29)

30)

31)

32)

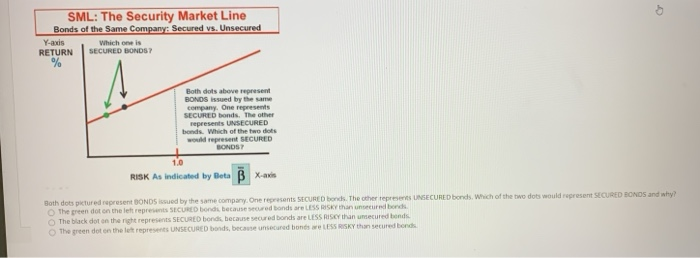

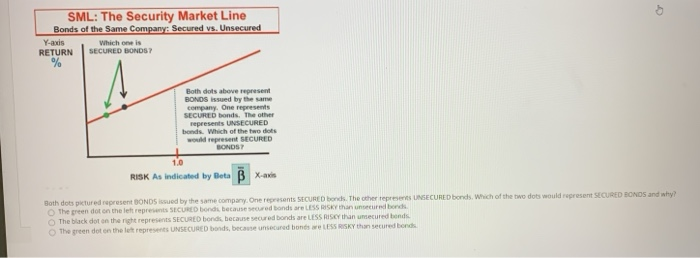

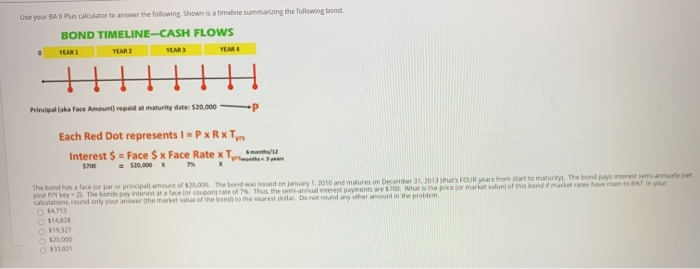

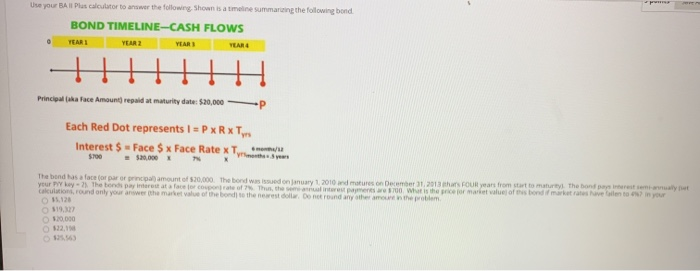

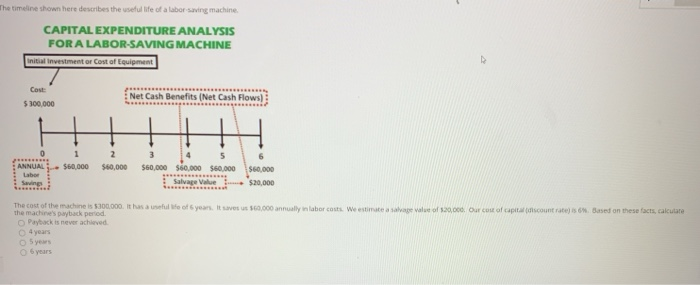

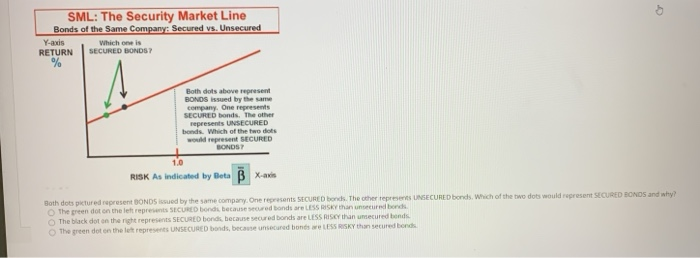

SML: The Security Market Line Bonds of the Same Company: Secured vs. Unsecured Y-axis Which one is RETURN SECURED BONDS % Both dots above represent BONDS issued by the same company. One represents SECURED bonds. The other represents UNSECURED bonds. Which of the two dots would represent SECURED BONDS 1.0 RISK As indicated by Beta B X-axis Both dots pictured representBONDS issued by the same company. One represents SECURED bonds. The other represents UNSECURED bonds. Which of the two dots would represent SECURED BONOS and why? The green dot on the left represents SECURED bonds because scured bonds are LESS RISKY than unsecured The black dot on the right represents SECURED bonds because secured bonds are LESS RISC than umecured bonds The green dot on the last represents UNSECURED bonds, because unsecured bonds we LESS RISKY thon secured bonds Use your BA II Plus calculator to answer the following Shown is a timeline summarizing the following bond BOND TIMELINE-CASH FLOWS YEAR: YEAR 2 YEARS YUR 0 Principal aka Face Amount repeld at maturity dute: $20,000P Each Red Dot represents I = P xRxTy Interest $ = Face $ x Face Rate x Tm/ 5700 = $20,000 The bord has a face par or principal amount of $20.000. The bond was den yt, 2010 and mare on December, 2013 FOUR years from start to maturity. The bond pays interest semiannuale your key 2 The bonds pay interest at a facelor coupon rate of Thus the semiannual interest payments are 700 What the price for market value of this bond market resent in your calculations. round only your answer the market value of the bond to the rest. Do not round any other ment in the problem 51 5013 FF Use your BA II Plus calculator to answer the following Shown is a timeline summarizing the following bond BOND TIMELINE-CASH FLOWS YEAR YEAR 2 YEAR VLAR Principal aka Face Amount repaidat maturity date: $20,000 -P Each Red Dot represents I = PxRxT Interest $ - Face $ x Face Rate x T. $700 = $20,000 The band has a face for par or principal amount of 520,000. The bond was issued on January 1, 2010 and matures on December 31, 2013 has four years from start to marry the bond present your Why? The bond pay interest at a face propone of ? Thus, the intereses 700 What is the price for market value of bond market resave folento in your calculation round only your answer the market value of the bond to the newest dolla. Do not found any other amount the problem 15.120 519, The timeline shown here describes the useful life of a labor saving machine CAPITAL EXPENDITURE ANALYSIS FOR A LABOR-SAVING MACHINE Initial investment or Cost of Equipment Cost: $300,000 Net Cash Benefits (Net Cash Flows) 0 ANNUAL Labor Saving 1 $60,000 2 560,000 3 5 6 $60,000 $10,000 $60,000 550.000 Salvage Value $20,000 The cost of the machine is $300.000. It has a self of years. It saves us $60,000 annually labor costs. We estimate avea of 20,000. Our cost of capitaliscount rates 6. Based on these facts, calculate the machine's Dayback period Payback is never achieved 4 years