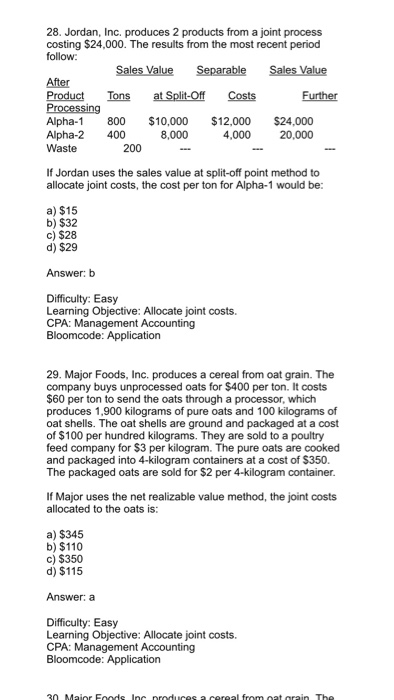

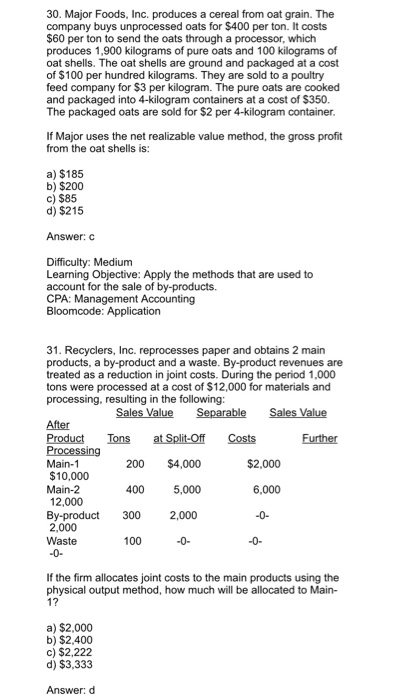

28. Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow Sales Value Separable Sales Value Product Tons at Split-Off Costs Processing Alpha-1 800 $10,000 $12,000 $24,000 Alpha-2 400 Waste Further 8,000 4,000 20,000 200 If Jordan uses the sales value at split-off point method to allocate joint costs, the cost per ton for Alpha-1 would be a) $15 b) $32 c) $28 d) $29 Answer: b Difficulty: Easy Learning Objective: Allocate joint costs. CPA: Management Accounting 29. Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 kilograms of pure oats and 100 kilograms of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred kilograms. They are sold to a poultry feed company for $3 per kilogram. The pure oats are cooked and packaged into 4-kilogram containers at a cost of $350. The packaged oats are sold for $2 per 4-kilogram container. If Major uses the net realizable value method, the joint costs allocated to the oats is: a) $345 b) $110 c) $350 d) $115 Answer: a Difficulty: Easy Learning Objective: Allocate joint costs. CPA: Management Accounting 0 Ma 30. Major Foods, Inc. produces a cereal from oat grain. The company buys unprocessed oats for $400 per ton. It costs $60 per ton to send the oats through a processor, which produces 1,900 kilograms of pure oats and 100 kilograms of oat shells. The oat shells are ground and packaged at a cost of $100 per hundred kilograms. They are sold to a poultry feed company for $3 per kilogram. The pure oats are cooked and packaged into 4-kilogram containers at a cost of $350. The packaged oats are sold for $2 per 4-kilogram container. If Major uses the net realizable value method, the gross profit from the oat shells is: a) $185 b) $200 c) $85 d) $215 Answer: C Difficulty: Medium Learning Objective: Apply the methods that are used to account for the sale of by-products. CPA: Management Accounting 31. Recyclers, Inc. reprocesses paper and obtains 2 main products, a by-product and a waste. By-product revenues are treated as a reduction in joint costs. During the period 1,000 tons were processed at a cost of $12,000 for materials and processing, resulting in the following: After Product ons at Split-Off Costs Processing Main-1 $10,000 Main-2 12,000 By-product 300 2,000 2,000 Waste Further 200 $4,000 $2,000 400 5,000 6,000 100 If the firm allocates joint costs to the main products using the physical output method, how much will be allocated to Main- 1? a) $2,000 b) $2,400 c) $2,222 d) $3,333 Answer: d