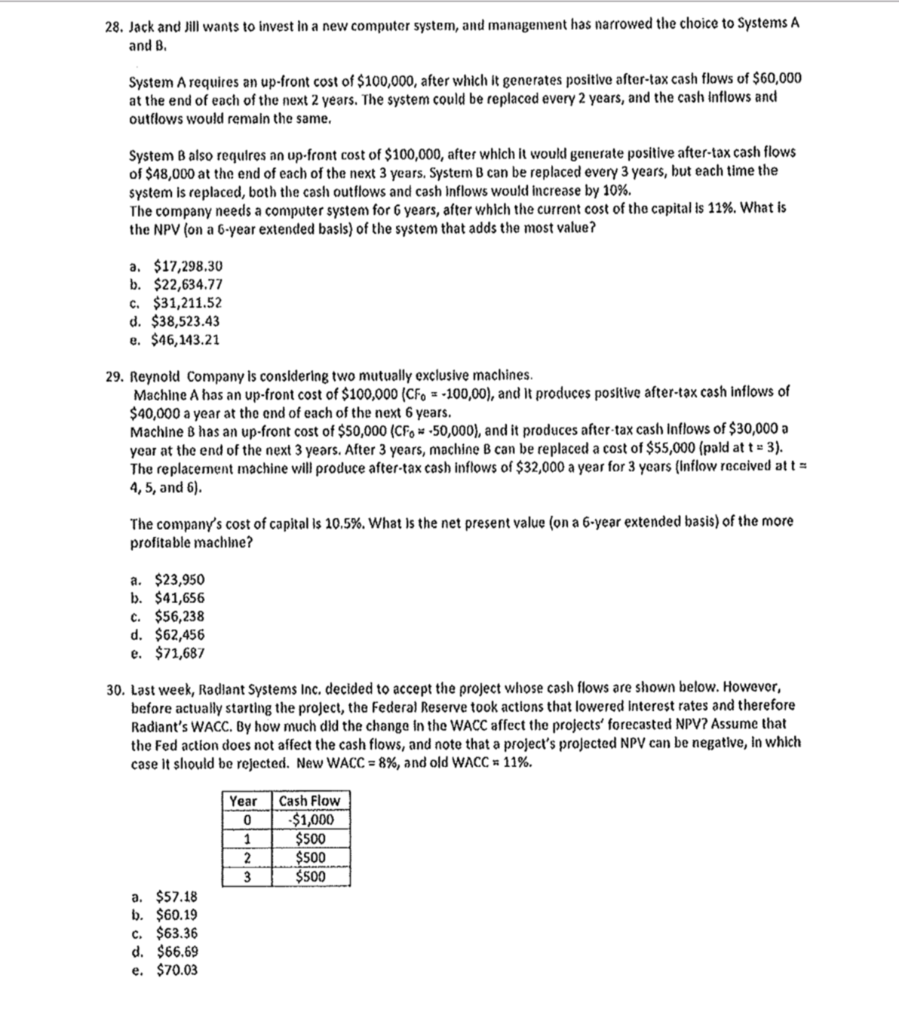

28. Jack and Jill wants to invest in a new computer system, and management has narrowed the choice to Systems A and B. System A requires an up-front cost of $100,000, after which it generates positive after-tax cash flows of $60,000 at the end of each of the next 2 years. The system could be replaced every 2 years, and the cash inflows and outflows would remain the same. System B also requires an up-front cost of $100,000, after which it would generate positive after-tax cash flows of $48,000 at the end of each of the next 3 years. System B can be replaced every 3 years, but each time the system is replaced, both the cash outflows and cash Inflows would increase by 10%. The company needs a computer system for 6 years, after which the current cost of the capital is 11%. What is the NPV (on a 6-year extended basis) of the system that adds the most value? a. $17,298.30 b. $22,634.77 c. $31,211.52 d. $38,523.43 e. $46, 143.21 29. Reynold Company is considering two mutually exclusive machines. Machine A has an up-front cost of $100,000 (CFO = -100,00), and it produces positive after-tax cash inflows of $40,000 a year at the end of each of the next 6 years. Machine B has an up-front cost of $50,000 (CF, *.50,000), and it produces after tax cash Inflows of $30,000 a year at the end of the next 3 years. After 3 years, machine B can be replaced a cost of $55,000 (pald at t = 3). The replacement machine will produce after-tax cash inflows of $32,000 a year for 3 years (Inflow received at t = 4,5, and 6). The company's cost of capital is 10.5%. What is the net present value (on a 6-year extended basis of the more profitable machine? a. $23,950 b. $41,656 c. $56,238 d. $62,456 e. $71,687 30. Last week, Radiant Systems Inc. decided to accept the project whose cash flows are shown below. However, before actually starting the project, the Federal Reserve took actions that lowered Interest rates and therefore Radiant's WACC. By how much did the change in the WACC affect the projects' forecasted NPV? Assume that the Fed action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected. New WACC = 8%, and old WACC = 11%. Year 0 1 Cash Flow $1,000 $500 $500 $500 2 3 a. $57.18 b. $60.19 c. $63.36 d. $66.69 e. $70.03