Answered step by step

Verified Expert Solution

Question

1 Approved Answer

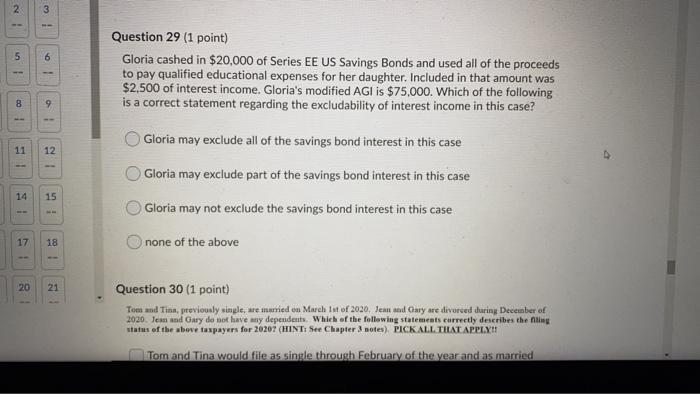

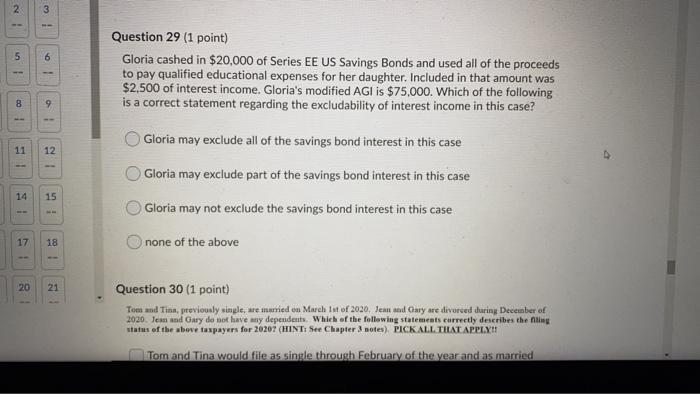

29 2 3 5 6 Question 29 (1 point) Gloria cashed in $20,000 of Series EE US Savings Bonds and used all of the proceeds

29

2 3 5 6 Question 29 (1 point) Gloria cashed in $20,000 of Series EE US Savings Bonds and used all of the proceeds to pay qualified educational expenses for her daughter. Included in that amount was $2,500 of interest income. Gloria's modified AGI is $75,000. Which of the following is a correct statement regarding the excludability of interest income in this case? 1 8 Gloria may exclude all of the savings bond interest in this case 11 12 14 15 Gloria may exclude part of the savings bond interest in this case Gloria may not exclude the savings bond interest in this case 17 18 none of the above 20 21 Question 30 (1 point) Tom and Tina, previously simple, are married on March 1st of 2020. Jean and Gary se divorced during December of 2020 Jean and Gary do not have my dependents. Which of the following statements correctly describes the ling status of the above taxpayers for 20207 (HINT: See Chapter 3 notes). PICK ALL THAT APPLY!! Tom and Tina would file as single through February of the year and as married

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started