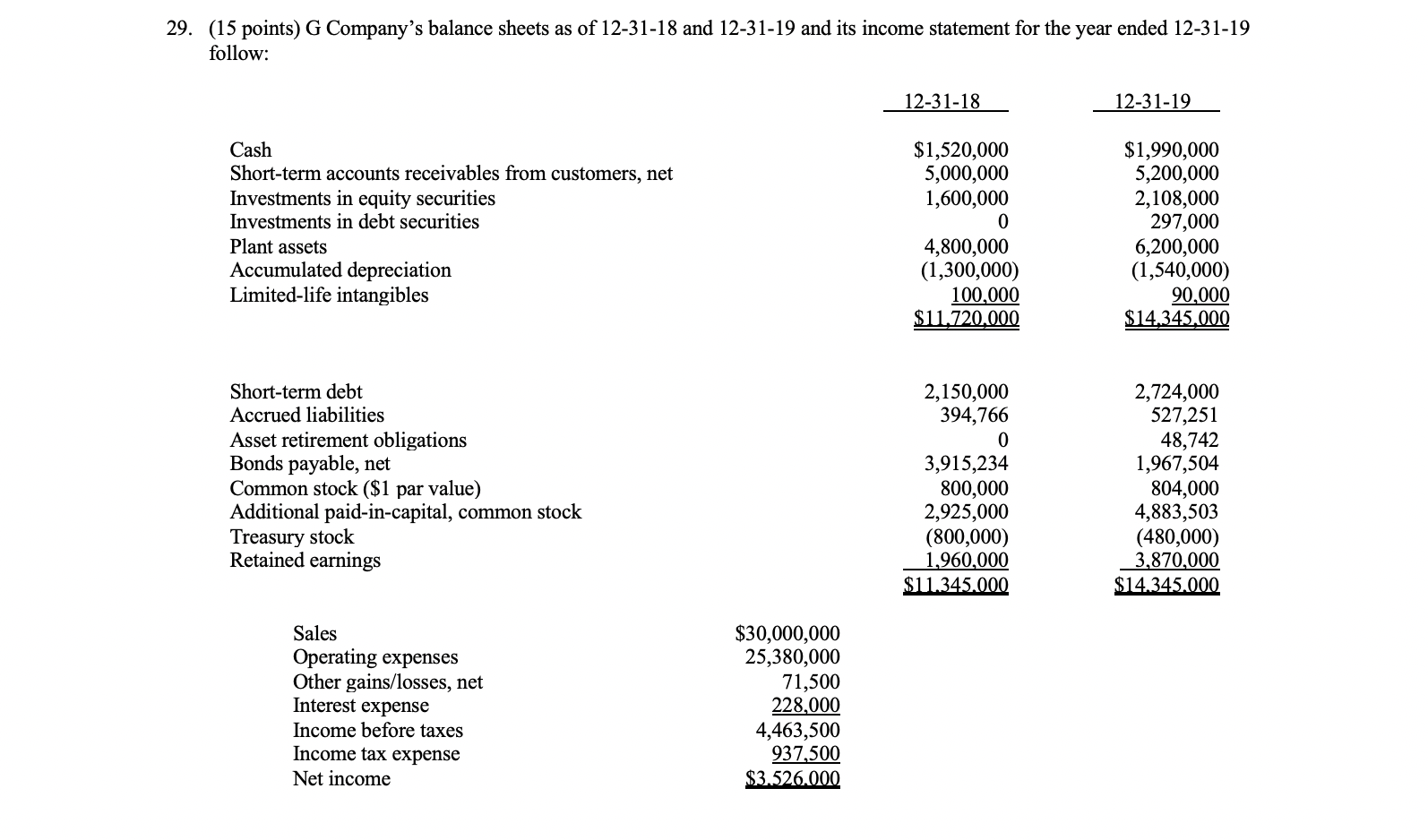

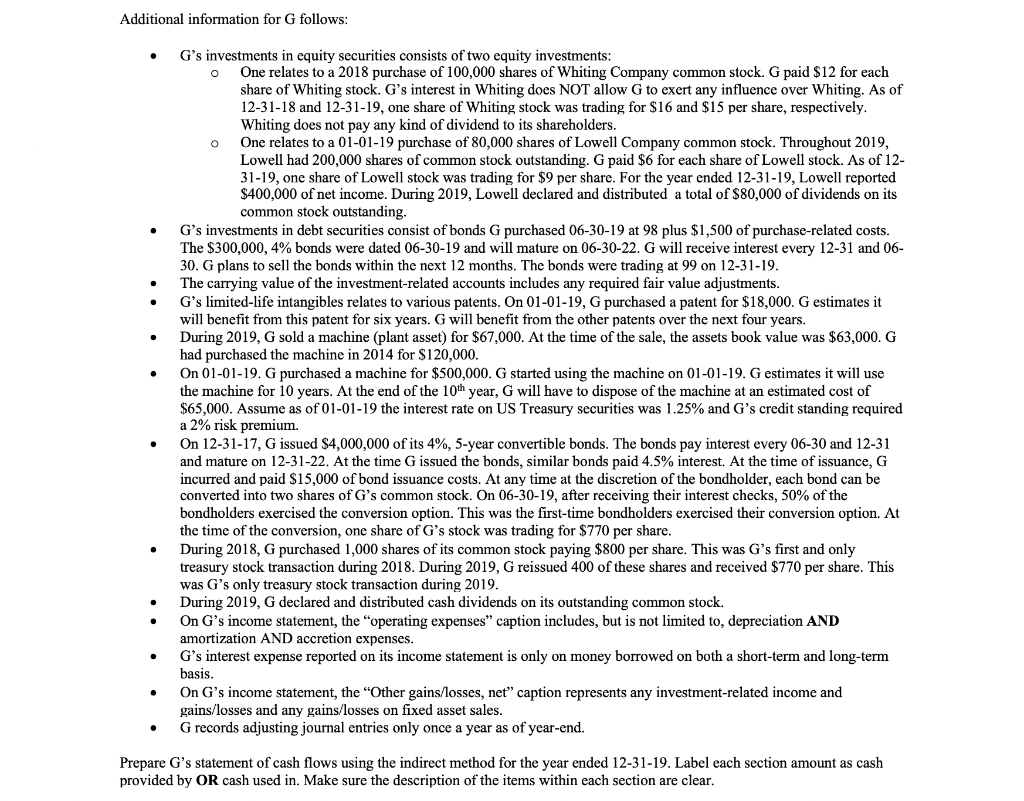

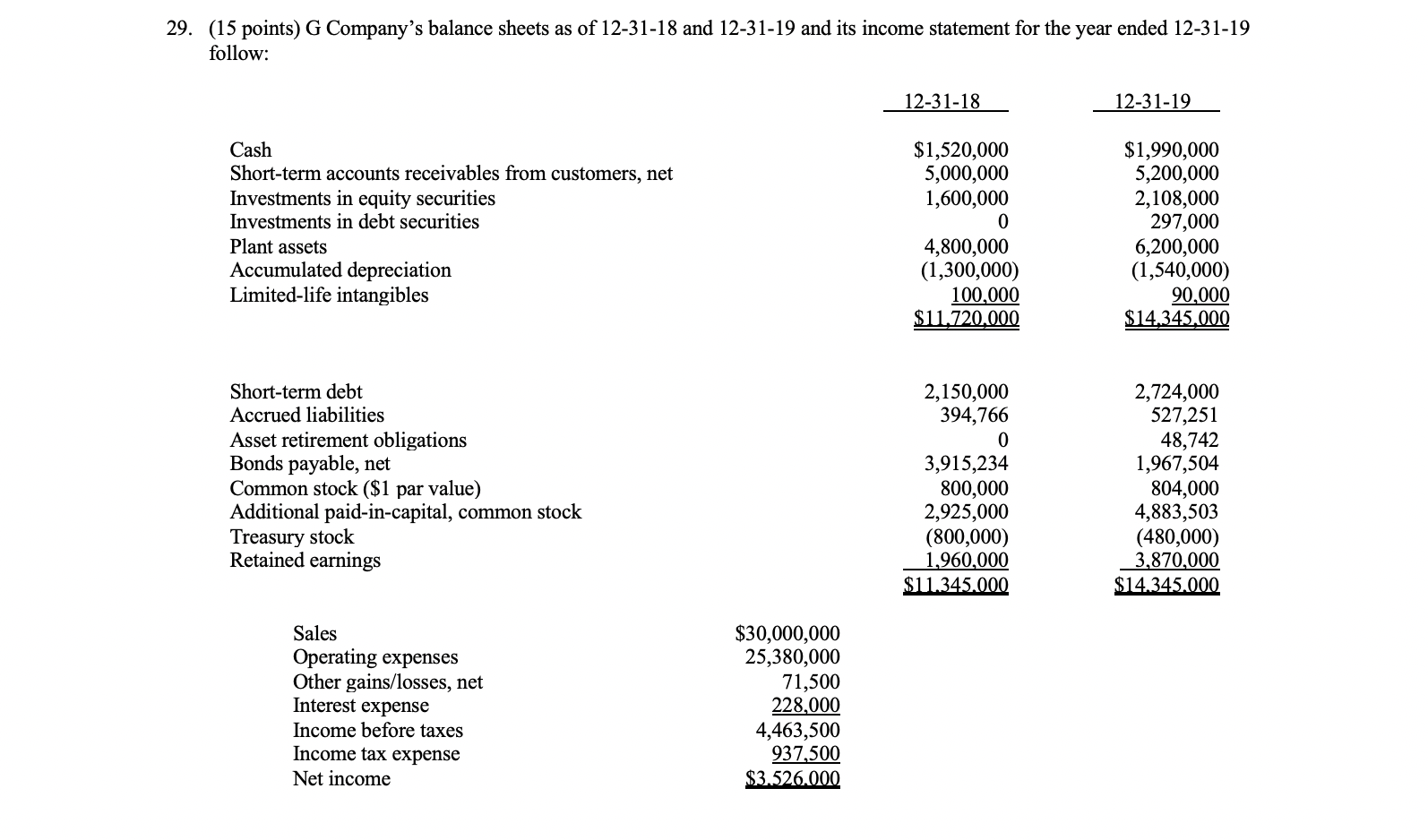

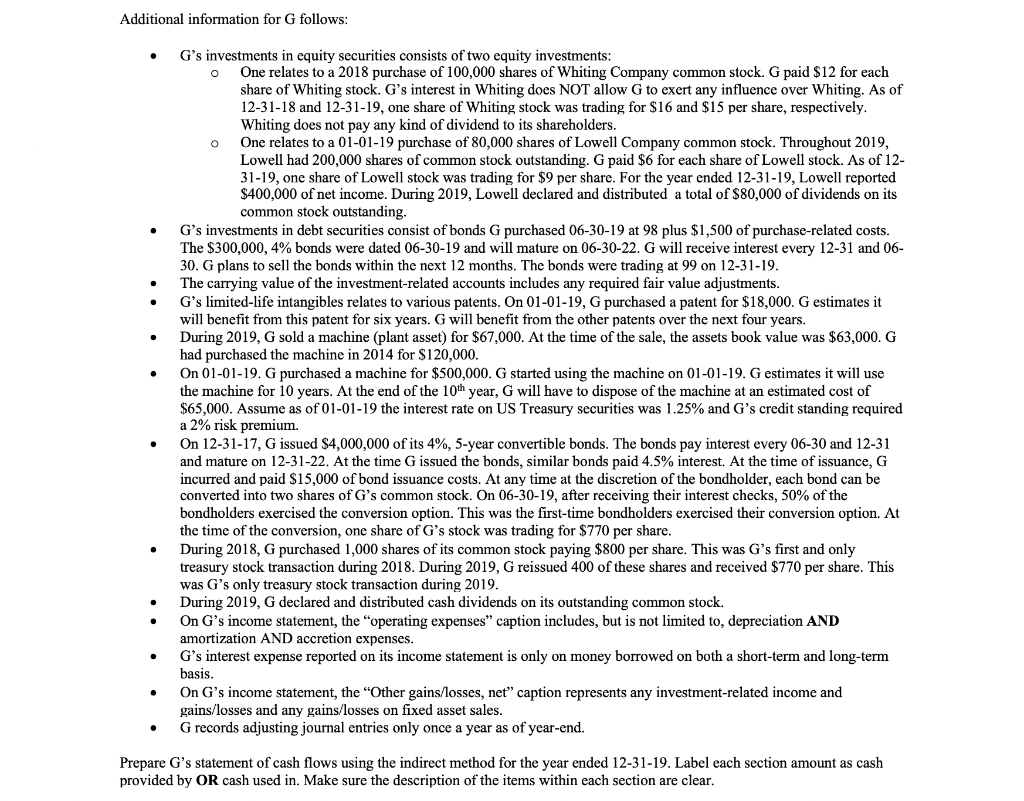

29. (15 points) G Company's balance sheets as of 12-31-18 and 12-31-19 and its income statement for the year ended 12-31-19 follow: 12-31-18 12-31-19 Cash Short-term accounts receivables from customers, net Investments in equity securities Investments in debt securities Plant assets Accumulated depreciation Limited-life intangibles $1,520,000 5,000,000 1,600,000 0 4,800,000 (1,300,000) 100,000 $11.720,000 $1,990,000 5,200,000 2,108,000 297,000 6,200,000 (1,540,000) 90,000 $14,345,000 Short-term debt Accrued liabilities Asset retirement obligations Bonds payable, net Common stock ($1 par value) Additional paid-in-capital, common stock Treasury stock Retained earnings 2,150,000 394,766 0 3,915,234 800,000 2,925,000 (800,000) 1,960,000 $11.345.000 2,724,000 527,251 48,742 1,967,504 804,000 4,883,503 (480,000) 3,870,000 $14.345.000 Sales Operating expenses Other gains/losses, net Interest expense Income before taxes Income tax expense Net income $30,000,000 25,380,000 71,500 228,000 4,463,500 937,500 $3.526.000 Additional information for G follows: G's investments in equity securities consists of two equity investments: o One relates to a 2018 purchase of 100,000 shares of Whiting Company common stock. G paid $12 for each share of Whiting stock. G's interest in Whiting does NOT allow G to exert any influence over Whiting. As of 12-31-18 and 12-31-19, one share of Whiting stock was trading for $16 and $15 per share, respectively. Whiting does not pay any kind of dividend to its shareholders. One relates to a 01-01-19 purchase of 80,000 shares of Lowell Company common stock. Throughout 2019, Lowell had 200,000 shares of common stock outstanding. G paid $6 for each share of Lowell stock. As of 12- 31-19, one share of Lowell stock was trading for $9 per share. For the year ended 12-31-19, Lowell reported $400,000 of net income. During 2019, Lowell declared and distributed a total of $80,000 of dividends on its common stock outstanding. G's investments in debt securities consist of bonds G purchased 06-30-19 at 98 plus $1,500 of purchase-related costs. The $300,000, 4% bonds were dated 06-30-19 and will mature on 06-30-22. G will receive interest every 12-31 and 06- 30. G plans to sell the bonds within the next 12 months. The bonds were trading at 99 on 12-31-19. The carrying value of the investment-related accounts includes any required fair value adjustments. G's limited-life intangibles relates to various patents. On 01-01-19, G purchased a patent for $18,000. G estimates it will benefit from this patent for six years. G will benefit from the other patents over the next four years. During 2019, G sold a machine (plant asset) for $67,000. At the time of the sale, the assets book value was $63,000. G had purchased the machine in 2014 for $120,000. On 01-01-19. G purchased a machine for $500,000. G started using the machine on 01-01-19. G estimates it will use the machine for 10 years. At the end of the 10th year, G will have to dispose of the machine at an estimated cost of $65,000. Assume as of 01-01-19 the interest rate on US Treasury securities was 1.25% and G's credit standing required a 2% risk premium. On 12-31-17, G issued $4,000,000 of its 4%, 5-year convertible bonds. The bonds pay interest every 06-30 and 12-31 and mature on 12-31-22. At the time G issued the bonds, similar bonds paid 4.5% interest. At the time of issuance, G incurred and paid $15,000 of bond issuance costs. At any time at the discretion of the bondholder, each bond can be converted into two shares of G's common stock. On 06-30-19, after receiving their interest checks, 50% of the bondholders exercised the conversion option. This was the first-time bondholders exercised their conversion option. At the time of the conversion, one share of G's stock was trading for $770 per share. During 2018, G purchased 1,000 shares of its common stock paying $800 per share. This was G's first and only treasury stock transaction during 2018. During 2019, G reissued 400 of these shares and received $770 per share. This was G's only treasury stock transaction during 2019. During 2019, G declared and distributed cash dividends on its outstanding common stock. On G's income statement, the "operating expenses" caption includes, but is not limited to, depreciation AND amortization AND accretion expenses. G's interest expense reported on its income statement is only on money borrowed on both a short-term and long-term basis. On G's income statement, the "Other gains/losses, net" caption represents any investment-related income and gains/losses and any gains/losses on fixed asset sales. G records adjusting journal entries only once a year as of year-end. Prepare G's statement of cash flows using the indirect method for the year ended 12-31-19. Label each section amount as cash provided by OR cash used in. Make sure the description of the items within each section are clear. 29. (15 points) G Company's balance sheets as of 12-31-18 and 12-31-19 and its income statement for the year ended 12-31-19 follow: 12-31-18 12-31-19 Cash Short-term accounts receivables from customers, net Investments in equity securities Investments in debt securities Plant assets Accumulated depreciation Limited-life intangibles $1,520,000 5,000,000 1,600,000 0 4,800,000 (1,300,000) 100,000 $11.720,000 $1,990,000 5,200,000 2,108,000 297,000 6,200,000 (1,540,000) 90,000 $14,345,000 Short-term debt Accrued liabilities Asset retirement obligations Bonds payable, net Common stock ($1 par value) Additional paid-in-capital, common stock Treasury stock Retained earnings 2,150,000 394,766 0 3,915,234 800,000 2,925,000 (800,000) 1,960,000 $11.345.000 2,724,000 527,251 48,742 1,967,504 804,000 4,883,503 (480,000) 3,870,000 $14.345.000 Sales Operating expenses Other gains/losses, net Interest expense Income before taxes Income tax expense Net income $30,000,000 25,380,000 71,500 228,000 4,463,500 937,500 $3.526.000 Additional information for G follows: G's investments in equity securities consists of two equity investments: o One relates to a 2018 purchase of 100,000 shares of Whiting Company common stock. G paid $12 for each share of Whiting stock. G's interest in Whiting does NOT allow G to exert any influence over Whiting. As of 12-31-18 and 12-31-19, one share of Whiting stock was trading for $16 and $15 per share, respectively. Whiting does not pay any kind of dividend to its shareholders. One relates to a 01-01-19 purchase of 80,000 shares of Lowell Company common stock. Throughout 2019, Lowell had 200,000 shares of common stock outstanding. G paid $6 for each share of Lowell stock. As of 12- 31-19, one share of Lowell stock was trading for $9 per share. For the year ended 12-31-19, Lowell reported $400,000 of net income. During 2019, Lowell declared and distributed a total of $80,000 of dividends on its common stock outstanding. G's investments in debt securities consist of bonds G purchased 06-30-19 at 98 plus $1,500 of purchase-related costs. The $300,000, 4% bonds were dated 06-30-19 and will mature on 06-30-22. G will receive interest every 12-31 and 06- 30. G plans to sell the bonds within the next 12 months. The bonds were trading at 99 on 12-31-19. The carrying value of the investment-related accounts includes any required fair value adjustments. G's limited-life intangibles relates to various patents. On 01-01-19, G purchased a patent for $18,000. G estimates it will benefit from this patent for six years. G will benefit from the other patents over the next four years. During 2019, G sold a machine (plant asset) for $67,000. At the time of the sale, the assets book value was $63,000. G had purchased the machine in 2014 for $120,000. On 01-01-19. G purchased a machine for $500,000. G started using the machine on 01-01-19. G estimates it will use the