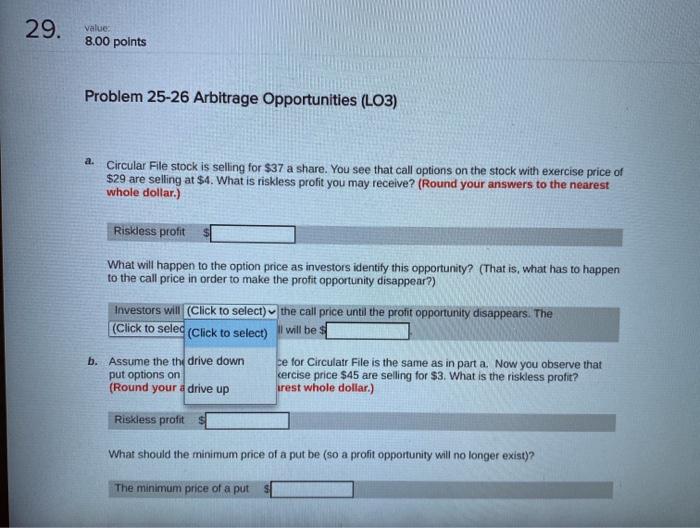

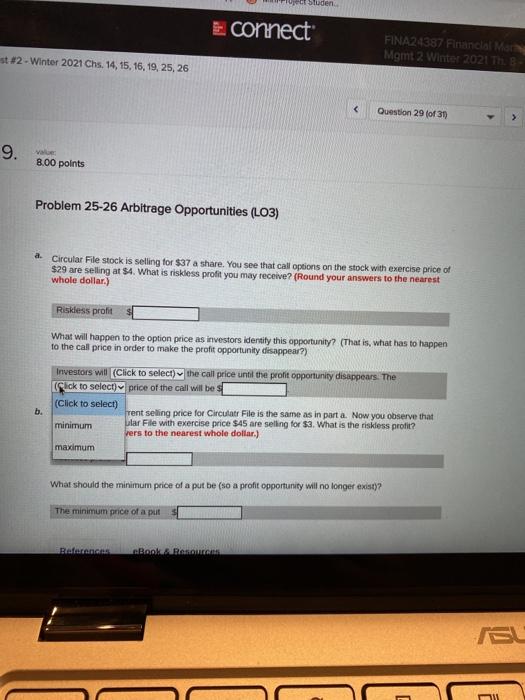

29. value 8.00 points Problem 25-26 Arbitrage Opportunities (LO3) a. Circular File stock is selling for $37 a share. You see that call options on the stock with exercise price of $29 are selling at $4. What is riskless profit you may receive? (Round your answers to the nearest whole dollar.) Riskless profit What will happen to the option price as investors identify this opportunity? (That is what has to happen to the call price in order to make the profit opportunity disappear?) Investors will (Click to select the call price until the profit opportunity disappears. The (Click to seleo (Click to select) will be $ b. Assume the th drive down ce for Circulatr File is the same as in part a. Now you observe that put options on kercise price $45 are selling for $3. What is the riskless profit? (Round your a drive up trest whole dollar.) Riskless profits What should the minimum price of a put be (so a profit opportunity will no longer exist)? The minimum price of a put saden E connect FINA24387 Financial Mana Mgmt 2 Winter 2021 Th. B- st #2 - Winter 2021 Chs. 14, 15, 16, 19, 25, 26 Question 29 (of 31 9. Valle 8.00 points Problem 25-26 Arbitrage Opportunities (L03) a. Circular File stock is selling for $37 a share. You see that call options on the stock with exercise price of $29 are selling at $4. What is riskless profit you may receive? (Round your answers to the nearest whole dollar.) Riskless profit What will happen to the option price as investors identity this opportunity? (That is what has to happen to the call price in order to make the profit opportunity disappear?) Investors will (Click to select the call price until the profit opportunity disappears. The Flick to select) price of the call will be (Click to select) rent selling price for Circular File is the same as in part a. Now you observe that minimum ular File with exercise price $45 are selling for $3. What is the riskless profit? vers to the nearest whole dollar) maximum b. What should the minimum price of a put be (so a profit opportunity will no longer exist)? The minimum price of a put Bafranca Bok RA