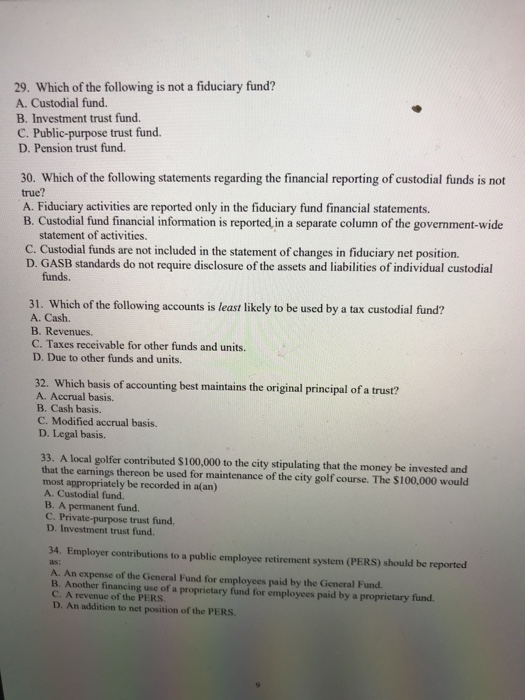

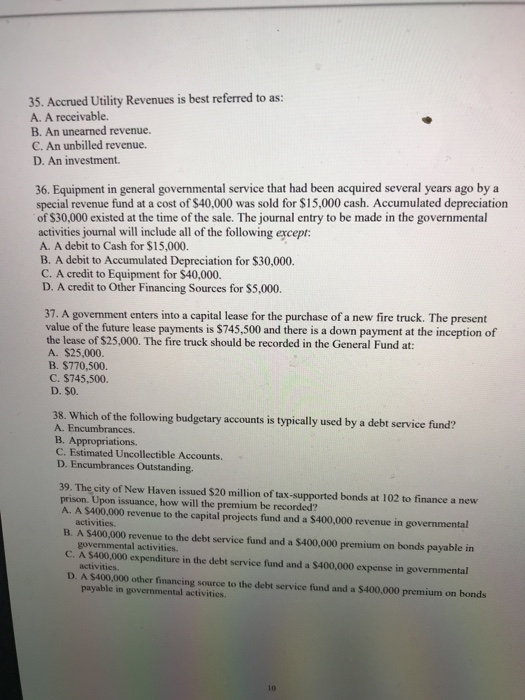

29. Which of the following is not a fiduciary fund? A. Custodial fund. B. Investment trust fund. C. Public-purpose trust fund. D. Pension trust fund. 30. Which of the following statements regarding the financial reporting of custodial funds is not true? A. Fiduciary activities are reported only in the fiduciary fund financial statements. todial fund financial information is reported in a separate column of the government-wide statement of activities. C. Custodial funds are not included in the statement of changes in fiduciary net position. D. GASB standards do not require disclosure of the assets and liabilities of individual custodial funds. 31. Which of the following accounts is least likely to be used by a tax custodial fund? A. Cash B. Revenues C. Taxes receivable for other funds and units. D. Due to other funds and units. 32. Which basis of accounting best maintains the original principal of a trust? A. Accrual basis. B. Cash basis. C. Modified accrual basis. D. Legal basis. 33. A local golfer contributed S100,000 to the city stipulating that the money be invested and that the earnings thereon be used for maintenance of the city golf course. The $100.000 would most appropriately be recorded in aan) A. Custodial fund. B. A permanent fund. C. Private purpose trust fund. D. Investment trust fund. 34. Employer contributions to a publie employee retirement system (PERS) should be reported A. An expense of the General Fund for employees paid by the Cieneral Fund. B. Another financing use of a proprietary fund for employees paid by a proprietary fund. C. A revenue of the PERS D. An addition to net position of the PERS. 35. Accrued Utility Revenues is best referred to as: A. A receivable. B. An unearned revenue. C. An unbilled revenue. D. An investment. 36. Equipment in general governmental service that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash. Accumulated depreciation of $30,000 existed at the time of the sale. The journal entry to be made in the governmental activities journal will include all of the following except: A. A debit to Cash for $15,000. B. A debit to Accumulated Depreciation for $30,000. C. A credit to Equipment for $40,000. D. A credit to Other Financing Sources for $5,000. 37. A government enters into a capital lease for the purchase of a new fire truck. The present value of the future lease payments is $745,500 and there is a down payment at the inception of the lease of $25,000. The fire truck should be recorded in the General Fund at: A. $25,000 B. $770,500 C. $745,500 D. SO. 38. Which of the following budgetary accounts is typically used by a debt service fund? A. Encumbrances. B. Appropriations. C. Estimated Uncollectible Accounts. D. Encumbrances Outstanding. 39. The city of New Haven issued $20 million of tax-supported bonds at 102 to finance a new prison. Upon issuance, how will the premium be recorded? A A $400,000 revenue to the capital projects fund and a $400,000 revenue in governmental activities. governmental activities. C. A $400.000 expenditure in the debt service fund and a $400,000 expense in governmental activities. D A $400,000 other financing source to the debt service fund and a $400.000 premium on bonds payable in governmental activities