Answered step by step

Verified Expert Solution

Question

1 Approved Answer

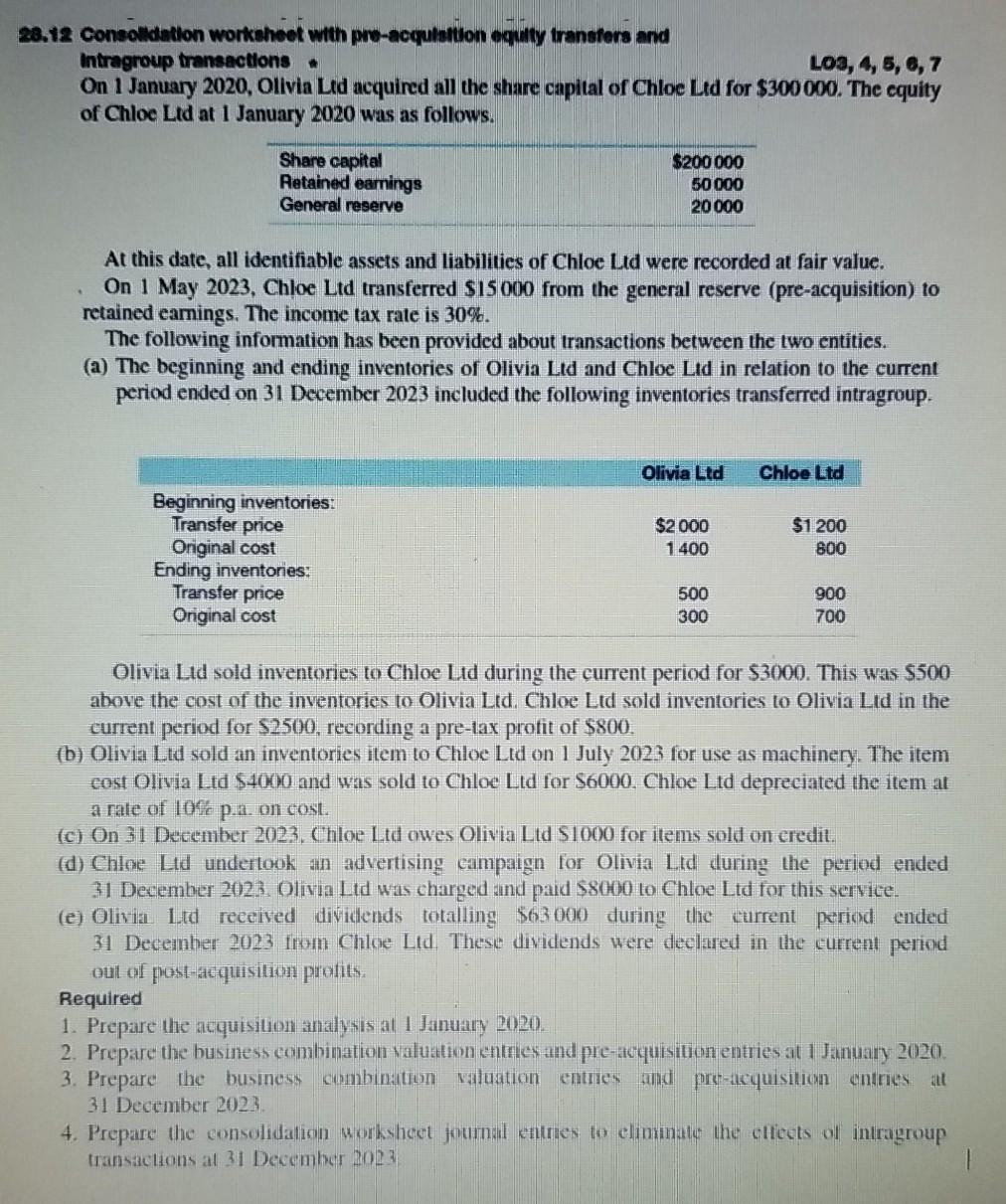

. 28.12 Consolidation worksheet with pre-acquisition equally transfers and Intragroup transactions LO3, 4, 5, 6, 7 On 1 January 2020, Olivia Ltd acquired all the

. 28.12 Consolidation worksheet with pre-acquisition equally transfers and Intragroup transactions LO3, 4, 5, 6, 7 On 1 January 2020, Olivia Ltd acquired all the share capital of Chloe Ltd for $300 000. The cquity of Chloe Ltd at 1 January 2020 was as follows. Share capital Retained earings General reserve $200 000 50 000 20 000 At this date, all identifiable assets and liabilities of Chloe Ltd were recorded at fair value. On 1 May 2023, Chloe Ltd transferred $15000 from the general reserve (pre-acquisition) to retained earnings. The income tax rate is 30%. The following information has been provided about transactions between the two entities. a) The beginning and ending inventories of Olivia Ltd and Chloe Lid in relation to the current period ended on 31 December 2023 included the following inventories transferred intragroup. Olivia Ltd Chloe Ltd $2000 1400 $1 200 800 Beginning inventories: Transfer price Original cost Ending inventones: Transfer price Original cost 500 300 900 700 Olivia Lid sold inventories to Chloe Ltd during the current period for $3000. This was $500 above the cost of the inventories to Olivia Ltd, Chloe Ltd sold inventories to Olivia Lid in the current period for $2500, recording a pre-tax profit of $800. (b) Olivia Ltd sold an inventories item to Chloe Lid on 1 July 2023 for use as machinery. The item cost Olivia Ltd $4000 and was sold to Chloe Lid for $6000. Chloe Ltd depreciated the item at a rate of 10% p.1. on cost. (c) On 31 December 2023. Chloe Ltd owes Olivia Ltd S1000 for items sold on credit. (d) Chloe Ltd undertook an advertising campaign for Olivia Ltd during the period ended 31 December 2023. Olivia Ltd was charged and paid $8000 to Chloe Ltd for this service. (e) Olivia Ltd received dividends totalling S63000 during the current period ended 31 December 2023 from Chloe Ltd. These dividends were declared in the current period out of post-acquisition profits. Required 1. Prepare the acquisition analysis at 1 January 2020. 2. Prepare the business combination valuation entries and pre-acquisition entries at 1 January 2020. 3. Prepare the business combination valuation entries and pre-acquisition entries 31 December 2023 4. Prepare the consolidation worksheet journal entries to eliminate the cllects of intragroup transactions at 31 December 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started