Answered step by step

Verified Expert Solution

Question

1 Approved Answer

29. On January 1, 2020, Vesper Company granted several executives stock options that allowed the executives to purchase 24 million of Vesper's $1 par value

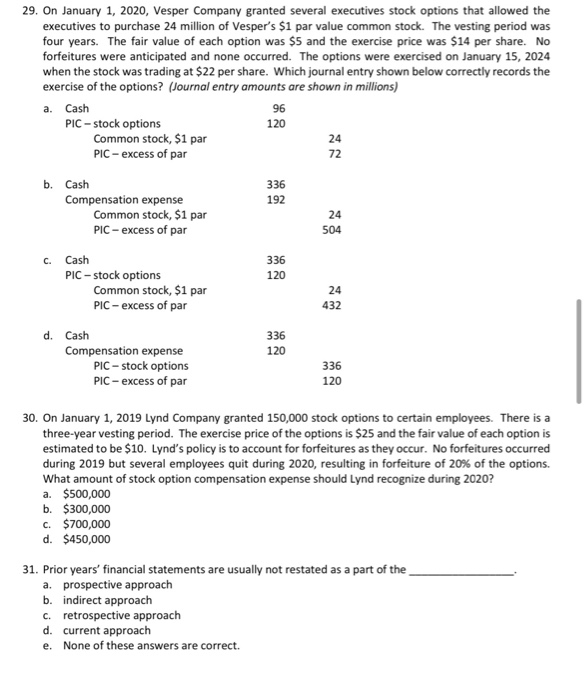

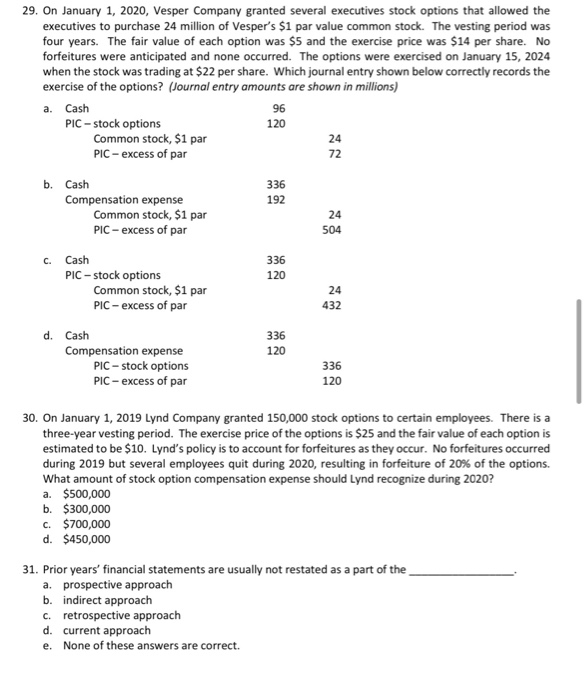

29. On January 1, 2020, Vesper Company granted several executives stock options that allowed the executives to purchase 24 million of Vesper's $1 par value common stock. The vesting period was four years. The fair value of each option was $5 and the exercise price was $14 per share. No forfeitures were anticipated and none occurred. The options were exercised on January 15, 2024 when the stock was trading at $22 per share. Which journal entry shown below correctly records the exercise of the options? (Journal entry amounts are shown in millions) a. Cash 96 PIC - stock options 120 Common stock, $1 par PIC - excess of par b. Cash Compensation expense Common stock, $1 par PIC - excess of par C. Cash PIC - stock options Common stock, $1 par PIC - excess of par d. Cash Compensation expense PIC - stock options PIC - excess of par 336 120 30. On January 1, 2019 Lynd Company granted 150,000 stock options to certain employees. There is a three-year vesting period. The exercise price of the options is $25 and the fair value of each option is estimated to be $10. Lynd's policy is to account for forfeitures as they occur. No forfeitures occurred during 2019 but several employees quit during 2020, resulting in forfeiture of 20% of the options. What amount of stock option compensation expense should Lynd recognize during 2020? a. $500,000 b. $300,000 C. $700,000 d. $450,000 31. Prior years' financial statements are usually not restated as a part of the a. prospective approach b. indirect approach C. retrospective approach d. current approach e. None of these answers are correct

29. On January 1, 2020, Vesper Company granted several executives stock options that allowed the executives to purchase 24 million of Vesper's $1 par value common stock. The vesting period was four years. The fair value of each option was $5 and the exercise price was $14 per share. No forfeitures were anticipated and none occurred. The options were exercised on January 15, 2024 when the stock was trading at $22 per share. Which journal entry shown below correctly records the exercise of the options? (Journal entry amounts are shown in millions) a. Cash 96 PIC - stock options 120 Common stock, $1 par PIC - excess of par b. Cash Compensation expense Common stock, $1 par PIC - excess of par C. Cash PIC - stock options Common stock, $1 par PIC - excess of par d. Cash Compensation expense PIC - stock options PIC - excess of par 336 120 30. On January 1, 2019 Lynd Company granted 150,000 stock options to certain employees. There is a three-year vesting period. The exercise price of the options is $25 and the fair value of each option is estimated to be $10. Lynd's policy is to account for forfeitures as they occur. No forfeitures occurred during 2019 but several employees quit during 2020, resulting in forfeiture of 20% of the options. What amount of stock option compensation expense should Lynd recognize during 2020? a. $500,000 b. $300,000 C. $700,000 d. $450,000 31. Prior years' financial statements are usually not restated as a part of the a. prospective approach b. indirect approach C. retrospective approach d. current approach e. None of these answers are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started