Answered step by step

Verified Expert Solution

Question

1 Approved Answer

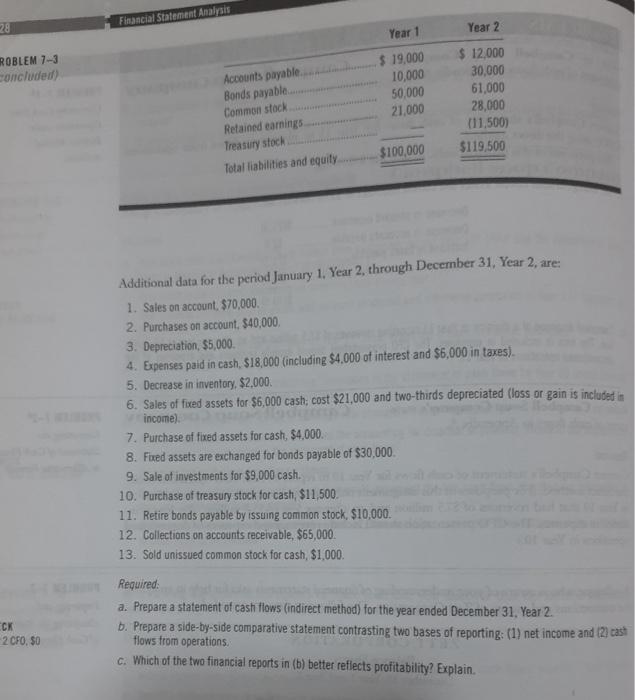

28 ROBLEM 7-3 concluded) CK 2 CFO, $0 Financial Statement Analysis Year 1 $ 19,000 10,000 50,000 21,000 ce Accounts payable...................... Bonds payable.. Common stock.

28 ROBLEM 7-3 concluded) CK 2 CFO, $0 Financial Statement Analysis Year 1 $ 19,000 10,000 50,000 21,000 ce Accounts payable...................... Bonds payable.. Common stock. Retained earnings. Treasury stock....... Total liabilities and equity............$100,000 Year 2 $ 12,000 30,000 61,000 28,000 (11,500) 7. Purchase of fixed assets for cash, $4,000. 8. Fixed assets are exchanged for bonds payable of $30,000. 9. Sale of investments for $9,000 cash. 10. Purchase of treasury stock for cash, $11,500.0 11. Retire bonds payable by issuing common stock, $10,000. Dar neder 12. Collections on accounts receivable, $65,000. 13. Sold unissued common stock for cash, $1,000. $119,500 Additional data for the period January 1, Year 2, through December 31, Year 2, are: 1. Sales on account, $70,000. 2. Purchases on account, $40,000. 3. Depreciation, $5,000. 4. Expenses paid in cash, $18,000 (including $4,000 of interest and $6,000 in taxes). 5. Decrease in inventory, $2,000. 6. Sales of fixed assets for $6,000 cash; cost $21,000 and two-thirds depreciated (loss or gain is included in income).J Required: a. Prepare a statement of cash flows (indirect method) for the year ended December 31, Year 2. b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cash flows from operations. c. Which of the two financial reports in (b) better reflects profitability? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started