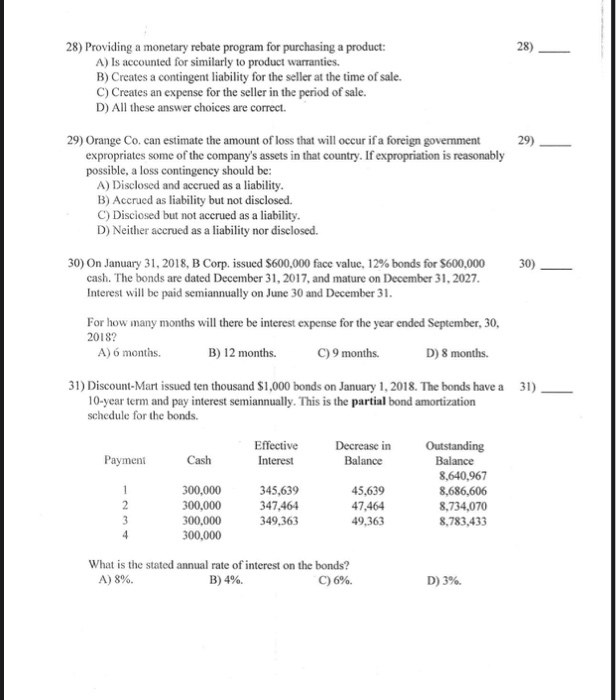

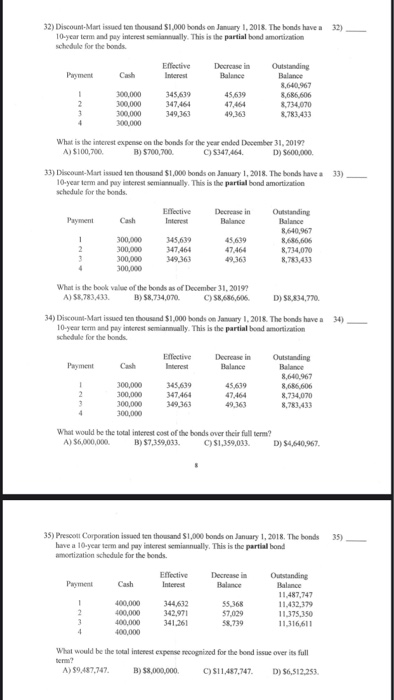

28) Providing a monetary rebate program for purchasing a product: A) Is accounted for similarly to product warranties. B) Creates a contingent liability for the seller at the time of sale. C) Creates an expense for the seller in the period of sale. D) All these answer choices are correct. 29) 29) Orange Co. can estimate the amount of loss that will occur if a foreign government expropriates some of the company's assets in that country. If expropriation is reasonably possible, a loss contingency should be: A) Disclosed and accrued as a liability. B) Accrued as liability but not disclosed. C) Disclosed but not accrued as a liability. D) Neither accrued as a liability nor disclosed. 30) 30) On January 31, 2018, B Corp. issued $600,000 face value, 12% bonds for $600,000 cash. The bonds are dated December 31, 2017, and mature on December 31, 2027. Interest will be paid semiannually on June 30 and December 31. For how many months will there be interest expense for the year ended September, 30, 2018? A) 6 months. B) 12 months. C) 9 months. D) 8 months. 31) 31) Discount-Mart issued ten thousand $1,000 bonds on January 1, 2018. The bonds have a 10-year term and pay interest semiannually. This is the partial bond amortization schedule for the bonds. Effective Interest Decrease in Balance Payment Cash 300,000 300,000 300,000 300,000 345,639 347,464 349,363 45,639 47,464 49,363 Outstanding Balance 8,640,967 8,686,606 8,734,070 8,783,433 What is the stated annual rate of interest on the bonds? A) 8%. B) 4%. C) 6% D) 3%. 32) 32) Discount-Mart issued ten thousand $1.000 bonds on January 1, 2018 The bonds have a 10-year lem p uy interest sm a lly. This is the partial how morir schedule for the bonds Dec Effective Interest Og Balance 45679 0.000 0.000 300.000 DO 345 639 347,464 8 686 606 2734070 7413 What is the rest expense on the bends for the year ended December 31, 2019 AS10000 B) 5700.700. 5347,454. ) 600,000 33) 33) Mut h ond 1.000 boodson January 1, 2016. The bonds 10-year and painterest semi l y. This is the partial bond ameti schedule for the bonds Effective O Balance ding Talence 8.640,967 300.000 300.000 100.000 300.000 145,609 347,464 349.363 5.619 47464 9163 8,714,070 8.781433 What is the back A) S783,431 of the bands as of December 31, 2019? B) 58.734,070. C) 58.686,606 D) SR34,770. 34) 34) Discount-Mart issued ten thousand $1.000 hands on January 1, 2016. The beads have a 10 year command pay interest mia l ly. This is the partial bond amortization Schedule for the bonds. Effective Interest Decrease in Balance Payment Ch Outstanding Balance 8.640.967 8,606 606 8,714020 871413 100,000 300.000 345.639 347,464 45639 47.464 49.163 300.000 What would be the total interest cost of the bonds over their full term? A) 56,000,000. ) 57.399,033 C) 51.359,033 D) 4,540,967 35) 35) Cop t hod have a 10 year s schedule for the bends 1.000 boods on my 1, 2016. The bonds . This is the partial bond E Outstanding Decrease in Balance 00000 200.000 300.000 100.000 344612 362971 341.261 55 165 5709 58.739 11.457,747 11.41919 11.375.150 11.116611 What would be the sal es expense recognized for the hand over its full A) 59,487,747 ) 58,000,000 $11,487,747. D) 56,512.253