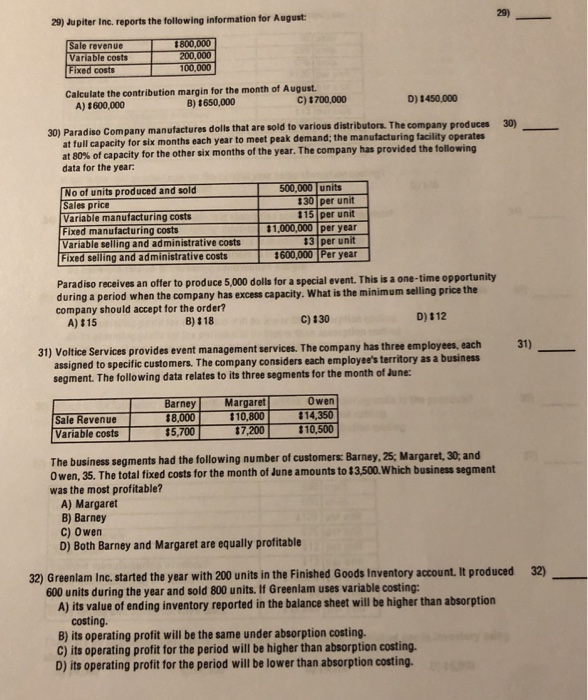

29) Jupiter Inc. reports the following information for August revenue ariable costs ixed costs Calculate the contribution margin for the month of August. D) 1450,000 C) $700,000 B) 1650,000 A) $600,000 company produces 30) 30) Paradiso Company manufactures dolls that are sold to various distributors. The at full capacity for six months each year to meet peak demand; the manufacturing facility operates at 80% of capacity for the other six months of the year. The company has provided the following data for the year No of units produced and sold Sales price Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs 1301 per unit 15 per unit 1,000,000 per year 13 per unit 600,000 Per year Paradiso receives an offer to produce 5,000 dolls for a special event. This is a one-timeo rice the during a period when the company has excess capacity. What is the minimum selling p company should accept for the order? D) 112 C) $30 8) $18 A) $15 31) 31) Voltice Services provides event management services. The company has three employees, each assigned to specific customers. The company considers each employee's territory as a business segment. The following data relates to its three segments for the month of June: Barney Margaret Owen $10,800 Sale Revenue 8,000 Variable costs 4,350 15,7007,20010,500 The business segments had the following number of customers: Barney, 25, Margaret, 30, and Owen, 35. The total fixed costs for the month of June amounts to 13,500.Which business segment was the most profitable? A) Margaret B) Barney C) 0wen D) Both Barney and Margaret are equally profitable 32) 32) Greenlam Inc. started the year with 200 units in the Finished Goods Inventory account. It produced 600 units during the year and sold 800 units. If Greenlam uses variable costing: A) its value of ending inventory reported in the balance sheet will be higher than absorption costing. B) its operating profit will be the same under absorption costing. C) its operating profit for the period will be higher than absorption costing D) its operating profit for the period will be lower than absorption costing