machine for 10 years. At the end of the 10th year, G will have to dispose of the machine at an estimated cost of $65,000. Assume as of 01-01-19 the interest rate on US Treasury securities was 1.25% and G's credit standing required a 2% risk premium. On 12-31-17, G issued $4,000,000 of its 4%, 5-year convertible bonds. The bonds pay interest every 06-30 and 12-31 and mature on 12-31-22. At the time G issued the bonds, similar bonds paid 4.5% interest. At the time of issuance, G incurred and paid $15,000 of bond issuance costs. At any time at the discretion of the bondholder, each bond can be converted into two shares of G's common stock. On 06-30-19, after receiving their interest checks, 50% of the bondholders exercised the conversion option. This was the first-time bondholders exercised their conversion option. At the time of the conversion, one share of G's stock was trading for $770 per share. During 2018, G purchased 1,000 shares of its common stock paying $800 per share. This was G's first and only treasury stock transaction during 2018. During 2019, G reissued 400 of these shares and received $770 per share. This was G's only treasury stock transaction during 2019. During 2019, G declared and distributed cash dividends on its outstanding common stock. On G's income statement, the "operating expenses" caption includes, but is not limited to, depreciation AND amortization AND accretion expenses. G's interest expense reported on its income statement is only on money borrowed on both a short-term and long-term basis. On G's income statement, the "Other gains/losses, net" caption represents any investment-related income and gains/losses and any gains/losses on fixed asset sales. G records adjusting journal entries only once a year as of year-end. Prepare G's statement of cash flows using the indirect method for the year ended 12-31-19. Label each section amount as cash provided by OR cash used in. Make sure the description of the items within each section are clear