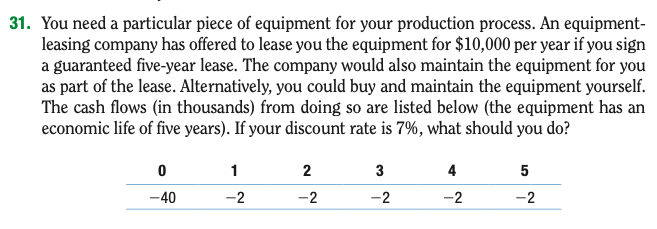

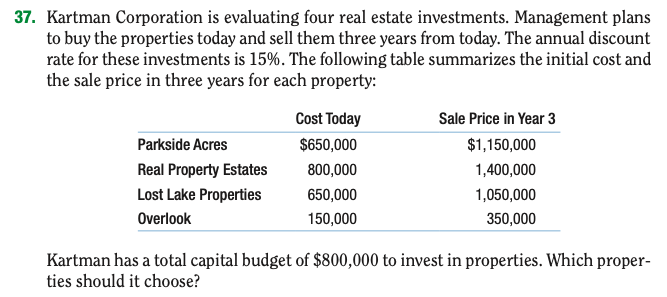

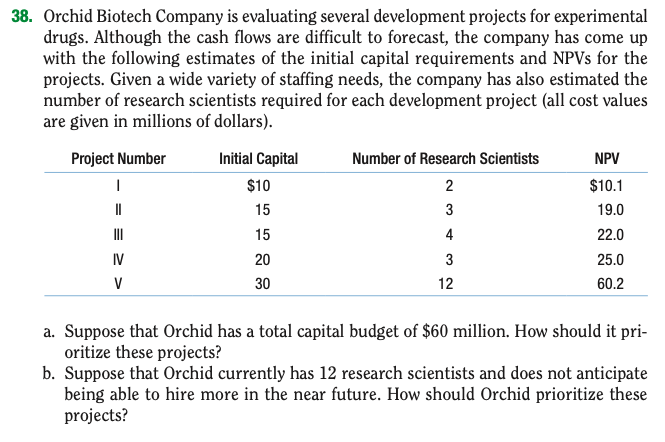

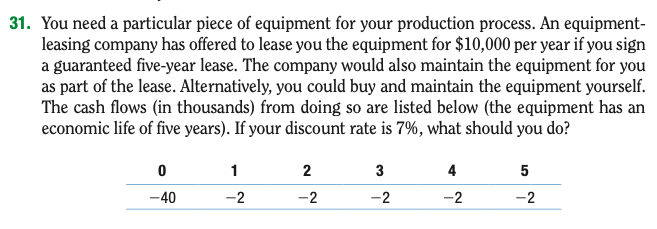

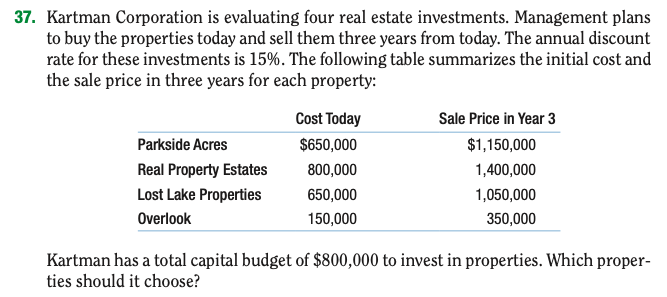

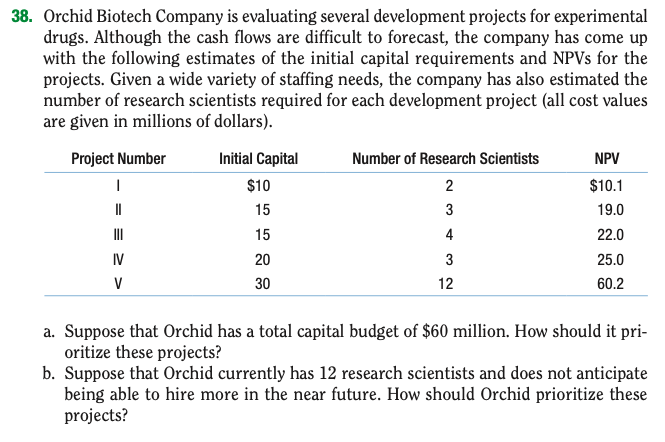

29. You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10 million. Investment A will generate $2 million per year (starting at the end of the first year) in perpetuity. Investment B 31. You need a particular piece of equipment for your production process. An equipment- leasing company has offered to lease you the equipment for $10,000 per year if you sign a guaranteed five-year lease. The company would also maintain the equipment for you as part of the lease. Alternatively, you could buy and maintain the equipment yourself. The cash flows (in thousands) from doing so are listed below (the equipment has an economic life of five years). If your discount rate is 7%, what should you do? 1 2 3 4 5 0 -40 -2 -2 -2 -2 -2 37. Kartman Corporation is evaluating four real estate investments. Management plans to buy the properties today and sell them three years from today. The annual discount rate for these investments is 15%. The following table summarizes the initial cost and the sale price in three years for each property: Parkside Acres Real Property Estates Lost Lake Properties Overlook Cost Today $650,000 800,000 650,000 150,000 Sale Price in Year 3 $1,150,000 1,400,000 1,050,000 350,000 Kartman has a total capital budget of $800,000 to invest in properties. Which proper- ties should it choose? 38. Orchid Biotech Company is evaluating several development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects. Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars). Project Number Initial Capital Number of Research Scientists NPV 1 $10 2 $10.1 II 15 3 19.0 15 4 22.0 IV 20 3 25.0 V 30 12 60.2 a. Suppose that Orchid has a total capital budget of $60 million. How should it pri- oritize these projects? b. Suppose that Orchid currently has 12 research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects